Government Reporting

Welcome to the New World ERP Government Reporting Processing online guide. This guide will walk you through both the setup and processing aspects of the Government Reporting Module.

The guide is divided into two sections:

The System Administration section will focus on the initial setup needed to map the G/L Accounts to the proper locations on the various financial reports. This will include detailed information on defining the various classifications that appear on the reports and then mapping these classifications to the proper accounts in the system. This section will also include the security settings which will be utilized to enable workflow and tailor user options to your needs.

The End User Processing section will describe the steps, workflow and options available in Government Reporting to the end-user. It will guide you through the process from initializing the report fiscal year, maintaining the chart of accounts settings, to generating the fiscal year reports.

System Administrator Guide

G/L Account Summary Codes

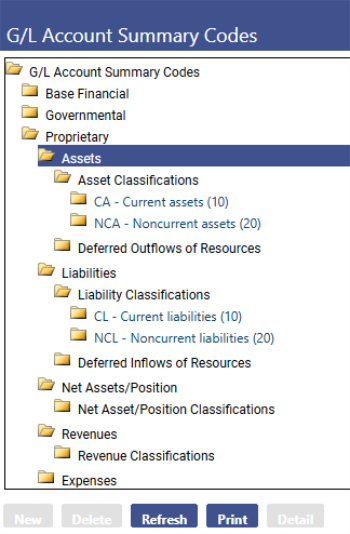

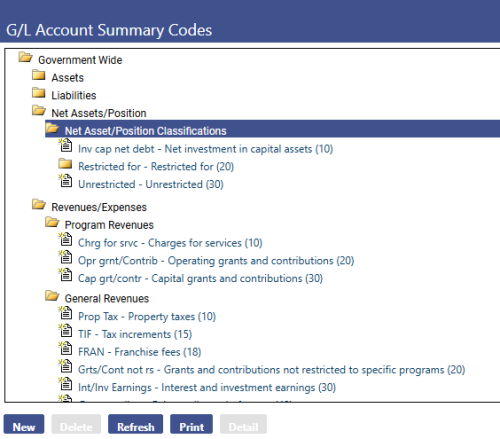

G/L Account Summary Codes are used to define the various column and row headings that are presented on the financial statements. To assist in defining these items, it is helpful to have the prior year financial statements on hand.

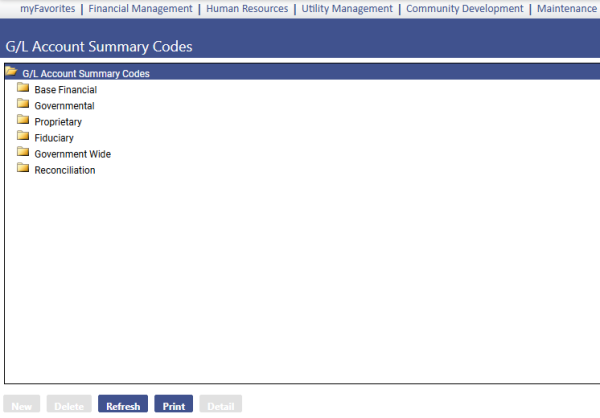

The G/L Account Summary Code page groups all of the codes in folders by report type, as shown below.

Maintenance > new world ERP Suite > Chart of Accounts > G/L Account Summary Codes

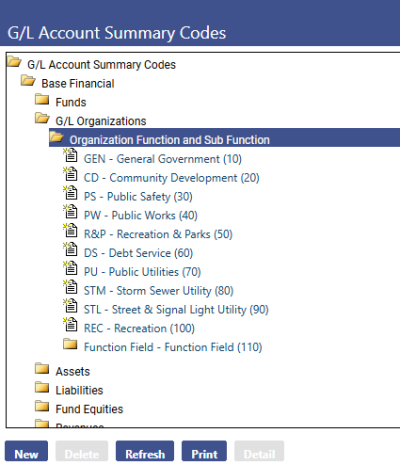

Under the G/L Account Summary Codes folder there are 6 main sections used in the setup of governmental reporting. Within the Base Financial folder, there are two sections that apply to the Governmental Reporting Module:

- Base Financial>Funds>Fund Category and Type. The types of funds that are available for reporting purposes are defined here.

- G/L Organizations>Organization Function and Sub Function section pertains to the Government Reporting module. The other five sections (Governmental, Proprietary, Fiduciary, Government-Wide, and Reconciliation) represent each type of report that can be generated from the Government Reporting module.

Fund Category and Type

The Fund categories and types are defined in the GASB blue books and are as follows:

Governmental Funds

- a. General Fund

- b. Special Revenue Funds

- Debt Service Funds

- Capital Project Funds

- Permanent Funds

Proprietary Funds

- a. Internal Service Funds

Fiduciary Funds

- Pension Trust Funds

- Investment Trust Funds

- Private Purpose Trust Funds

- Agency Funds

Function and Sub Function

To add a Function/Sub Function, expand the Base Financial > G/L Organizations>Organization Function and Sub Function Folder.

Click New.

Enter the Code, Description, and Report Sequence Number.

Code – Up to 16 alphanumeric characters can be entered. The code is informational only and will not appear on any of the reports.

Description – Up to 64 alphanumeric characters can be used to describe the line item. The description will appear on the various reports.

Report Sequence Number – This determines the ordering of the function/sub function on the financial statements. It is recommended to space the sequence numbers by multiples of at least 5, to allow for future insertions.

Click Save to save the newly created record, or Save/New to save the record and enter another one.

Once a function is created, a sub function can be created beneath it. To add a sub function to a function, click in the icon next to the function to select it and then click New.

Account Classifications

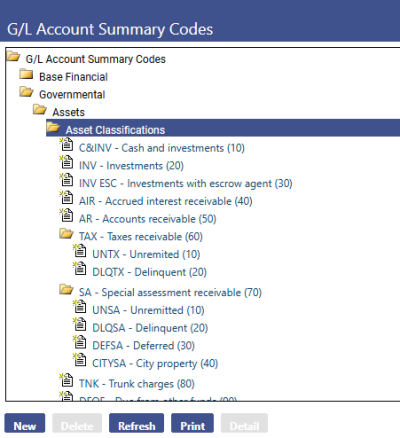

Account Classifications determine how each account is grouped and presented on a line item on the financial reports. Each report type (Governmental, Proprietary, Fiduciary, & Government Wide) will have its own set of account classifications and each account can have multiple classifications tied to it – one for each report type.

The system will allow up to 6 levels of account classifications, although the majority will only use one level.

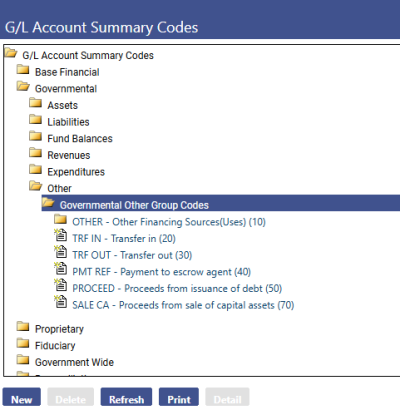

Governmental

Assets, Liabilities, Fund Equity, and Revenues – To create a governmental fund account classification, expand the Governmental folder, expand the appropriate account type folder, select the Classifications folder, and click New. Follow these steps when adding asset, liability, fund balance, and revenue classifications.

Expenditures – Adding an expenditure classification follows a slightly different process than the other account types. In addition to the Expense Classification field, the Governmental Character also needs to be defined. On the Statement of Revenues, Expenditures, and Changes in Fund Balance, the governmental character is reported as a parent level category with expenditure classifications as the sub level.

Governmental Character - When adding a character, one of two choices must be selected in the Character Sort Code field. This determines how the expenses will be classified.

Organization Function and Sub Function – Expense accounts with this character will be automatically classified based on the function/sub function tied to that expense account.

Fund Reporting Profile – Expense accounts with this character will be classified based on the expenditure classification tied to that expense account.

Common examples of Governmental Character and related Character Sort Code:

- Current – Organization Function and Sub Function

- Capital Outlay – Fund Reporting Profile

Principal – Fund Reporting Profile

Expenditure Classification – Define the expenditure classifications used to sub group the expenditure accounts for financial statement reporting. Remember, only the expenditure classifications that are not based on the function/sub function of that account need to be created.

Common examples of Expenditure Classifications:

- Principal

- Interest

- Capital Outlay

- Land

Other – This section is used to define the separately reported line items on the Governmental Funds Statement of Revenues, Expenditures and Changes in Fund Equity. These items will appear on the report below the expenditures section.

Examples of Other Classifications:

- Sale of capital assets

- Transfers in

- Transfers out

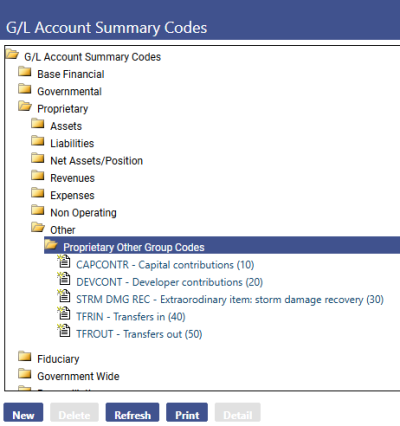

Proprietary

Assets, Liabilities, Net Assets, Revenues, and Expenses – To create a proprietary fund account classification, expand the Proprietary folder, expand the appropriate account type folder, select the Classifications folder, and click New. Follow these steps when adding asset, liability, net asset, revenue, and expense classifications.

Non-Operating –Non-Operating classifications will appear in the Non-Operating Revenues (Expenses) section on the Proprietary Funds Statement of Revenues, Expenses, and Changes in Fund Net Assets.

Other – Other classifications will appear at the end of the Proprietary Funds Statement of Revenues, Expenses, and Changes in Fund Net Assets.

Examples:

- Transfers in

- Transfers out

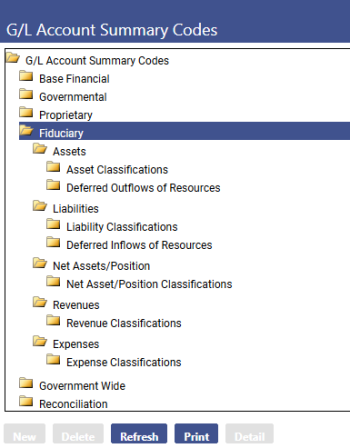

Fiduciary

Assets, Liabilities, Net Assets, Revenues, and Expenses – To create a fiduciary fund account classification, expand the Fiduciary folder, expand the appropriate account type folder, select the Account Classifications folder, and click New. Follow these steps when adding asset, liability, net asset, revenue, and expense classifications.

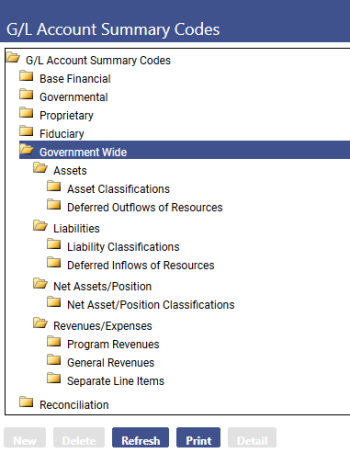

Government Wide

Assets, Liabilities, and Net Assets– To create a government wide account classification, expand the Government Wide folder, expand the appropriate account type folder, select the Classifications folder, and click New. Follow these steps when adding asset, liability, and net asset classifications.

Revenues/Expenses - Revenue and expense classifications are grouped together under a single section and divided between three subsections, which are Program Revenues, General Revenues, and Separate Line Items.

Program Revenues – This section defines the column headings that appear at the top of the Government Wide Statement of Activities. Under this section, the following program revenue types should be created: Charges for Services, Operating Grants and Contributions, Capital Grants and Contributions.

General Revenues – This section defines the rows that will appear in the bottom section of the Government Wide Statement of Activities.

Examples:

- Property Tax

- Sales Tax

- Other Taxes

Separate Line Item - On the expense side, the system will automatically classify the expenses based on the function/sub function tied to that account. If the expense account needs to be reported as a separate line item at the end of the financial statement then the classification should be setup as a separate line item. These classifications will appear after the General Revenue section on the Government Wide Statement of Activities.

Chart of Accounts Setup

Once all the account classifications have been defined, the next step is to link these to the appropriate chart of accounts items in the system.

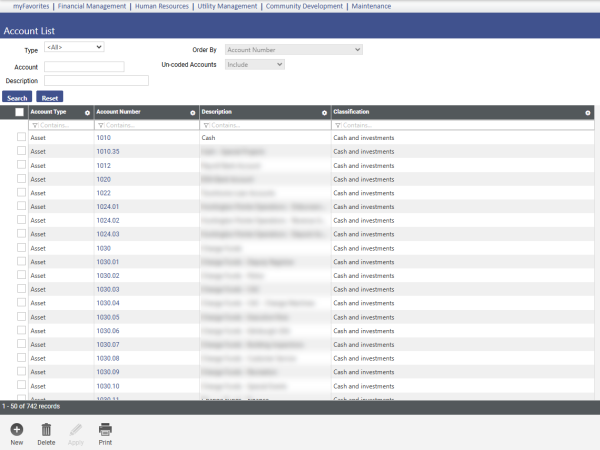

Account Setup

Maintenance > new world ERP Suite > Chart of Accounts > Accounts

To update or setup the classification on one or more accounts, first select the account type in the Type field and click Search. Next check the box next to each desired account and click the Apply button at the bottom of the screen.

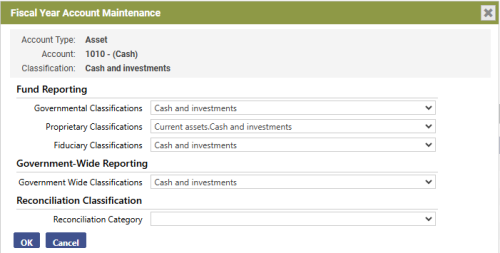

The Update Account Summary Codes window will pop up on the screen. This will vary depending on the Type of account being updated. To update the classification of the selected Account(s), check the Update box for each applicable report type.

Asset, Liability and Fund Equity Account Summary Codes

Financial Reporting Profile - This profile is related to the standard financial statements and should not be updated during the government reporting setup.

Fund Reporting – Governmental - Select the appropriate account classification from the Governmental Classification field.

Fund Reporting – Proprietary - Select the appropriate account classification from the Proprietary Classification field.

Fund Reporting – Fiduciary - Select the appropriate account classification from the Fiduciary Classification field.

Government-Wide Reporting - Select the appropriate account from the Government Wide Classification field.

Expense Account Summary Codes

Financial Reporting Profile - This profile is related to the standard financial statements and should not be updated during the government reporting setup.

Fund Reporting – Governmental - Select either Standard or Other in the Expense Classification field.

If Standard is selected, the user will then be prompted to select from the Government Character and Classification field. The Government Character items were previously setup in the GL Account summary page with a Character Sort Code of either Organization Function and Sub Function or Fund Reporting Profile. If the Character was setup as Organization Function and Sub Function then leave the Classification field blank. The system will automatically classify these expenses account(s) based on the function/sub function tied to the G/L account. If the Character was setup as Fund Reporting Profile then an expense classification will need to be selected from the Classification field.

If Other is selected, the user will then be prompted to select from the Other Report Group field. This field is populated with the other governmental classifications setup in the GL Account summary code section.

Fund Reporting – Proprietary - Select Operating Expense, Non-Operating Revenue, or Other Expense from the Expense Classification field.

- If Operating Expense is selected, the user will then be prompted to select from the Operating Expense Classification field, which is based on the Proprietary Expense Classifications setup on the GL Account Summary Codes page.

- If Non-Operating Revenue is selected, the user will then be prompted to select from the Non-Operating Expense Classification field, which is based on the Proprietary Non-Operating Classifications setup on the GL Account Summary Codes page.

- If Other Expense is selected, the user will then be prompted to select from the Other Reporting Code field, which is based on the Proprietary Other Classifications setup on the GL Account Summary Codes page.

Fund Reporting – Fiduciary - Select the expense classification from the Fiduciary Classification field.

Government Wide Reporting - This section will either be left blank or have one of the following check boxes selected: Indirect Expense, Extraordinary Item, or Separate Line Items.

If left blank, the system will automatically classify the expense account based on the function/sub function tied to it.

If the Indirect Expense box is selected, the expense amount will also be classified based on the function/sub function but will also be reported in the Indirect Expense Allocation column of the Government Wide Reporting – Statement of Activities – Allocate Indirect Expense to Functions report.

If the Extraordinary Item box is selected, the expense will show in the bottom section of the Government Wide Statement of Activities under Extraordinary Items.

If the Separate Line Items box is selected, the Separate Line Item drop-down field will appear, from which the user will select one of the items previously defined in the GL Account Summary Code page. The separate line item will appear in the bottom section of the Statement of Activities.

Revenue Account Summary Codes

Financial Reporting Profile and Revenue Accounting Profile: Both of these profiles are related to the standard financial statements and should not be updated during the government reporting setup.

Fund Reporting – Governmental - Select either Standard or Other in the Revenue Classification field.

- If Standard is selected, the user will select one of the standard classifications, which were setup as revenue classifications in the GL Account summary code section.

- If Other is selected, the user will then be prompted to select from the Other Report Group field. This field is populated with the other governmental classifications setup in the GL Account summary code section.

Fund Reporting – Proprietary - Select Operating Revenue, Non-Operating Revenue, or Other Revenue from the Revenue Classification field.

- If Operating Revenue is selected, the user will then be prompted to select from the Operating Revenue Classification field, which is based on the Proprietary Revenue Classifications setup on the GL Account Summary Codes page.

- If Non-Operating Revenue is selected, the user will then be prompted to select from the Non-Operating Revenue Classification field, which is based on the Proprietary Non-Operating Classifications setup on the GL Account Summary Codes page.

- If Other Revenue is selected, the user will then be prompted to select from the Other Reporting Code field, which is based on the Proprietary Other Classifications setup on the GL Account Summary Codes page.

Fund Reporting – Fiduciary - Select the revenue classification from the Fiduciary Classification field.

Government Wide Reporting - Select Program Revenue, General Revenue, or Separate Line Item from the Revenue Classification field.

- If Program Revenue is selected, the user will then be prompted to select from the Program Revenue Classification field, which is based on the Government Wide Program Revenue classifications setup on the GL Account Summary Codes page.

- If General Revenue is selected, the user will then be prompted to select from the General Revenue Classification field, which is based on the Government Wide General Revenue classifications setup on the GL Account Summary Codes page.

- If Separate Line Item is selected, the user will then be prompted to select from the Separate Line Item field, which is based on the Government Wide Separate Line Item classifications setup on the GL Account Summary Codes page.

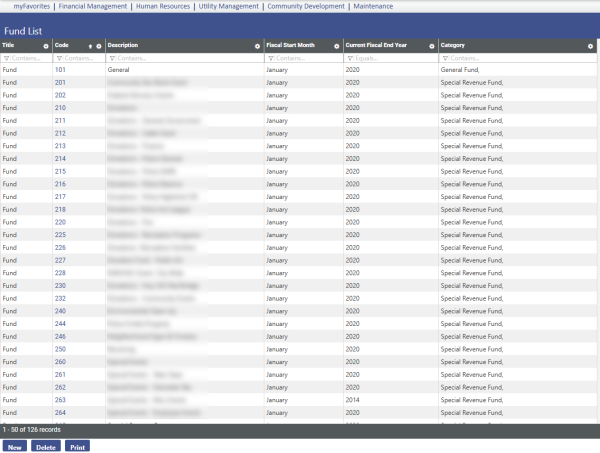

Fund Setup

Maintenance>new world ERP Suite> Chart of Accounts>Funds

On the fund list page, click on the fund number to open it and make changes to the fund’s characteristics.

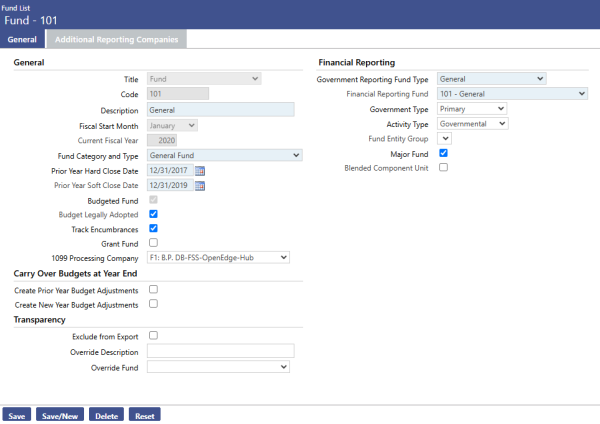

Only the fields specific to the Government Reporting module will be explained in this guide.

Fields:

Budget Legally Adopted – Checking this activates the Budget to Actual Statements for the fund.

Government Reporting Fund Type –This field contains all of the possible reporting fund types. The fund will appear on the within the selected section of the report fund type. The options are as follows:

Governmental

- General

- Special Revenue

- Debt Service

- Capital Project

- Permanent

Proprietary

- Enterprise

- Internal Service

Fiduciary

- Pension Trust

- Investment Trust

- Private Purpose Trust

- Agency

Government-Wide

- Government Wide Reporting

Excluded

- Other/Excluded

Financial Reporting Fund – This field is used for grouping multiple funds into a single fund for reporting purposes. The fund names appearing in drop-down are pulled from the Description field for each fund setup in the system. When grouping multiple funds into a single fund for reporting, it is recommended that a new fund is created. This name of the new fund will then be selected in the Financial Reporting Fund field by all funds that should be combined.

Government Type – Choose between Primary and Component Unit. This will determine if the fund is included as part of the Primary Governmental Activities section or as a separate column on the Government-Wide Statement of Net Assets.

Activity Type – Choose between Business and Government. This determines whether the fund is reported in the Governmental Activities or Business-Type Activities section on the Government-Wide statements.

Major Fund – If selected, the fund will be considered a major fund on the reports and will have its own column on the main statements. If cleared, the fund is treated as a non-major fund and will be included in the Other Non-Major Funds column of the reports, as well as the combining statements.

Blended Component Unit – This checkbox is informational only and is used to keep track of which funds qualify as blended component units.

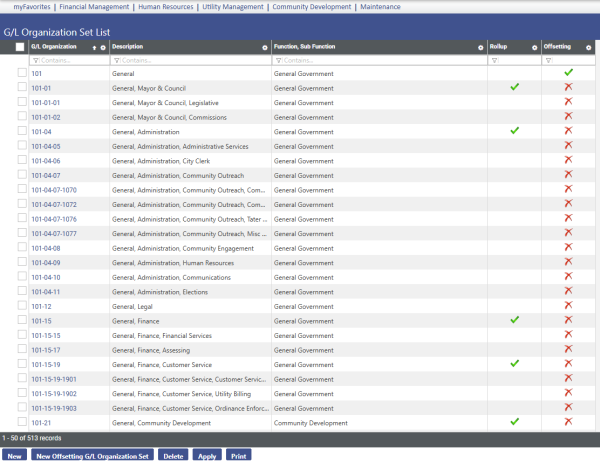

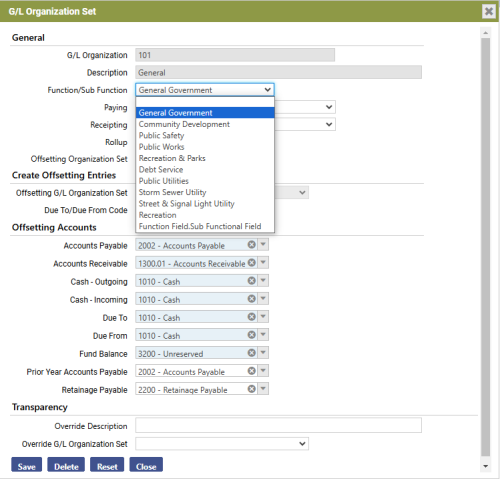

G/L Organization Sets

Maintenance>new world ERP Suite> Chart of Accounts>G/L Organization>Sets

Click on the blue organization set number to open the G/L Organization Set maintenance window to view/change the Function/Sub Function tied to the organization set. The Function/Sub Function determines how expenses and revenues are classified on the following reports:

- Government-Wide Statement of Activities,

- Governmental Statements of Revenues, Expenditures and Changes in Fund Balances

- Budget to Actual Statements.

The Function/Sub Function drop-down list is defined in the G/L Account Summary Code under Base Financial>GL Organizations>Organization Function and Sub Function.

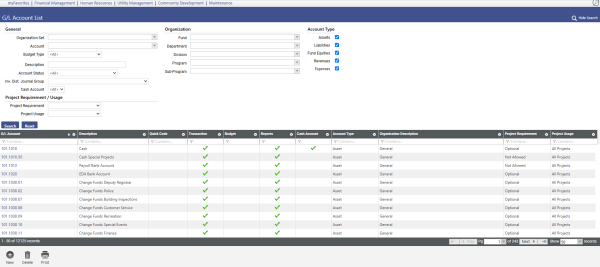

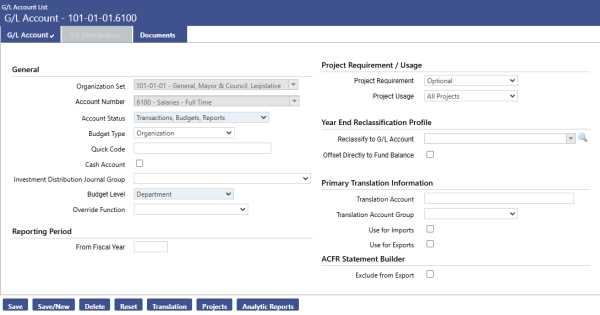

G/L Accounts

Maintenance>new world ERP Suite> Chart of Accounts>G/L Accounts>List

If a G/L Account has a different function/sub function than the one setup on the G/L organization set then it can be overridden at the G/L Account level. To change the function/sub function on a particular G/L Account click on the G/L Account number to open the G/L Account edit screen and select the appropriate function in the Override Function field.

Application Permissions

Security for Government Reporting is controlled through the Application Permissions, which can often be completed effectively with 2 security templates. The first set of permissions allows the user access to the chart of accounts through maintenance menu. The second set allows the user access to the government reporting module.

Feature Group – Multiple

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|

|---|---|---|---|---|---|---|---|---|---|

|

FM |

Organization 1 Summary listing |

This would allow the user to run the summary reports of the funds including the major fund status and the combining of any funds |

ü |

|

|

|

ü |

ü |

|

|

Suite |

Account Listing |

This would allow the user to run reports on the accounts including the government reporting classifications for those accounts |

ü |

|

|

|

|

ü |

|

|

Suite |

Account Maintenance |

This will allow the user to edit the government classification codes on the accounts |

ü |

ü |

ü |

ü |

ü |

|

|

|

Suite |

Organization 1 Maintenance |

This will allow the user to edit the funds including Major fund status and reporting fund status. |

ü |

|

|

|

ü |

ü |

|

|

Suite |

Organization Component Maintenance |

This will the user to edit the organization components including the function/sub-function codes |

ü |

ü |

ü |

ü |

ü |

|

|

|

Suite |

Organization Association Maintenance |

This will allow the user to create new organization sets from existing organizations |

ü |

ü |

ü |

ü |

ü |

|

|

|

Suite |

GL Summary Codes Listing |

Allows the user to run the GL summary codes listing – this provides all of the classifications that were created for each of the GASB 34 reports |

ü |

|

|

|

|

ü |

|

|

Suite |

Organization Component Listing |

Allows the user to run the GL organization component listing – this would show the function/sub-function assigned to each organization set. |

ü |

|

|

|

|

ü |

|

|

Suite |

Organization Set Listing |

Allows the user to run the organization set listing |

ü |

|

|

|

|

ü |

|

|

Suite |

Organization 1 Master Set Listing |

Allows the user to run the Organization 1 Master listing. |

ü |

|

|

|

|

ü |

|

Feature Group – Government Reporting

|

App |

Component |

Description |

All |

Add |

Change |

Delete |

View/Use |

|

|

|---|---|---|---|---|---|---|---|---|---|

|

FM |

Government Reporting |

Determines the level of access to the Government Reporting module. |

ü |

ü |

ü |

ü |

ü |

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Activities - Component Units |

The ability to run the Government Wide Reporting - Combining Statement of Activities - Component Units |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Activities – Non-major Component Units |

The ability to run the Government Wide Reporting - Combining Statement of Activities – Non-major Component Units |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Net Assets - Component Units |

The ability to run the Government Wide Reporting - Combining Statement of Net Assets - Component Units |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Net Assets - Component Units (Balance Sheet) |

The ability to run the Government Wide Reporting - Combining Statement of Net Assets - Component Units (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Net Assets – Non-major Component Units |

The ability to run the Government Wide Reporting - Combining Statement of Net Assets – Non-major Component Units |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Combining Statement of Net Assets – Non-major Component Units (Balance Sheet) |

The ability to run the Government Wide Reporting - Combining Statement of Net Assets – Non-major Component Units (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Statement of Activities |

The ability to run the Government Wide Reporting - Statement of Activities |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Statement of Activities - Allocate Indirect Expense to Functions |

The ability to run the Government Wide Reporting - Statement of Activities - Allocate Indirect Expense to Functions |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Statement of Net Assets |

The ability to run the Government Wide Reporting - Statement of Net Assets |

ü |

|

|

|

|

ü |

|

|

FM |

Government Wide Reporting - Statement of Net Assets (Balance Sheet) |

The ability to run the Government Wide Reporting - Statement of Net Assets (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Balance Sheet |

The ability to run the Governmental - Balance Sheet |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Budgetary Comparison Schedule |

The ability to run the Governmental - Budgetary Comparison Schedule |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet – Non-major Capital Projects Funds |

The ability to run the Governmental - Combining Balance Sheet – Non-major Capital Projects Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet - Non-major Debt Service Funds |

The ability to run the Governmental - Combining Balance Sheet - Non-major Debt Service Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet - Non-major Funds |

The ability to run the Governmental - Combining Balance Sheet - Non-major Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet - Non-major Funds (Fund Type Summary) |

The ability to run the Governmental - Combining Balance Sheet - Non-major Funds (Fund Type Summary) |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet - Non-major Permanent Funds |

The ability to run the Governmental - Combining Balance Sheet - Non-major Permanent Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Balance Sheet - Non-major Special Revenue Funds |

The ability to run the Governmental - Combining Balance Sheet - Non-major Special Revenue Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Capital Projects Funds |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Capital Projects Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Debt Service Funds |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Debt Service Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Funds |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Funds (Fund Type Summary) |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Funds (Fund Type Summary) |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Permanent Funds |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Permanent Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Special Revenue Funds |

The ability to run the Governmental - Combining Statement of Revenues, Expenditures, and Changes in Fund Balances - Non-major Special Revenue Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Statement of Revenues, Expenditures, and Changes in Fund Balances |

The ability to run the Governmental - Statement of Revenues, Expenditures, and Changes in Fund Balances |

ü |

|

|

|

|

ü |

|

|

FM |

Governmental - Statement of Revenues, Expenditures, and Changes in Fund Balances - Budget and Actual |

The ability to run the Governmental - Statement of Revenues, Expenditures, and Changes in Fund Balances - Budget and Actual |

ü |

|

|

|

|

ü |

|

|

FM |

Major Fund Determination Report |

The ability to run the Major Fund Determination Report |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Net Assets - Internal Service Funds |

The ability to run the Proprietary - Combining Statement of Net Assets - Internal Service Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Net Assets - Internal Service Funds (Balance Sheet) |

The ability to run the Proprietary - Combining Statement of Net Assets - Internal Service Funds (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Net Assets - Non-major Enterprise Funds |

The ability to run the Proprietary - Combining Statement of Net Assets - Non-major Enterprise Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Net Assets - Non-major Enterprise Funds (Balance Sheet) |

The ability to run the Proprietary - Combining Statement of Net Assets - Non-major Enterprise Funds (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Revenues, Expenses, and Changes in Fund Net Assets - Internal Service Funds |

The ability to run the Proprietary - Combining Statement of Revenues, Expenses, and Changes in Fund Net Assets - Internal Service Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Combining Statement of Revenues, Expenses, and Changes in Fund Net Assets - Non-major Enterprise Funds |

The ability to run the Proprietary - Combining Statement of Revenues, Expenses, and Changes in Fund Net Assets - Non-major Enterprise Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Statement of Net Assets |

The ability to run the Proprietary - Statement of Net Assets |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Statement of Net Assets (Balance Sheet) |

The ability to run the Proprietary - Statement of Net Assets (Balance Sheet) |

ü |

|

|

|

|

ü |

|

|

FM |

Proprietary - Statement of Revenues, Expenses, and Changes in Fund Net Assets |

The ability to run the Proprietary - Statement of Revenues, Expenses, and Changes in Fund Net Assets |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Investment Trust Funds |

The ability to run the Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Investment Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Pension Trust Funds |

The ability to run the Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Pension Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Private Purpose Trust Funds |

The ability to run the Fiduciary - Combining Statement of Changes Fiduciary Net Assets - Private Purpose Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Fiduciary Net Assets - Agency Funds |

The ability to run the Fiduciary - Combining Statement of Fiduciary Net Assets - Agency Funds Report |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Fiduciary Net Assets - Investment Trust Funds |

The ability to run the Fiduciary - Combining Statement of Fiduciary Net Assets - Investment Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Fiduciary Net Assets - Pension Trust Funds |

The ability to run the Fiduciary - Combining Statement of Fiduciary Net Assets - Pension Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Combining Statement of Fiduciary Net Assets - Private Purpose Trust Funds |

The ability to run the Fiduciary - Combining Statement of Fiduciary Net Assets - Private Purpose Trust Funds |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Statement of Changes in Fiduciary Net Assets |

The ability to run the Fiduciary - Statement of Changes in Fiduciary Net Assets |

ü |

|

|

|

|

ü |

|

|

FM |

Fiduciary - Statement of Fiduciary Net Assets |

The ability to run the Fiduciary - Statement of Fiduciary Net Assets |

ü |

|

|

|

|

ü |

|

Government Reporting Processing

So far all of the setup has been done through the Chart of Accounts maintenance and the G/L account Summary Code Section. This section goes over the six workflow icons in the Governmental Reporting module.

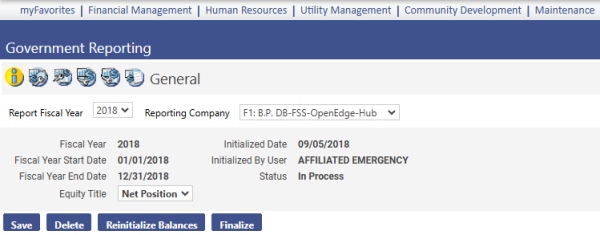

General

The General page of the Government Reporting module allows you to view a prior year or begin working on setting up the current fiscal year reports. If this is the first year using the Government Reporting module, the Report Fiscal Year drop-down field will be empty with a star icon next to it. Click on the star icon to initialize the fiscal year. The three buttons at the bottom will remain grayed out until the fiscal year has been initialized.

Delete – The delete button will allow the current report fiscal year to be uninitialized. Once the fiscal year is finalized the delete button will no longer be active.

Reinitialize Balances – The reinitializing balances button will update the reports for any transactions to the current fiscal year that were made after the Report Fiscal Year was initialized. It is important to note that any time a journal of any type is created and posted to the general ledger for the governmental reporting fiscal year, the balances must be re-initialized or the governmental reporting module will not reflect the changes created through those journals.

Finalize – The finalize button will finalize the year and prevent any changes from being made to the fiscal year reports.

Financial Management>Government Reporting Click on the General Icon

The next 4 areas are used for maintaining the chart of account items that were setup earlier in the System Administrator Guide.

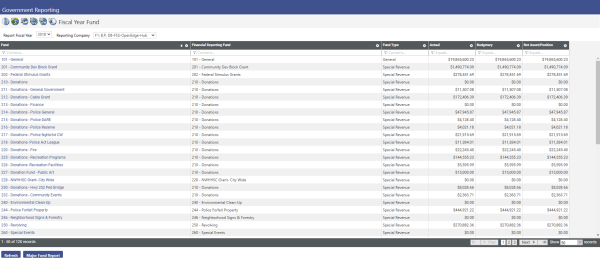

Fiscal Year Fund

Financial Management>Government Reporting Click on the Fiscal Year Fund Icon

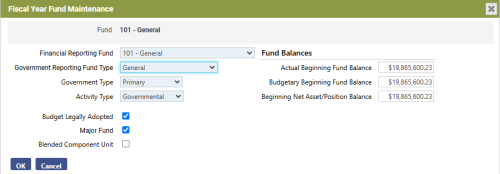

Click on the hyperlink fund name to open the Fiscal Year Fund Maintenance Window. This screen will allow users to make changes to the various attributes of the fund on the left side and the fund balances on the right.

The Fund Balances section will automatically calculate the Actual Beginning Fund Balance, Budgetary Beginning Fund Balance and Beginning Net Asset Balance based on the prior year ending figures. These should not be changed except in unique circumstances.

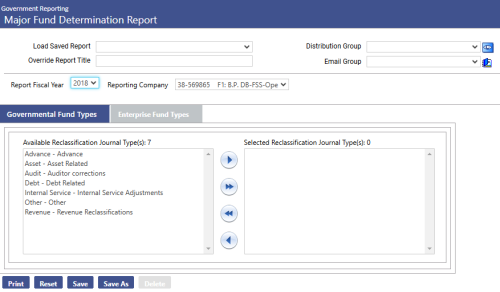

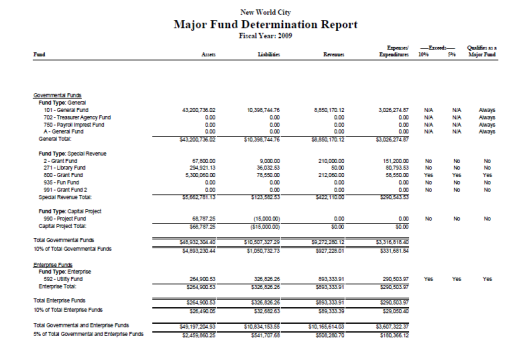

The Major Fund Report button will open the Major Fund Determination Report page. This screen allows the user to specify which reclassification journal types to be reflected in the Major Fund report which will be shown later on.

To apply a reclassification journal type to the report, under the Governmental Fund Types tab first select the type in the box on the left and move it to over to the box on the right. Click on the Enterprise Fund Types tab and repeat this same process.

Once the appropriate reclassification journal types have been selected, click the Print button at the bottom of the screen. This will send the report to myReports.

This report will automatically determine if the fund qualifies as a major fund based on the 10%/5% test. If the fund does qualify, the Major Fund checkbox on the fund must still be selected in order for it to be treated as a major fund on the reports.

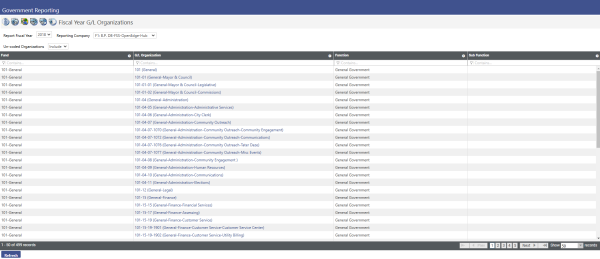

Fiscal Year G/L Organizations

Financial Management>Government Reporting Click on the Fiscal Year G/L Organizations Icon

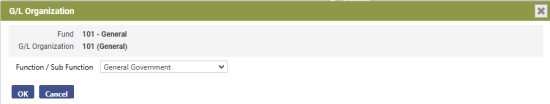

Click on the G/L Organization hyperlink to open the Fiscal Year G/L Organization Maintenance window. This will allow the Function/Sub Function to be changed on the selected organization set and will apply to all G/L accounts that are tied to that organization set, unless overridden at the G/L account level.

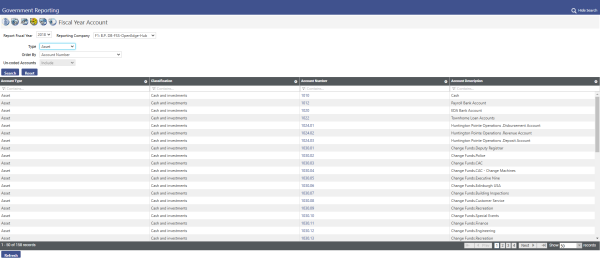

Fiscal Year Account

Enter the desired search criteria in the top section and click Search.

Financial Management>Government Reporting Click on the Fiscal Year Account Icon

Select an account by clicking on the number hyperlink, which will open the Fiscal Year Account Maintenance window. This screen will allow the user to change the reporting classifications for individual accounts. If the reporting classifications need to be mass changed on multiple accounts, it is recommended to use the mass apply function from the Account page under the Chart of Accounts menu.

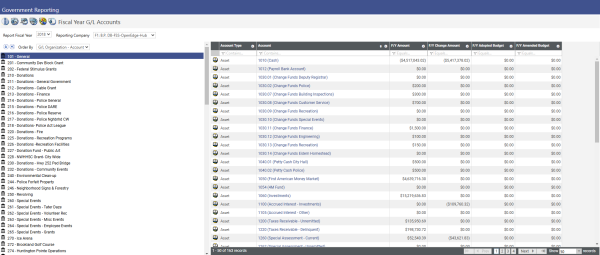

Fiscal Year G/L Accounts

Financial Management>Government Reporting Click on the Fiscal Year G/L Accounts Icon

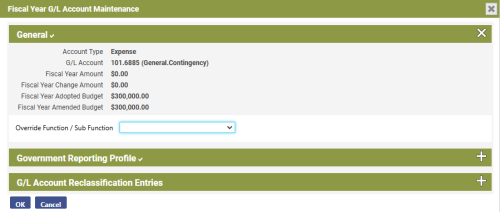

The page displays organization sets on the left side and accounts on the right side. To expand a fund and view the organization levels click on the icon to the left of the fund number. The account list on the right side of the screen will update based the organization set is selected on the left side. Click on the account hyperlink on the right to open the Fiscal Year G/L Account Maintenance window.

This screen is broken into three sections: General Information, Governmental Reporting Profile, and G/L Account Reconciliation Entries. These sections can be expanded by clicking on the plus sign on or collapsed by clicking on the X on the right side of the section header. If either an expense or a revenue G/L account is selected, the General section will include the Override Function/Sub Function field. This allows the Function/Sub Function to be overridden from what was established at the organization set level.

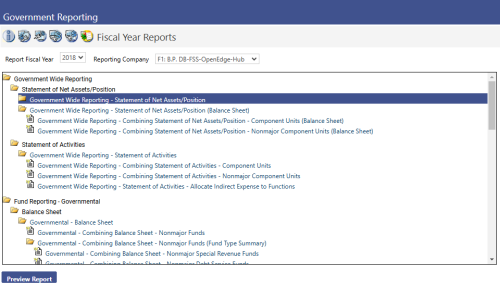

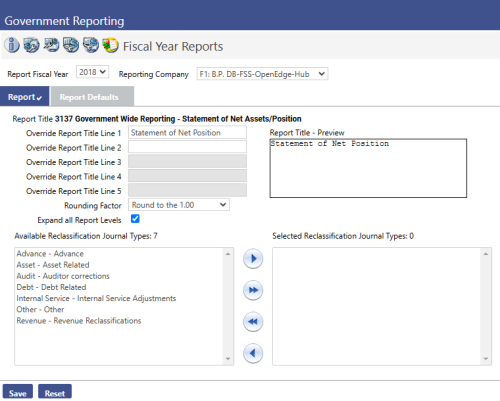

Fiscal Year Reports

Financial Management>Government Reporting Click on the Fiscal Year Reports Icon

The reports are organized by report type and appear in this list in the following order:

- Government Wide

- Governmental Funds

- Proprietary

- Fiduciary

See Appendix A for a complete list of the available reports.

Click on the name of the report to open the report edit window.

Override Report Title – These fields allow the user to override the standard report title (up to 5 lines) as they desire.

Rounding Factor – This field determines how the values on the report will be rounded. The available options are as follows:

No Rounding

- Round to the 1.00

- Round to the 10.00

- Round to the 100.00

- Round to the 1,000.00

- Round to the 10,000.00

- Round to the 100,000.00

Expand all Report Levels – Check this box to have the report expanded to the lowest account classification level. Leaving the box cleared will report roll up to the parent classification level.

Available Reclassification Journal Types – This lists the different reclassification types that are available for selection. To apply one of the reclassification types to the specific report, move it over to the selected box.

Click Save once the desired report settings have been selected and click on the Fiscal Year Reports icon at the top to return back to the report list.

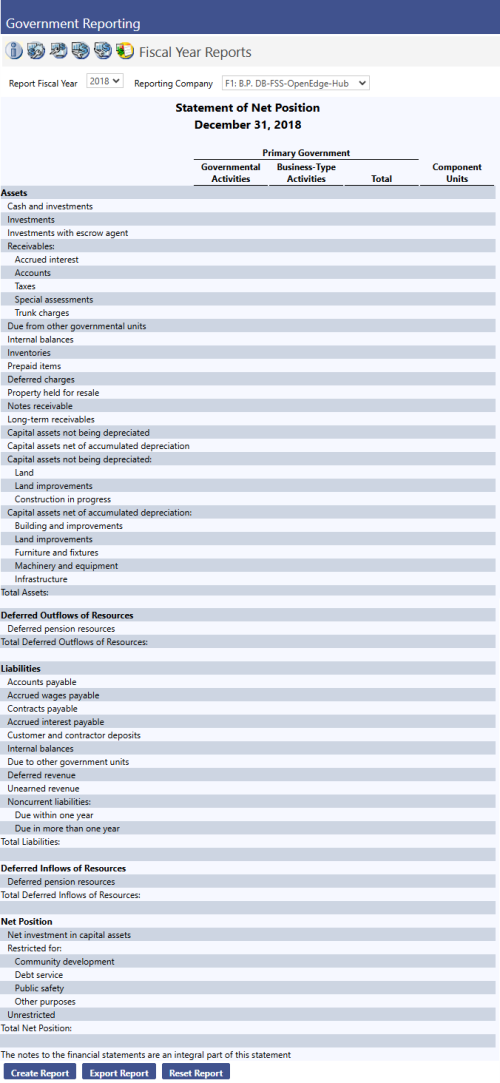

From the Fiscal Year Reports page click on the icon to the left of the report name to highlight it. Then click the Preview Report button to view the selected report.

When previewing the report for the first time, none of the values will initially appear on the screen.

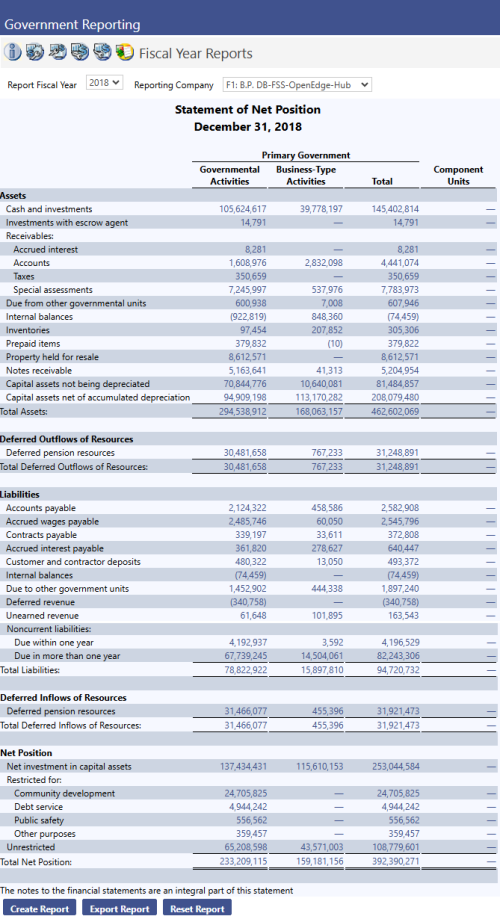

Click the Create Report button to populate the report with the financial data.

Once the report is populated with data, all amounts and totals become hyperlinks that can be clicked on to pull up an inquiry screen and see what makes up that figure.

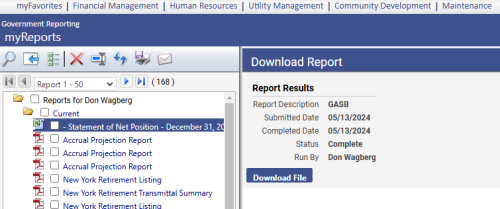

To export the report to Excel click the Export Report button then navigate to myReports.

Select the report on the left side and click the Download File button on the right.

Click the downloaded file to view and make changes to the report in Excel.

Appendix A: List of Reports By Type

Government-Wide Reporting

- Statement of Net Assets

- Combining Statement of Net Assets- Component Units

- Combining Statement of Net Assets – Non-major Component Units

- Statement of Net Assets (Balance Sheet)

- Combining Statement of Net Assets - Component Units (Balance Sheet)

- Combining Statement of Net Assets – Non-major Component Units (Balance Sheet)

- Statement of Activities

- Combining Statement of Activities - Component Units

- Combining Statement of Activities – Non-major Component Units

- Statement of Activities - Allocate Indirect Expense to Functions

Fund Reporting – Governmental

- Balance Sheet

- Combining Balance Sheet – Non-major Funds

- Combining Balance Sheet – Non-major Funds (Fund Type Summary)

- Combining Balance Sheet – Non-major Special Revenue Funds

- Combining Balance Sheet – Non-major Debt Service Funds

- Combining Balance Sheet – Non-major Capital Projects Funds

- Combining Balance Sheet – Non-major Permanent Funds

- Statement of Revenues, Expenditures and Changes in Fund Balance

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Funds

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Funds (Fund Type Summary)

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Special Revenue Funds

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Debt Service Funds

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Capital Projects Funds

- Combining Statement of Revenues, Expenditures and Changes in Fund Balance – Non-major Permanent Funds

- Statement of Revenues, Expenditures and Changes in Fund Balance – Budget and Actual

- Budgetary Comparison Schedule

Fund Reporting – Proprietary

- Statement of Net Assets

- Combining Statement of Net Assets – Internal Service Funds

- Combining Statement of Net Assets – Non-major Enterprise Funds

- Statement of Net Assets (Balance Sheet)

- Combining Statement of Net Assets – Internal Service Funds (Balance Sheet)

- Combining Statement of Net Assets – Non-major Enterprise Funds (Balance Sheet)

- Statement of Revenues, Expenses, and Changes in Fund Net Assets

- Statement of Revenues, Expenses, and Changes in Fund Net Assets – Internal Service Funds

- Statement of Revenues, Expenses, and Changes in Fund Net Assets – Non-major Enterprise Funds

Fund Reporting – Fiduciary

- Statement of Fiduciary Net Assets

- Combining Statement of Fiduciary Net Assets – Pension Trust Funds

- Combining Statement of Fiduciary Net Assets – Investment Trust Funds

- Combining Statement of Fiduciary Net Assets – Private Purpose Trust Funds

- Combining Statement of Fiduciary Net Assets – Agency Funds

- Statement in Changes in Fiduciary Net Assets

- Statement in Changes in Fiduciary Net Assets – Pension Trust Funds

- Statement in Changes in Fiduciary Net Assets – Investment Trust Funds

- Statement in Changes in Fiduciary Net Assets – Private Purpose Trust Funds

Other

- Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances to the Statement of Activities

- Reconciliation of the Governmental Funds Balance Sheet To the Statement of Net Assets

- Budget to GAAP Reconciliation

- Reconciliation of the Statement of Revenues, Expenses, and Changes in Fund Net Assets to the Statement of Activities

- Reconciliation of the Statement of Net Assets of Proprietary Funds to the Statement of Net Assets.