Look-Back Measurement Period

Maintenance > Human Resources > Affordable Care Act > Look-Back Measurement Periods > New/Edit

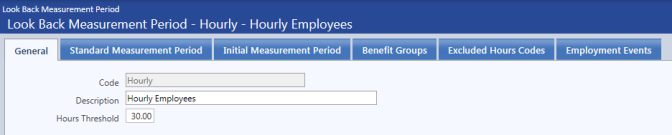

Use this page to set up a measurement period. The settings for a measurement period are separated into six tabbed categories:

- General

- Standard Measurement Period

- Initial Measurement Period

- Benefit Groups

- Excluded Hours Codes

- Employment Events

To view or work in a category, click the corresponding tab to bring it forward.

Measurement reporting uses the Hours Threshold to filter results. The entry allows for two decimal places.

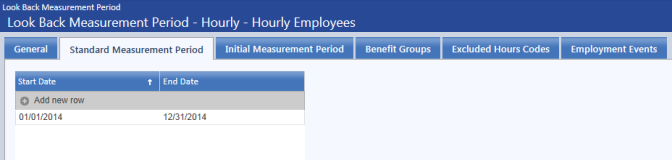

Use this tab to define standard measurement periods for evaluating the full-time status of ongoing employees in selected benefit groups. The Affordable Care Act allows for different measurement periods across bargaining and non-bargaining.

In the grid provided, specify the actual start and end work dates for a measurement period. (Each row represents a measurement period.) If you are using a calendar-year measurement period with the pay period method, specify the pay period start and end dates (the pay period that beings the measurement period and the pay period that ends it).

A measurement period may be between three and 12 months and may not overlap with other measurement periods.

Once a measurement period has been saved, it cannot be edited.

Federal Register, Vol. 79, No. 29 page 8586

(ii) Use of payroll periods. For payroll periods that are one week, two weeks, or semi-monthly in duration,

An employer is permitted to treat as a measurement period a period that ends on the last day of the payroll period preceding the payroll period that includes the date that would otherwise be the last day of the measurement period, provided that the measurement period begins on the first day of the payroll period that includes the date that would otherwise be the first day of the measurement period.

An employer may also treat as a measurement period a period that begins on the first day of the payroll period that follows the payroll period that includes the date that would otherwise be the first day of the measurement period, provided that the measurement period ends on the last day of the payroll period that includes the date that would otherwise be the last day of the measurement period.

For example, an employer using the calendar year as a measurement period could exclude the entire payroll period that included January 1 (the beginning of the year) if it included the entire payroll period that included December 31 (the end of that same year), or, alternatively, could exclude the entire payroll period that included December 31 of a calendar year if it included the entire payroll period that included January 1 of that calendar year.

If you want to have a one-year measurement period, 01/01/2014 – 12/31/2014,

Your measurement period would start with the pay period that includes 01/01/2014 through the pay period that preceded the pay period that includes 12/31/2014, or

Your measurement period would start with the pay period that follows the pay period that includes 01/01/2014 through the pay period that includes 12/31/2014.

Each measurement period would include 52 weekly pay periods or 26 biweekly pay periods.

Use this tab to define initial measurement periods for evaluating the full-time status of new employees in selected benefit groups. The Affordable Care act allows for different measurement periods across bargaining and non-bargaining.

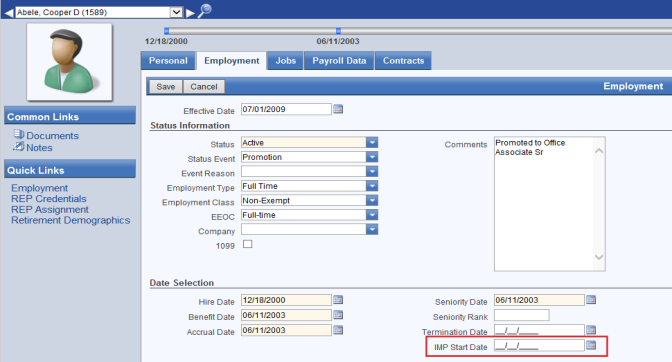

If the initial measurement period date is specified on the employee's Employment tab in Workforce Administration, this date is used.

When determining the start date for an initial measurement period, select any date between the start date and the first day of the first calendar month following the start date.

Note: This date is not copied forward during a create event.

Whether a rehire starts a new Initial Measurement Period depends on how long the break in service is. An employer can treat a rehired employee as a new hire if the employee has a break in for at least:

- 13 consecutive weeks OR

- Under the “rule of parity” an employer may treat a shorter term employee as a new hire if the employee’s break in service is at least:

- Four weeks but less than 13 weeks in duration and

- Shorter than the employee’s preceding period of employment.

The user makes the determination and update the employee record according. An employee who is a continuing employee uses the same measurement and stability period that would have applied to the employee had the employee not terminated.

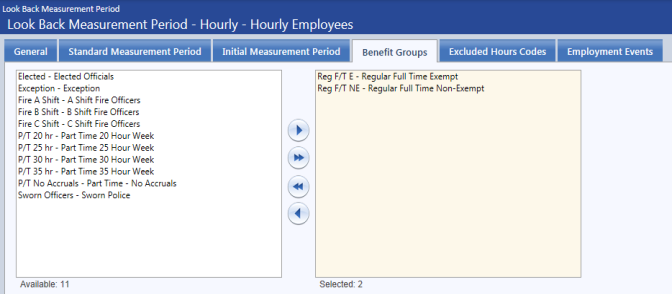

Use this tab to associate benefit groups with the measurement periods, so that the work hours of the employees belonging to the benefit groups may be evaluated. Select at least one benefit group.

Note: A benefit group cannot be associated with multiple measurement periods.

The average hours an employee works to stay in compliance with the Affordable Care Act need to be calculated. Hours include those paid for the performance of duties (regular pay, overtime, on-call) and those paid, or entitled to be paid, for benefits or events in which duties are not performed (vacation, holiday, disability, layoff, jury duty, military leave, leave of absence).

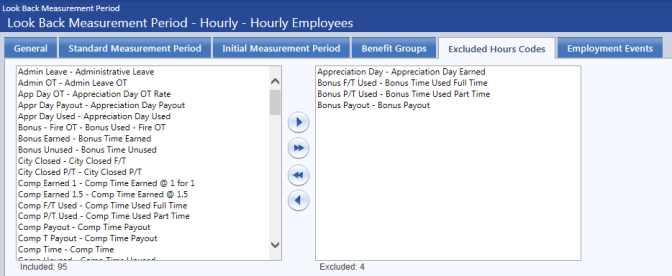

Since most hours codes are included in calculations, use this tab to exclude particular hours codes, or those that do not count towards hours of service.

The Included box contains hours codes that have been created in Hours Code Maintenance with a pay type of hourly.

Salaried employees do not require hours to be paid. For these employees, hours are calculated on a daily basis, using the daily hours defined on their primary jobs, excluding paid time off. Hours are credited for each work day an employee is in a payable status.

Note: For salaried employees, make sure to exclude paid time off hours codes to avoid increasing the hours worked, and include unpaid time off hours codes to reduce the hours worked.

Note: The selected hours codes are excluded in the calculation of hours of service. By default, all newly created hours codes are included in the total hours of service.

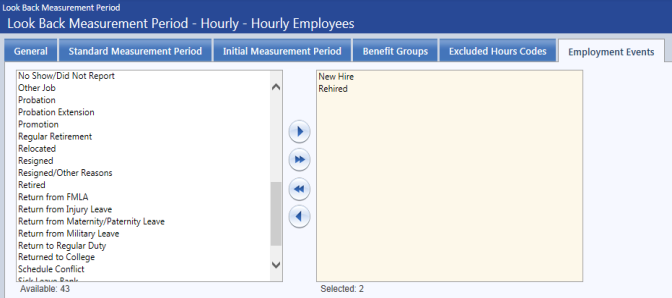

Use this tab to select the employment events, such as new hires and rehires, that trigger an employee's initial measurement period.

Select at least one employment event.

Employment events are displayed in alphabetical order by description.

Hours are calculated from the start of the measurement period (initial or standard) through either of the following:

- The end of the measurement period, if the measurement period is complete.

- The end of the pay period, if the measurement period is on-going.

When running the report, the user selects the date to run through.

Weekly Average = Totals Hours / Weeks

Total Hours is composed of the following:

- Hours that an employee is paid for performance of duties. These hours include regular pay, overtime and on-call.

- Hours that an employee is paid (or entitled to be paid) in which no duties are performed. These hours include vacation, holiday, disability, layoff, jury duty, military leave and leave of absence.

- The user defines these hours codes through the configuration.

What about unpaid leave under FMLA, USERRA, or jury duty ?

Unpaid time is not credited toward the hours of service “full-time” threshold. Employers have two options:

- Determine the weekly average hours during the measurement period by excluding the special unpaid leave period, or

- Credit the employee with hours for special unpaid leave at a rate equal to weekly average during the other weeks in the measurement period.

Special unpaid leave is entered through payroll hours or as an adjustment and tracked as hours.