New Hampshire Retirement Reporting

Human Resources > State Requirements > NH > System Settings Maintenance

Human Resources > State Requirements > NH > Retirement List

Providing a more efficient way to report retirement data, a System Settings Maintenance option and a new Retirement List option have been added to the Nevada State Requirements menu.

Human Resources > State Requirements > NH > System Settings Maintenance

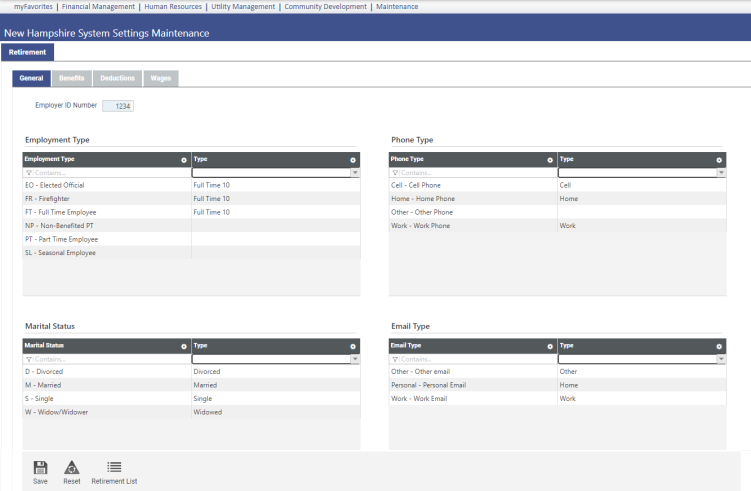

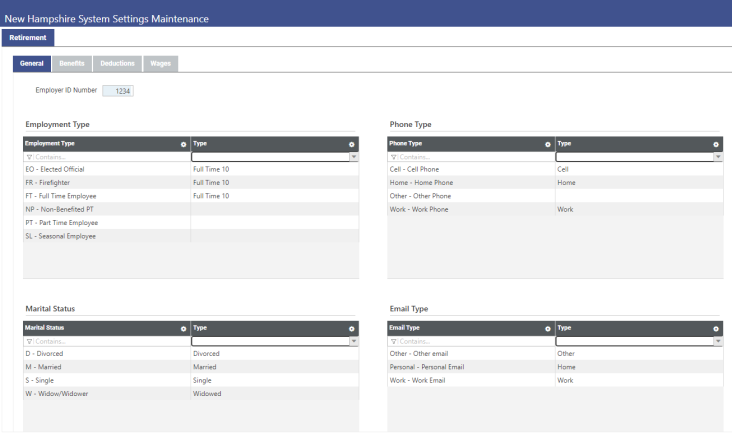

Before creating retirement data, use the New Hampshire System Settings Maintenance page to perform setup.

The Retirement Settings tab contains four sub-tabs: General, Deductions, Benefits and Wages.

This tab contains the state-assigned employer number and grids for mapping the employment types, phone types, marital status types and email types that will print on the state transmittal form:

Enter the state-assigned Employer ID Number.

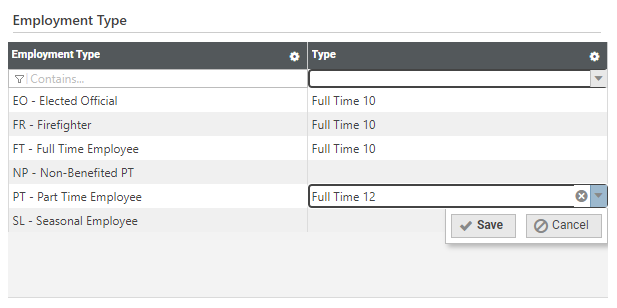

In the Employment Type grid, map applicable employment types in the left column to the appropriate Type codes in the right column, clicking Save after each selection:

Options in the right column come from validation set 672, New Hampshire Retirement Employment Type.

Employment Type codes display in the transmittal as follows:

- Full Time 10 = FT10

- Full Time 12 = FT12

- Full Time 12 - PT Judge = FT12 - PT Judge

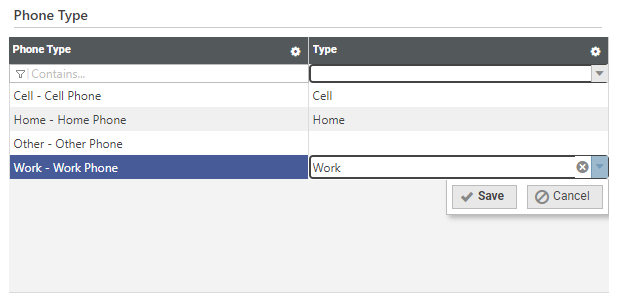

In the Phone Type grid, map applicable phone types in the left column to the appropriate Type codes in the right column, click Save after each selection:

Options in the right column come from validation set 679, New Hampshire Retirement Phone Type.

Phone Type codes display in the transmittal as follows:

- Cell = 2245

- Fax = 2247

- Home = 2203

- Main = 2016

- Pager = 2249

- Work = 2205

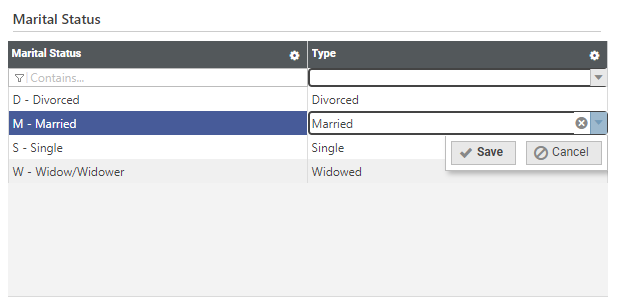

In the Marital Status grid, map applicable marital statuses in the left column to the appropriate Type codes in the right column, click Save after each selection:

Options in the right column come from validation set 676, New Hampshire Retirement Marital Status.

Marital Status codes display in the transmittal as follows:

- Divorced = 2075

- Domestic Partner = 573

- Married = 2071

- Separated = 2073

- Single = 2068

- Unknown = 2077

- Widowed = 3470

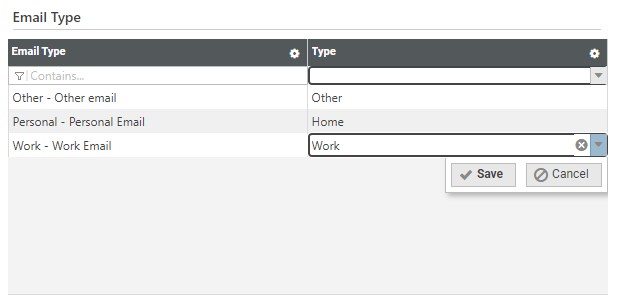

In the Email Type grid, map applicable email types in the left column to the appropriate Type codes in the right column, click Save after each selection:

Options in the right column come from validation set 680, New Hampshire Retirement Email Type.

Note: All validation sets come pre-built with installation.

Email Type codes display in the transmittal as follows:

- Home = 2203

- Main = 2016

- Other = 619

- Work = 2205

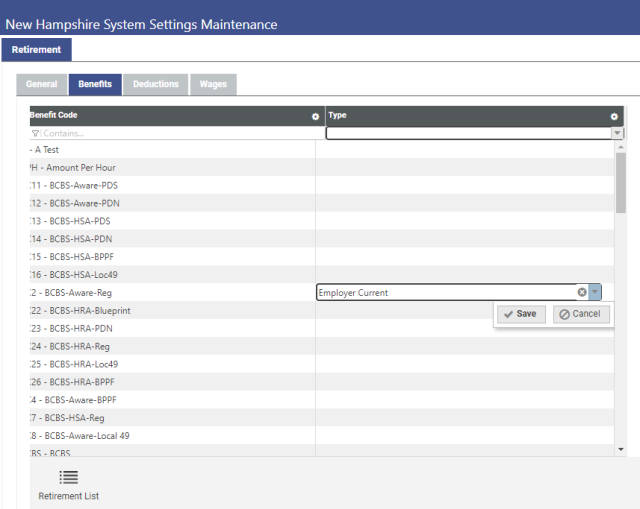

On the Benefits tab, for contributions the employer makes on behalf of employees, map applicable benefit codes in the left column of the grid to the appropriate contribution Type codes in the right column, clicking the Save button after each selection:

Type codes come from validation set 674, New Hampshire Retirement Contribution Type.

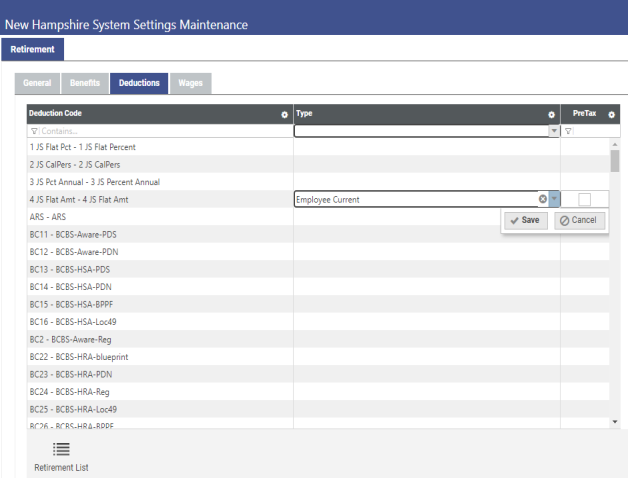

On the Deductions tab, for employee contributions, map applicable deduction codes in the left column of the grid to the appropriate contribution Type codes in the right column, clicking the Save button after each selection:

Note: If a deduction is pre-taxed, mark it as such in the PreTax column of the grid.

Type codes come from validation set 674, New Hampshire Retirement Contribution Type.

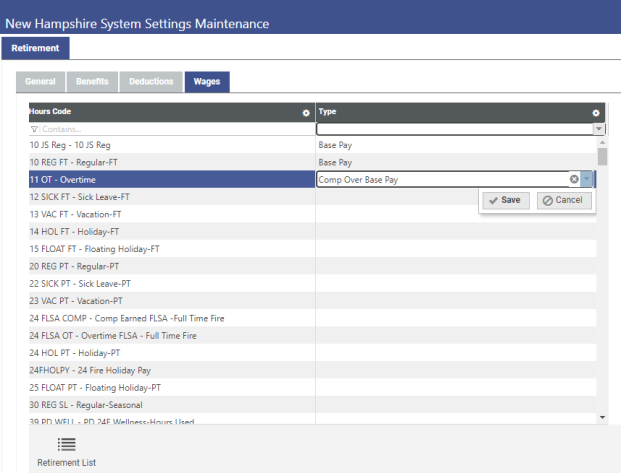

The left column of the grid on the Wages tab contains all active hours codes. Map applicable hours codes to wage types. To save a selection, click the Save button:

Type codes come from validation set 673, New Hampshire Retirement Wage Type.

After completing the setup, you are ready to create your retirement data from the New Hampshire Retirement List page.

Note: To navigate between this page and the New Hampshire Retirement List page while performing setup and running reports, use the Retirement List button on this page and the Settings button on the New Hampshire Retirement List page.

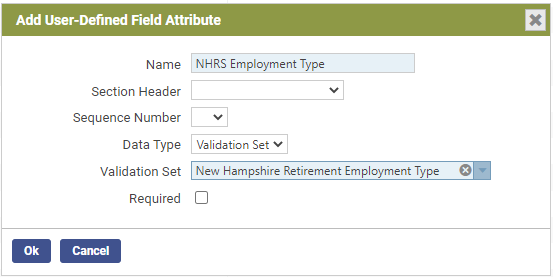

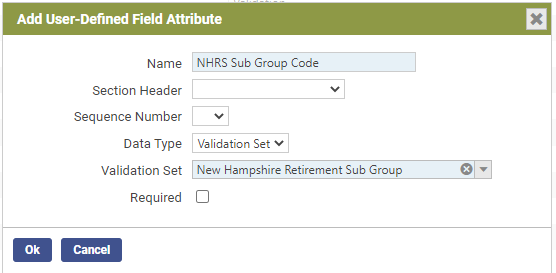

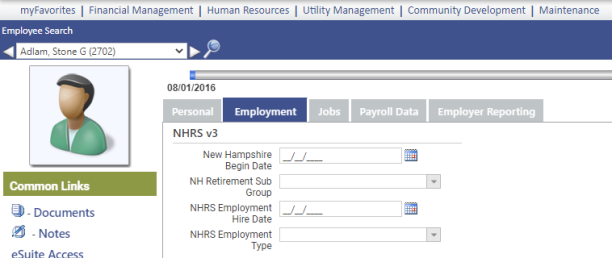

The following user-defined fields (UDFs) must be built for the Employment tab of Workforce Administration:

- NHRS Employment Type

- NHRS Sub Group Code

- NHRS Employment Hire Date

- NHRS Participation Begin Date

- Navigate to Maintenance > new world ERP Suite > Security > User-Defined Fields. The Select a Record Type dialog displays.

- Select Employee Employment. A grid displays, containing all user-defined fields that have been built for the Employment tab of Workforce.

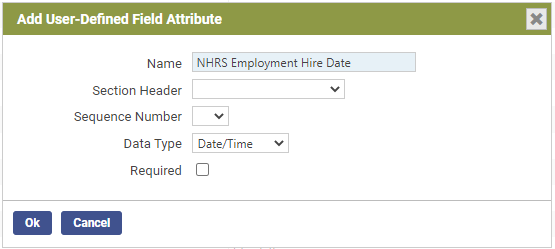

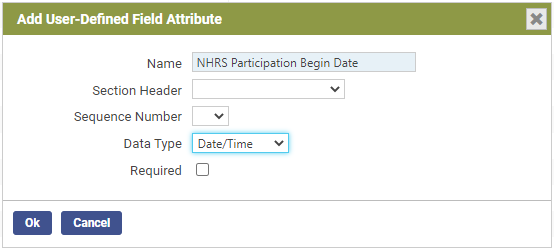

- Click New. The Add User-Defined Field Attribute dialog displays.

-

Fill in the fields as shown below:

- Click Ok.

-

For the next three UDFs, repeat steps 3-5, filling in the fields as shown below:

Once built, these fields display in the User-Defined Fields section of each employee's Workforce Administration Employment tab:

Human Resources > State Requirements > NH > Retirement List

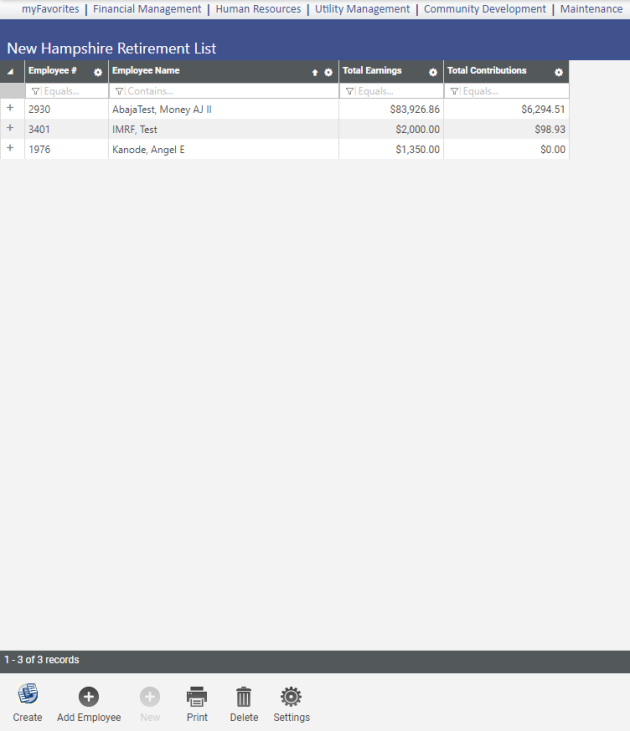

Use the New Hampshire Retirement List page to create and maintain retirement data and generate the retirement list and transmittal file for New Hampshire retirement system reporting.

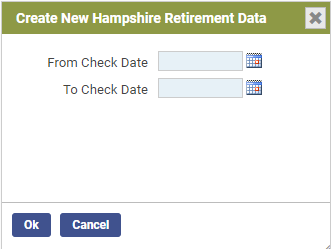

Once you have completed the setup and are ready to create an on-screen work file of the data to be submitted to the Retirement System of New Hampshire, click the Create button on the New Hampshire Retirement List page. The Create New Hampshire Retirement Data dialog opens:

Select the From Check Date and To Check Date of the payroll date range to be reported. The create process looks for wages and contributions for every check date that falls within the date range selected.

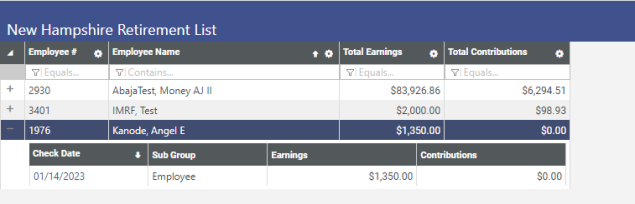

After making your selections, Click Ok. (If retirement data has been created previously, a dialog asks whether you want to overwrite the data.) Retirement data for the date range(s) selected populates the grid on the New Hampshite Retirement List page:

Sorted alphabetically by employee, the grid summarizes the earnings and contributions of each employee.

Click the plus sign next to an Employee # to open a sub-grid that displays information for individual pay periods that fall within the check dates selected in the create process. Each row provides a breakdown of earnings and contributions for a particular Check Date:

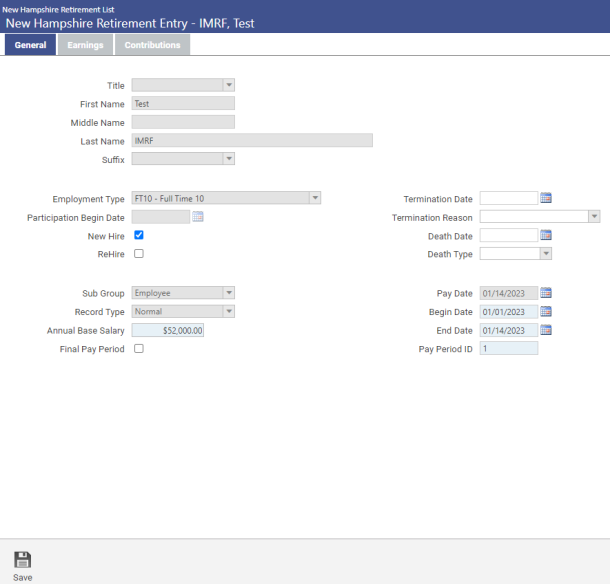

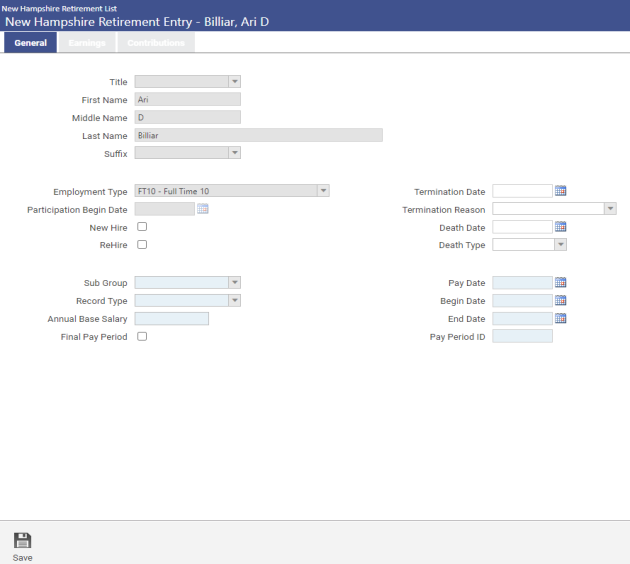

To review an employee's detailed data, click the Check Date. The New Hampshire Retirement Entry page for that employee opens. This page contains three tabs, General, Earnings and Contributions:

-

General

Demographic data on the General tab comes from Workforce Administration and is display-only:

This tab includes data from user-defined fields. If any data is incorrect, correcting it in Workforce updates it here automatically.

-

Earnings

Data on the employee's Earnings tab grid comes from the wage mappings in System Settings Maintenance:

-

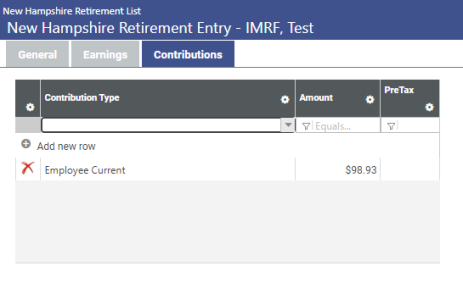

Contributions

Data on the employee's Contributions tab grid comes from the benefit and deduction mappings in System Settings Maintenance:

If an employee has multiple deductions or benefits of the same contribution type, the contribution type is listed once with the total amount.

If necessary, you may add, edit and delete rows.

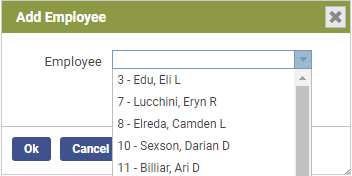

To add an employee to the retirement list, click the Add Employee button on the New Hampshire Retirement List page. The Add Employee dialog opens:

Select the Employee and click Ok. The New Hampshire Retirement Entry page opens with the employee's demographic data loaded on the General tab:

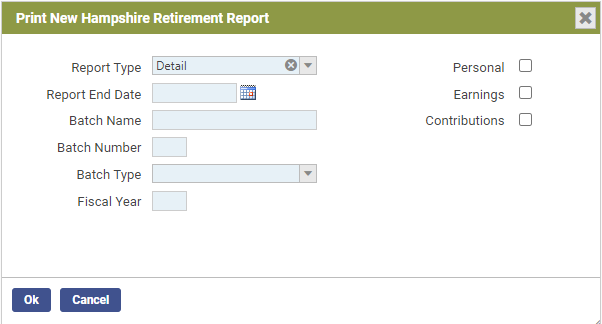

To generate the New Hampshire Retirement Listing and transmittal file, click the Print button on the New Hampshire Retirement List page. The Print Nevada Retirement Report dialog opens:

All fields require entries. Select the Report Type (Summary by Employee, Summary by Entry or Detail), Batch Name, Batch Number, Batch Type (Scheduled or Unscheduled) and the Fiscal Year being reported.

Mark the appropriate check box to include personal, earnings and/or contributions.

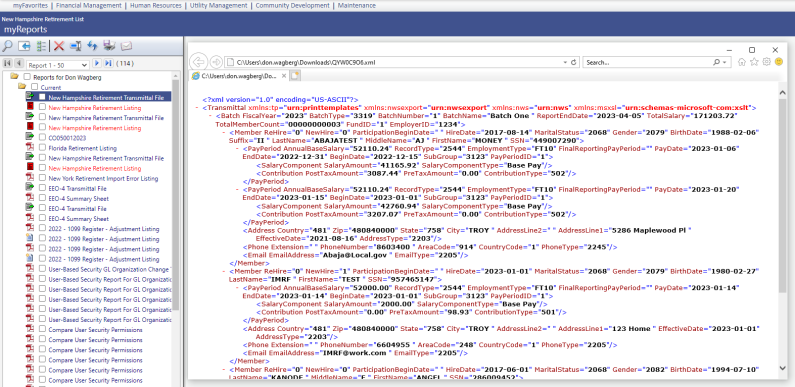

Click Ok to generate and send the listing and transmittal file to myReports.

Note: To navigate between this page and the New Hampshire System Settings Maintenance page, use the Settings button on this page and the Retirement List button on the New Hampshire System Settings Maintenance page.