Hours Code

This page contains the details of an hours code.

| Field/Check Box | Description |

|---|---|

| Code | Identifies the hours, typically an abbreviated, easily recognizable version of the full description. This entry may contain 16 characters. |

| Hours Category | Category under which the hours code falls. The drop-down is populated with the categories you have set up on the Hours Categories page (Maintenance > Human Resources > Earnings Maintenance > Hours Categories). |

| Description | Full description of the hours Code. |

| Effective Dates | Not available for entry. Once you save the hours code, the default entry shows [Date Saved] - <Open>. If the hours code is edited on a future date, the Effective Dates change to show [Date Saved] - [Date Ended], and the Effective Dates of the new or changed version of the hours code show [Date Saved] - <Open>. |

| Start Date |

Start date of the hours code. Typically this date is well in the past and used for all hours codes during the initial setup. Once the hours code is saved, this date is used to create an Effective Dates range located directly above the Start Date. |

| Pay Type Information | |

| Pay Type |

Three options: Hourly, Other Amount or Other Percent. Select Hourly if this hours code uses an employee's hourly rate to calculate earnings. Most regular pay, overtime, sick time and vacation time are set up using this type. Select Other Amount if the pay type is a flat dollar amount, such as a salary or a car allowance. Select Other Percent for percent increases of an employee's pay cycle gross check. The FLSA calculation includes hours codes that have been set up with pay types of Other Percent. |

| Hours Multiplier |

Use if Pay Type is Hourly. Examples include 1 for regular hours, 0 for absent without change to pay, 1.5 for time-and-a-half overtime. |

| Default Amount |

Use if Pay Type is Hourly or, most often, Other Amount. If you are using a default amount, such as minimum wage for Hourly or holiday bonus for Other Amount), type the amount here. This amount is used automatically to calculate an employee's earnings. |

| Default Percent | Required if the Pay Type is Other Percent. Type the percentage increase paid to employees. |

| Cap at Pay Cycle |

Use if Pay Type is Other Percent. The increase caps automatically at the cycle pay amount. Cycle pay is equal to an employee's pay rate multiplied by his standard cycle hours (hours worked in a given cycle). |

|

Distribution Identifies the general ledger (G/L) distribution for the hours code. The Debit Account or the Debit G/L Account requires an entry. If you select a Debit Account only, the account combines with an employee's organization set to create a complete G/L account when payroll is run. If you select a Debit G/L Account, the account is expensed using this hours code when payroll is completed. |

|

| Project Information | |

| Project Requirement | Determines how the hours code uses projects. Select Required if the project selection is required. |

|

Hours Options This section contains check boxes that further define the characteristics of this hours code. Select those that apply. |

|

| Taxable Only | Earnings calculated only increase an employee's taxable earnings. The gross or net pay, i.e., imputed income, is not affected. |

| Hours Accrual | Hours code identifies accrual earnings, such as vacation time earned. If this code is used to increase an employee's accrual bank, select this box. |

| Salary | Enabled only Pay Type is Other Amount. If the hours code is used for salaries, select this box. |

| Seniority Hours | Hours worked increase an employee's seniority hours. |

| Employee G/L Override | Enabled if the distribute employee costs by organization box is deselected. Select this box if an employee's G/L distribution should be used instead of the distribution set on the hours code. |

| Productive Hours | Identifies these hours as productive. |

| Workers' Compensation Hours | If workers' comp wages are paid from payroll, identifies these hours as applying toward workers' comp wages. Using this code, the system automatically calculates the amount of wages lost. To designate the hours codes that count toward the total, select this check box on all applicable codes. |

| FMLA Eligible Hours |

Identifies these hours as counting toward FMLA hours worked. Note: This check box is visible only if you are licensed to the FMLA feature. |

| FMLA Taken Hours | Identifies these hours as counting toward FMLA taken time, so that FMLA taken time may be updated from recorded payroll hours, eliminating the need to re-key the time. |

| Premium Pay | Identifies these hours as premium, such as bonuses or overtime. |

| FLSA Eligible | Identifies these hours as factors in FLSA calculations. |

| FLSA Amount Only |

Allows the exclusion of hours from the calculation of FLSA-eligible earnings. If an hours code has FLSA Amount Only selected, only the earnings are used in the FLSA calculation; the hours is not used to determine whether an employee has reached or exceeded the threshold hours. Example: If an employee is paid $20 for an hour of court time and the FLSA Amount Only check box is selected on the hours code for court time, only the $20 is used in the FLSA calculation, and the hour is excluded. Note: The FLSA Amount Only check box does not apply if a custom FLSA calculation is being used. |

| Pension Hours | Identifies these hours as counting toward pension wages. |

| Apply to Longevity |

If Adjust Rate is selected on the Benefit Group, hours code applies to hours used in the calculation of longevity. If Adjust Rate is deselected, hours code applies only to hours that award longevity as a lump sum. |

| Apply to Accruals | Used to determine the number of working hours that affect how much an employee accrues; for example, if standard hours are 80 per pay period and an employee works only 72 hours, if Allow Percentage is selected on the Benefit Group Accrual Profile, the amount accrued is 72 divided by 80, multiplied by the employee's Hours Earned step. |

| Certification Applies | For employees set up with certification, gross from this hours code is increased by this amount. |

| Apply to Contract Pay |

Must be selected for any hours code used to pay a contract employee. Selecting this box disables the Salary check box. Note: This check box is visible only if you are licensed to the Employee Contracts feature. |

| Time Off Eligible | Indicates the hours for this code may be reduced by a time off request during payroll initialization. This check box is disabled when Pay Type is Other Amount or Other Percent, when Taxable Only is selected and when Hours Accrual is selected. |

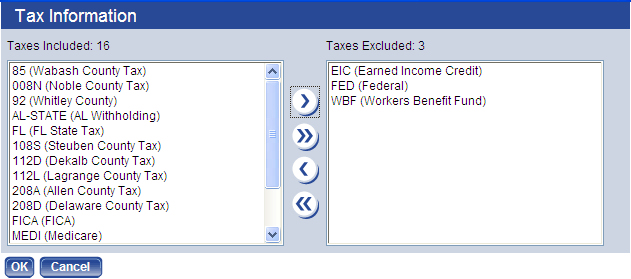

When you save this hours code, the Tax Information button at the bottom of the page becomes active. If pay earned using this hours code should be tax exempt, click this button. The Tax Information dialog opens.

Move the appropriate taxes from the Taxes Included box to the Taxes Excluded box, and click OK.