Maintenance > Human Resources > Benefits Administration > Benefit Plans Maintenance > New/Edit > Plan > New/Edit

Use the tabs on this page to set up and manage all of the details of a benefit plan (ex. Community Blue) for a selected benefit category (ex. Medical).

When selecting plans during open enrollment, an employee sees only the plans that apply to his benefit group.

Note: Once a plan has been used in a payroll or assigned to an employee who has a payroll date that is equal to or later than the plan effective date, the ability to edit the plan is disabled.

The fields on this tab define the general plan data for a selected benefit category. Data may be edited only if the plan has not been used in a payroll.

Some fields are common to all benefit plans, while others are specific to a plan.

To see descriptions of common or plan-specific fields, click the appropriate link below:

| Field | Description |

|---|---|

| Plan Name | Required. Name of the benefit plan. This name displays throughout the system. You may change the Plan Name at any time. |

| Description |

Full description of the benefit plan. It may be the same as the Plan Name. This entry displays as the plan name in eSuite. |

| Benefit Plan Category | Read-only name of the benefit plan category, defaulted from the Benefits Administration Category page. |

| Last Used Date | Read-only end date of the last pay batch to include the benefit plan. During the plan year, this date is updated with the end date of each pay batch. |

| Status | Active or Inactive. |

| Plan Year |

Calendar year of the benefit plan, defaulted from the Benefits Administration Category page. Click in the field to select from a list of applicable years. Selecting the year fills in the rest of the page with data relevant to the benefit plan year and plan. |

| Provider | Required. Vendor providing the benefit plan. Click in the field to select from a drop-down of vendors from Vendor Maintenance. |

| Calculation Method |

Required. Determines how the cost of the benefit plan is calculated and how the cost is split between the employer and the employee. The available options are Flat Amount, Flat Percent and Employee Defined. Flat Amount is based on a flat dollar amount per option, while Flat Percent is based on a percentage of an employee's pay. A selection of Flat Percent or Employee Defined clears and disables the Number of Payments field on the Payment Frequency tab. If the Calculation Method is Employee Defined, the employee always determines on his enrollment page how much he contributes. Once the benefit plan and associated options have been set up, this entry cannot be changed. |

| Validated | Displays a green check mark if the plan has been validated. To validate a plan, click the Validate button, located at the bottom of the General tab. |

| Coverage Effective Dates |

Date range during which the selected plan is in effect, constrained by the Plan Year entry; for example, category X has a plan year of 2010 with a Start Date of 11/01. Effective dates for plans in category X in plan year 2010 may fall between 11/01/09 and 10/31/10 only. To navigate between different effective- dated periods of this plan, click the arrow buttons on either side of the field, or click directly in the field to select from a drop-down of all effective-dated periods. |

| 6055 Reporting |

Determines whether the benefit plan is available for Regardless of whether the category or plan has a last-used date, this check box may be selected or deselected at any time. |

| Comments | Free-form comments that may be added to record additional plan information not covered by field entries. This box may contain 1,000 characters. |

| Field | Description |

|---|---|

| Does not contain plan-specific fields | |

| Field | Description |

|---|---|

| Does not contain plan-specific fields | |

| Field | Description |

|---|---|

| Track Primary Doctor |

Determine whether a primary care provider, secondary care provider and identification number may be selected and tracked when an employee signs up for this plan. Within the effective-dated period of the selected plan, this data may be tracked for the employee and the employee's dependents in the Benefit Plans section in Workforce Administration. |

| Track Secondary Doctor | |

| Track Identification Number | |

| Allow Employer Contribution Percentage |

Gives the option in Workforce Administration to override an individual employee’s health care or dental contribution based on a percentage of the employer’s total contribution. This feature eliminates the need to set up plan costs for multiple percentages and makes it easy to designate a different contribution amount for any employee in a plan. Note: This check box is available for use only when the Calculation Method for the benefit plan is Flat Amount. If Allow Employer Contribution Percentage is checked, an Employee Deduction Code must be selected on the Cost Entry pop-up that opens from the grid on the Options tab of the Benefits Administration Plan Entry page. This selection is required even if the employer contribution is set up as 100%. |

| Minimum Employer Contribution |

Enabled when Allow Employer Contribution Percentage is checked, allows for the designation of a minimum dollar amount an employer is to contribute to the plan, regardless of the employer contribution percentage selected for an individual retiree in Workforce Administration. Note: This field is available for use only when the Calculation Method for the benefit plan is Flat Amount. |

| Rule Set Type |

Tells what rule set is applied, based on the date type selected. The valid selections are Accrual Date, Benefit Date, Cycle Hours, Hire Date and Seniority Date. If a Rule Set Type is not applicable, leave this field blank. |

| Apply FTE or % |

Identifies whether a position full-time equivalency or plan calculation percentage is applied to the calculation method. Full-time equivalency refers to budgeted hours, not actual hours; for example, if a full-time position equals 40 hours per week, an employee who works 20 hours per week corresponds with a .5 FTE. |

| Allow Override of Pretax Flag on Employee | Determines whether an employee may have contributions taken before taxes. |

| Field | Description |

|---|---|

| Does not contain plan-specific fields | |

| Field | Description |

|---|---|

| Does not contain plan-specific fields | |

To see what a button does, click its image below:

Note: When a benefit plan is saved, the associated benefits and deductions are added automatically to their respective sections in Workforce Administration.

Use the Options tab to associate benefit groups with rule sets and benefit coverage options and to set up and maintain the employer and employee costs of those options. Examples of benefit plan options for a medical category may include Employee, Employee +1 and Family. When enrolling in the associated plan, an employee is prompted to select one of these options.

Note: More than one benefit group may be associated with the same rule set.

When selecting plans during open enrollment, an employee sees only the plans that apply to his benefit group.

Coverage options that already have been set up and associated with rule sets and benefit groups as of the effective date range of the benefit plan display in a grid, with each row corresponding to one grouping of coverage options, rule set and benefit group.

Grid rows are sorted alphabetically by Rule Set, followed by Benefit Group.

Note: Once a plan has been used in a payroll or assigned to an employee who has a payroll date that is equal to or later than the plan effective date, the plan options cannot be edited.

| Column | Description |

|---|---|

| Rule Set | Code identifying the rule set. |

| Benefit Group | Benefit group tied to this rule set and associated benefit options. |

| <Options> |

Individual columns pertaining to each option and its associated costs per employer and employee. Examples of options may include Employee, Employee + 1 and Family. To add or edit options data for a rule set-benefit group association, click directly in the appropriate row, and the Cost Entry pop-up opens. See sample |

The effective date range of the group of rule sets contained in the grid is displayed immediately above the right side of the grid in the Coverage Effective Dates field. To view or work with groups of rule sets for other effective date ranges, click the drop-down prompt or the horizontal arrows on either side of the field.

Rule sets establish the eligibility and rate rules for each benefit plan. They may be based on employment dates, work schedules or exception codes.

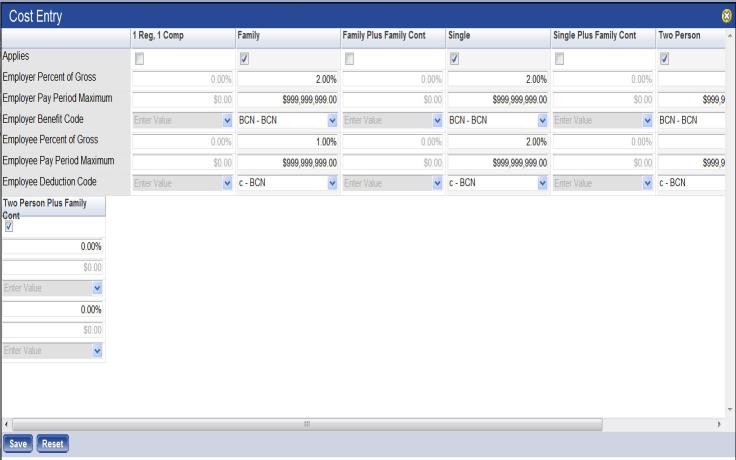

To add a rule set-benefit group association to the grid, click the New button, located in the bottom border of the grid. To edit a rule set-benefit group association, click the edit icon (![]() ), located in the far-left of the corresponding Rule Set. In both instances, the

), located in the far-left of the corresponding Rule Set. In both instances, the ![]() Benefit Administration Cost-Select Rule Set and Benefit Group pop-up opens, containing a field for selecting the Rule Set, and multi-select list boxes for the selection of one or more benefit groups to be associated with the rule set. Only rule sets associated with the selected category are available on the Rule Set drop-down.

Benefit Administration Cost-Select Rule Set and Benefit Group pop-up opens, containing a field for selecting the Rule Set, and multi-select list boxes for the selection of one or more benefit groups to be associated with the rule set. Only rule sets associated with the selected category are available on the Rule Set drop-down.

Note: If you are editing a rule set that is associated with one or more benefit plans, a warning message displays, showing the names of the benefit plan(s).

To delete a rule set-benefit group association, click the delete icon (![]() ), located in the cell immediately to the left of the appropriate Rule Set. A dialog asks you to confirm the delete. Related coverage options also is deleted.

), located in the cell immediately to the left of the appropriate Rule Set. A dialog asks you to confirm the delete. Related coverage options also is deleted.

Note: A rule set-benefit group association that has been used in a payroll cannot be deleted.

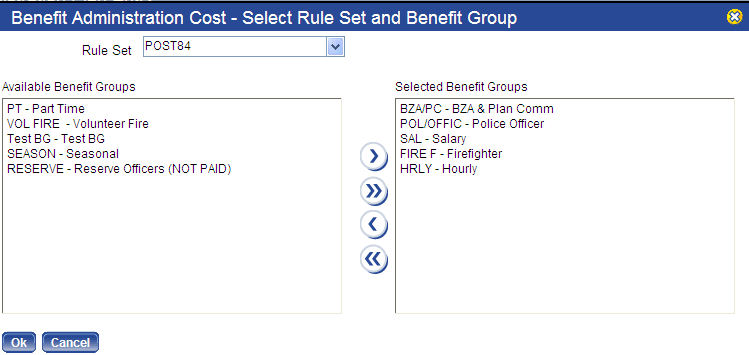

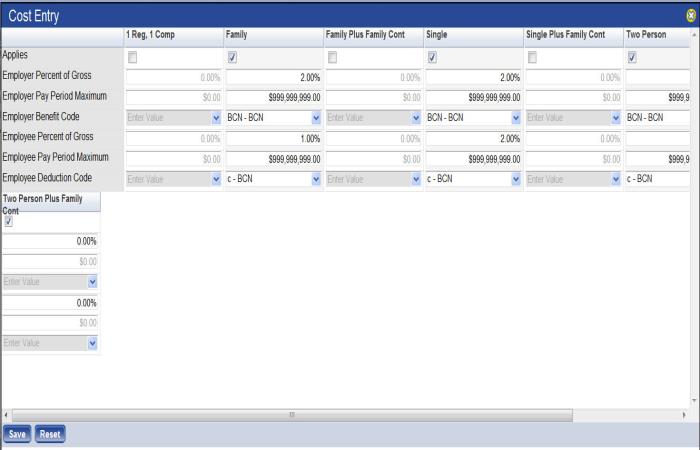

To add or edit benefit coverage options for a rule set-benefit group association, click directly in the appropriate row. The Cost Entry pop-up opens, containing a grid of the available options (as set up on the Coverage Options Listing page), the employer and employee amounts paid for the coverage and the benefit and deduction codes that apply. See sample ![]() Cost Entry pop-up for medical plan.

Cost Entry pop-up for medical plan.

Each column corresponds to a coverage option. Type or make selections directly in the grid cells.

To see sample Cost Entry pop-ups and field descriptions for a particular plan type, click the appropriate link below:

| Cell | Description |

|---|---|

| Applies | Determines whether this option is active and available for selection. |

| Credit Amount | Required. Dollar amount of the credits given to an employee for the associated eligibility status. |

| Payout Percentage | Percentage of an employee's remaining benefit credits that is reimbursed. |

| Payout Hours Code | Used for paying employees who do not use all of their benefit credits. |

| Employer Benefit Code | Required. Similar to benefit codes in other categories, benefit code expensed for the amount of the employer's contribution. The drop-down contains all benefit codes that have Include in Benefit Plan checked and are not in use by another category or plan. This benefit code may be used for the same plan with other rule sets. |

| Pre-Tax Deduction Code | Required. Similar to deduction codes in other categories, provider deduction code. The drop-down contains all deduction codes that have Include in Benefit Plan checked and are not in use by another category or plan. This deduction code may be used for the same plan with other rule sets. The pre-tax and post-tax deduction codes may be the same. |

| Post-Tax Deduction Code | Similar to deduction codes in other categories, provider deduction code. The drop-down contains all deduction codes that have Include in Benefit Plan checked and are not in use by another category or plan. This deduction code may be used for the same plan with other rule sets. The pre-tax and post-tax deduction codes may be the same. |

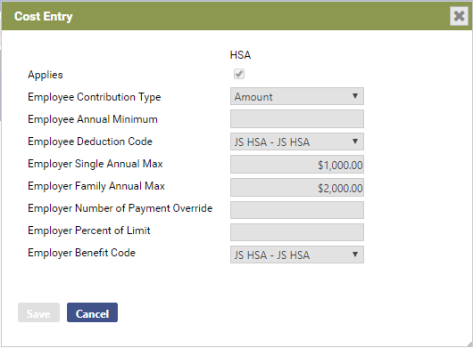

| Cell | Description |

|---|---|

| Applies | Determines whether this option applies to the selected plan. |

| Employee Contribution Type | Required. Determines whether the employee's contribution is based on a dollar amount or percentage. |

| Employee Annual Minimum | Enabled if Contribution Type is Amount, identifies an employee's minimum annual contribution in dollars. |

| Employee Deduction Code |

Required. Deduction code used to calculate the employee's cost. A deduction code is available on the drop-down if it has been marked in Maintenance as Active, if Include in Benefit Plan is selected, if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page and if another benefit category is not already using it. The selected code is assigned to an employee upon enrollment in this benefit plan option. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

| Employer Single Annual Max |

Identifies the employer's maximum contribution in dollars for employee self coverage. This amount divided by the Employer Number of Payments Override is the amount contributed each check; for example, if the Employer Family Annual Max is $1,000 and the Employer Number of Payments Override is 1, the entire $1,000 is contributed with the first check. This field is disabled if the Employer Percent of Limit contains an entry. |

| Employer Family Annual Max |

Identifies the employer's maximum contribution in dollars for employee family coverage. This amount divided by the Employer Number of Payments Override is the amount contributed each check; for example, if the Employer Family Annual Max is $1,000 and the Employer Number of Payments Override is 2, $500 is contributed with the first check and $500 with the second. This field is disabled if the Employer Percent of Limit contains an entry. |

| Employer Number of Payments Override |

Number of payments the employer makes to an HSA to reach the annual maximum; for example, selecting 1 means the entire amount is deposited in the HSA with the first check. Note: While the HSA benefit plan allows for the employer's contribution to be made all at once, the 26-pay cycle is maintained for employee contributions. |

| Employer Percent of Limit | Employer's share of the cost limit, expressed as a percentage. This field is disabled if the Employer Amount contains an entry. |

| Employer Benefit Code |

Required if Employer Amount or Employer Percent of Limit contains an entry, disabled if both fields are blank. Benefit code used to calculate the employer's share of the cost. The selected code is assigned to an employee upon enrollment in this benefit plan option. A benefit code is available on the drop-down if it has been marked in Maintenance as Active, if Include in Benefit Plan selected and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employer Benefit Code cannot be in use by another active benefit plan. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

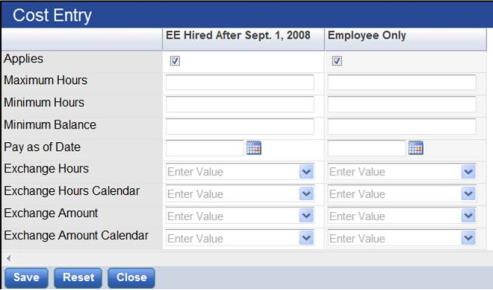

| Cell | Description |

|---|---|

| Applies | Determines whether this option is active and available for selection. |

| Maximum Hours | Maximum number of hours that may be exchanged. At enrollment, the employee's election is validated against this number. If there is no maximum, leave this field blank. |

| Minimum Hours | Minimum number of hours that may be exchanged. At enrollment, the employee's election is validated against this number. If there is no minimum, leave this field blank. |

| Minimum Balance | Minimum hours balance required for an employee to be eligible to make elections. (Employee Service > Hours History shows whether an employee has the hours to exchange.) It does not have to be related to the number of hours an employee elects to exchange. |

| Pay As of Date | Required. Used to find the hourly pay rate used to calculate the exchange amount. |

| Exchange Hours |

A taken hours code with a zero (0) multiplier. This code defines when the leave time is exchanged to lower an employee's accrual balance. It coincides with how leave is earned. Leave is earned every pay period or monthly. Note: If you use an accrual hours code, you will add the hours to an employee's bank instead of take them away. And if the hours code does not have a zero (0) multiplier, you will pay the employee for the hours and use them to pay for benefits, effectively paying the employee twice for the hours. |

| Exchange Hours Calendar | Calendar used to determine the schedule for exchanging leave hours. This entry coincides with how leave is earned—every pay period or monthly.(Maintenance > Human Resources > Benefits Administration > Leave Exchange Calendars) |

| Exchange Amount | Hours code used to pay the amounts for leave time exchange. The drop-down contains all Other pay hours codes. |

| Exchange Amount Calendar | From defined leave schedules, determines how often dollars are given to an employee for leave hours exchanged. The entry should coincide with the times when benefits are deducted from an employee's check. (Maintenance > Human Resources > Benefits Administration > Leave Exchange Calendars) |

Life and disability insurance options are based on a Flat Amount or a Rate Per Salary.

Flat Amount is a fixed cost and a fixed cost sharing method. Most medical, dental and vision plans fall into this category; the cost is a fixed amount per month, and the employee/employer contribution is set at the start of the benefit year.

Rate Per Salary is an employer-only paid benefit, where the premium (benefit amount) is based on a policy amount that is determined by an employee's base salary.

Particular rules determine a policy amount, upon which the premium is calculated. As an employee's base pay may change during the year, the policy amount and, therefore, the premium also varies.

During employee benefit enrollment, premiums calculate automatically based on the selections you make on the Cost Entry pop-up.

This pop-up gives employees the ability to purchase life insurance in equal blocks, or increments, of pre-set amounts, up to a maximum of $300,000, avoiding the need to set up options for each increment. This feature is available for a Rate per SalaryCalculation Method.

| Cell | Description |

|---|---|

| Plan Cost | Required. Plan cost by pay period, month or year. |

| Employer Share (percent) |

Employer's share of the cost, expressed as a percentage of the total cost. The acceptable range of entry is from 0.01 to 100.00 percent. Typing a percentage disables the Amount field, and its value and the value of the Employee Share calculate automatically. Values recalculate based on the Employee Share percent. Typing an amount disables the Percent field, and its value and the value of the Employee Share are calculated. For cafeteria benefit plan options, the employer share of the cost sets automatically to 100%; consequently, the Employer Share field is hidden on this page. |

| Employer Share (amount) |

Employer's share of the cost, expressed as a fixed amount. For cafeteria benefit plan options, the employer share of the cost sets automatically to 100%; consequently, the Employer Share field is hidden on this page. |

| Employee Share (percent) |

Employee's share of the cost, expressed as a percentage of the total cost and as a fixed amount. For cafeteria benefit plan options, the employee share of the cost sets automatically to 0; consequently, the Employee Share field is hidden on this page. |

| Benefit Code |

Required if the Employer Share is greater than 0 percent. Benefit code used to calculate the employer's share of the cost. The drop-down is populated with all active flat-amount benefit codes for which the Include in Benefit Plans box is checked on the Benefit page in Maintenance. This code is assigned to an employee upon enrollment in this benefit plan option. This field is disabled if the Employee Share is $0.00 or 0%. |

| Deduction Code |

Required if the Employee Share is less than or greater than $0.00 or 0%. Deduction code used to calculate an employee's share of the cost. The drop-down is populated with all active flat-amount deduction codes for which the Include in Benefit Plans box is checked on the Deduction page in Maintenance. This code is assigned to an employee upon enrollment in this benefit plan option. This field is disabled if the Employee Share is $0.00 or 0%. For cafeteria benefit plan options, since the employer share of the cost sets automatically to 100%, the Deduction Code field is hidden on this page. |

| Medicare Reduction Amount | Displayed only if the Medicare Reduction Applies box is checked on the Benefits Administration Category page. Amount by which the total plan cost is reduced for each person who qualifies for Medicare. |

| Max. Number of Dependents |

Displayed only if the Track Covered Dependents box is checked on the Benefits Administration Category page. Number of dependents who may be covered under this option. When enrolling in this benefit plan option, an employee may associate up to this number of dependents. |

| Max % Projected Salary |

Maximum percentage of an employee's projected salary to be used in paying an insurance premium. The payroll calculation checks whether the premium amount exceeds this percentage. If it does, the Max % Projected Salary is used as the calculated amount. This field is available for regular and cafeteria benefit plan options using flat-amount calculations in the medical, dental and vision benefit categories. Entries in this field also are included on the Benefit Plan Listing. |

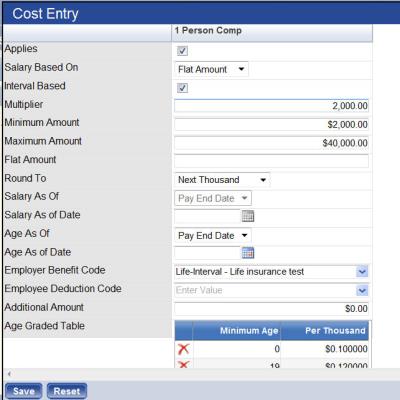

| Cell | Description |

|---|---|

| Applies | Determines whether this option applies to the selected plan. |

| Salary Based On |

Required. Amount on which the policy value and, by extension, the premium/benefit amount are based. The available selections are as follows:

If the selection is Flat Amount, the Option column of the grid displays "Flat Amount" followed by the actual dollar amount. If the selection is something other than Flat Amount, the column displays the name of the selection (Annual, Biweekly), multiplied by the selected Multiplier and, below that, the Minimum and Maximum amounts. To give employees the ability to purchase incrementally based life insurance, the Salary Based On selection must be Flat Amount, and Interval Based must be checked. (The Interval Based check box is enabled once Flat Amount has been selected in the Salary Based On field.) |

| Interval | Enabled when Salary Based On is Flat Amount, determines whether employees are able to purchase incrementally based life insurance. |

| Multiplier |

Required if Salary Based on is not Flat Amount. Multiplier factor applied to the employee's base salary to determine the policy amount. While 1 (base salary) is the usual option, some employees receive life insurance policies for two times (or more) their annual salary. Likewise, a long-term disability policy may be equal to 60 percent (0.60) of an employee's base monthly salary. The acceptable range for the Multiplier is 0.0001 through 999.9999. |

| Minimum Amount | Minimum policy amount if an employee's base salary times the multiplier returns an amount less than this one. |

| Maximum Amount |

Maximum policy amount if an employee's base salary times the multiplier returns an amount greater than this one. If insurance may be purchased incrementally (Interval is checked), the Minimum Amount and Maximum Amount refer to the starting and ending policy amounts; for example, if the city provides life insurance from $5,000 to $100,000, the Minimum Amount would be $5,000, the Maximum Amount$100,000 and the Multiplier$5,000; therefore, employees would have the option to purchase life insurance in blocks of $5,000, up to a maximum of $100,000. |

| Flat Amount | Dollar amount of the benefit plan. An entry in this field clears and disables the Multiplier, Minimum Amount and Maximum Amount fields. |

| Override Amount |

Overrides all calculations and returns this policy amount for all members in this plan. |

| Round To |

Required if Salary Based on is Flat Amount. When base salary is calculated, determines whether rounding should occur to the closest unit (true rounding) or up to the next unit (ceiling function). The unit tells what the program rounds to when the policy amount is calculated. The system can round to the Closest Thousand, Next Thousand, Closest Dollar or Next Dollar. |

|

Premium Amount Supplemental life premiums may be set up based on employee age. Premiums may be calculated based on salaries at the beginning of the benefit plan year. |

|

| Salary As Of |

Use the Salary As Of field to select whether the premium calculates based on an employee's salary as of the pay end date or some other date you specify. |

| Salary As of Date | Actual Pay End Date or Specific Date. Click the date prompt to select the date from a pop-up calendar. |

| Age As Of |

Use the Age as of field to select whether the premium calculates based on an employee's age as of the pay end date or some other date you specify. |

| Age As of Date | Actual Pay End Date or Specific Date. Click the date prompt to select the date from a pop-up calendar. |

| Benefit Code |

Benefit code used to calculate the employer's share of the cost, required when the benefit plan option contains an employer-paid amount greater than 0%. The drop-down is populated with all active benefit codes for which the Include in Benefit Plans box is checked on the Benefit page in Maintenance and the Vendor is the same as the Provider selected on the General tab of this page. This code is assigned to an employee upon enrolling in this benefit plan option. Payroll uses this code to charge the amounts to the appropriate locations. Select a Benefit Code or Deduction Code. |

| Deduction Code |

Deduction code used to calculate an employee's share of the cost, required when the employee-paid amount is greater than 0%. The drop-down is populated with all active deduction codes for which the Include in Benefit Plans box is checked on the Deduction page in Maintenance and the Vendor is the same as the Provider selected on the General tab of this page. This code is assigned to an employee upon enrolling in this benefit plan option. Payroll uses this code to charge the amounts to the appropriate locations. Select a Benefit Code or Deduction Code. |

| Additional Amount | Flat additional amount that should be added to the premium—for example, covering dependents on the policy may result in an additional $0.30. |

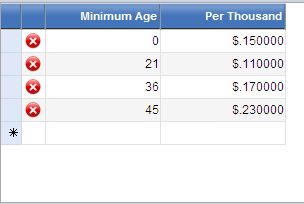

| Age-Graded Table |

The Age-Graded Table contains two columns, Minimum Age and, based on the Round To selected,Per Thousandor Per Dollar. These columns identify the rates per thousand dollars or per dollars applied to particular age ranges. The table must contain at least one entry.

In the example shown above, the rate for an employee aged 36 to 44 would be 17 cents per thousand dollars; the rate for an employee aged 45 or above would be 23 cents. To add a Minimum Age and rate Per Thousand to the Age-Graded Table, click the New button. An empty row with an asterisk to its left displays at the bottom of the table. Click in the row to open it for entries. The asterisk remains until you click Save or Save/New to save the entries. When you save or click outside the row, the dollar sign ($) is added automatically. To edit a row, click it and type directly over the existing entry. To delete a row, click the corresponding red-and-white X button |

| Cell | Description |

|---|---|

| Applies | Determines whether this coverage option--Employee, Employee + 1, etc.--applies to the selected plan. If it applies, check the box. |

| Monthly/Annual Plan Cost | Total dollar amounts required per month and year to pay for the coverage option selected. |

| Employer Amount |

Employer's share of the cost, expressed as a fixed dollar amount. For cafeteria benefit plan options, the employer share of the cost sets automatically to 100%; consequently, this field is hidden. |

| Employer Percent |

Employer's share of the cost, expressed as a percentage of the total cost. The acceptable range of entry is from 0.01 to 100.00 percent. Typing a percentage disables the Employer Amount field, and its value and the value of the Employee Share calculate automatically. Values are recalculated based on the Employee Percent percent. Typing an amount disables the Employer Percent field, and its value and the value of the employee share are calculated. For cafeteria benefit plan options, the employer share of the cost sets automatically to 100%; consequently, the Employer Amount field is hidden. |

| Employer Benefit Code |

Benefit code used to calculate the employer's share of the cost, required when the benefit plan option contains an employer-paid amount greater than 0%. This code is assigned to an employee upon enrollment in this benefit plan option. A benefit code is available on the drop-down if it is marked in Maintenance as Active, if the Include in Benefit Plan box is checked and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employer Benefit Code cannot be in use by another active benefit plan. This field is disabled if the employee share is $0.00 or 0%. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

| Max Percent of Annual Pay | Maximum amount, expressed as a percentage of annual pay, an employee may contribute in one year. |

| Employee Amount |

Employee's share of the cost, expressed as a fixed dollar amount, paid through deductions. Typing an amount in this cell automatically calculates and populates the Employee Percent. |

| Employee Percent | Employee's share of the cost, expressed as a percentage of the total cost. |

| Employee Deduction Code |

Deduction code used to calculate the employee's share of the cost, required when the benefit plan option contains an employee-paid amount greater than 0%. This code is assigned to an employee upon enrollment in this benefit plan option. A deduction code is available on the drop-down if it is marked in Maintenance as Active, if the Include in Benefit Plan box is checked and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employee Deduction Code cannot be in use by another active benefit plan. This field is disabled if the employee share is $0.00 or 0%. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

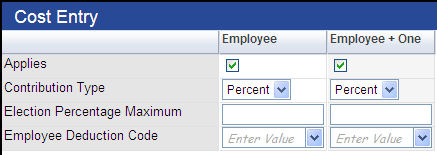

| Cell | Description |

|---|---|

| Applies | Determines whether this option applies to the selected plan. |

| Contribution Type | Required. Determines whether the contribution is based on a dollar amount or percentage. |

| Election Percentage Maximum | Enabled if Percentage is selected as the Contribution Type, maximum percentage of the employee's gross that may be deferred to the plan in a plan year. |

| Employee Deduction Code |

Deduction code used to calculate the employee's cost, required when the benefit plan option Contribution Type is Percentage and the Election Percentage Maximum greater than 0%. This code is assigned to an employee upon enrollment in this benefit plan option. A deduction code is available on the drop-down if it is marked in Maintenance as Active, if the Include in Benefit Plan box is checked and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employee Deduction Code cannot be in use by another active benefit plan. This field is disabled if the employee's contribution amount or percent is zero (0). Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

Deferred Comp options are based on a Flat Amount, Flat Percent or Employee Defined.

Employee Defined Example

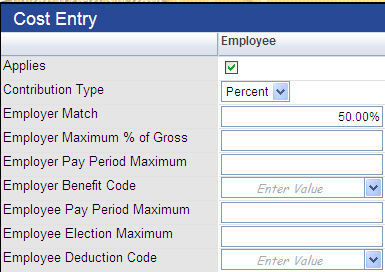

| Cell | Description |

|---|---|

| Applies | Determines whether this option applies to the selected plan. |

| Contribution Type | Determines whether the pension/deferred comp contribution is based on a dollar amount or a percentage. |

| Employer Match | Amount or percentage the employer chooses to contribute to an employee's pension/deferred comp account to match the amount or percentage the employee contributes. |

| Employer Maximum % of Gross | Maximum amount, expressed as a percentage of an employee's annual pay, the employer contributes in one year. |

| Employer Pay Period Maximum | The highest dollar amount the employer contributes to an employee's pension/deferred comp account in one pay period. |

| Employer Benefit Code |

Benefit code used to calculate the employer's share of the cost, required when the benefit plan option contains an employer-paid amount greater than 0%. This code is assigned to an employee upon enrollment in this benefit plan option. A benefit code is available on the drop-down if it is marked in Maintenance as Active, if the Include in Benefit Plan box is checked and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employer Benefit Code cannot be in use by another active benefit plan. This field is disabled if the employee share is $0.00 or 0%. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

| Employee Pay Period Maximum | The highest dollar amount an employee may contribute to his pension/deferred comp account per pay period. |

| Employee Election Maximum | The highest dollar amount an employee may contribute to his pension/deferred comp account per plan year. |

| Employee Deduction Code |

Deduction code used to calculate the employee's share of the cost, required when the benefit plan option contains an employee-paid amount greater than 0%. This code is assigned to an employee upon enrollment in this benefit plan option. A deduction code is available on the drop-down if it is marked in Maintenance as Active, if the Include in Benefit Plan box is checked and if the Vendor is the same as the Provider selected on the General tab of the Benefits Administration Plan Entry page. The Employee Deduction Code cannot be in use by another active benefit plan. This field is disabled if the employee share is $0.00 or 0%. Click the field prompt to select from an alphabetized list of valid codes, or begin to type the code, and select it when it appears in a list of codes that match what you are typing. |

To save your selections on the Cost Entry pop-up and update the grid on the Options tab, click Save. To reset all selections to their last-saved state, click Reset.

To close the pop-up, click the X in the top-right corner of the pop-up.

To see what a button does, click its image below:

Selecting Flat Amount or Flat Amount by Date as the Calculation Method on the General tab of the Benefits Administration Plan Entry page enables the Payment Frequency tab, where you identify how often employee payments are deducted for the selected benefit plan.

This tab contains a grid of the pay groups associated with the benefit plan, the frequency with which payments are withheld and the annual number of payments made to the plan for the plan year. Each row in the grid corresponds to a combination of pay group, frequency and annual number of payments.

Employees who belong to any of the pay groups in this grid are eligible to select the associated benefit plan.

When adding or editing a payment frequency, click directly in a grid cell to enable it for entry. The grid always provides a blank row at the bottom for adding a payment frequency. When you <Tab> off the last cell of the grid, a new blank row is added to the bottom.

| Column | Description |

|---|---|

| Pay Group |

Required. Group of employees who are paid in the same cycle. Examples of pay groups are Bi-Weekly, Weekly and Quarterly.Click in the field to select from a list of options that come from validation set 10 (Pay Group) in Maintenance. Note: Only one entry per pay group is permitted. |

| Frequency |

Required. How often deductions are taken for the benefit plan selected. Click in the field to select from a list of available frequencies. Examples may include, First Check of the Month, Last Check of the Month, Every Pay. |

| Number of Payments |

Required. The amount withheld is calculated by dividing the Employee Plan Amount by the number of payments specified here; for example: the frequency selected is Every Pay on a biweekly cycle, meaning there will be 26 pay periods during the year. Populating the Number of Payments field with 26 divides the Employee Plan Amount by 26 to get the per pay period amount. If the year is a 27-paycheck year, populating the Number of Payments field with 27 divides the Employee Plan Amount by 27 to yield an accurate amount for every paycheck. If the calculation method for the benefit plan is Flat Percent, the cells in this column are disabled. |

To delete a payment frequency, click the delete icon (![]() ), located in the far-left cell of the corresponding row.

), located in the far-left cell of the corresponding row.

To see what a button does, click its image below:

Note: For a benefit plan used in a cafeteria plan, it is not necessary to define the payment frequency for the benefit group. Payment frequency is defined at the cafeteria plan level.

To delete a payment frequency, click the delete icon (![]() ), located in the far-left cell of the corresponding row. A dialog asks you to confirm the delete.

), located in the far-left cell of the corresponding row. A dialog asks you to confirm the delete.

The Replaced Plans tab is where you identify benefit plans that have been discontinued for the current plan year and that may be linked automatically to a substitute benefit plan. At enrollment, employees who were enrolled in the discontinued plan(s) are enrolled in the substitute plan automatically.

If plans have not been deactivated from the previous effective-dated plan category, this tab is disabled.

Note: To deactivate plans, navigate to the Plan tab on the Benefits Administration Category page.

Use the multi-select list boxes to select the plans to be replaced. The list box on the left, Previous Year's Plans, is populated with all benefit plans that were offered for the selected benefit plan category in the previous year but have been deactivated since. In this box, select any plans that have been discontinued, and move them to the Replaced list box.

Note: Multiple discontinued plans may be linked to one substitute plan; for example, Blue Cross PPO #3 and Blue Cross PPO #4, if discontinued and selected as replaced plans on this tab, may be linked to one new plan, such as Aetna PPO.

After making all of your edits and new entries for the benefit plan, click Save on the General tab.

.

.