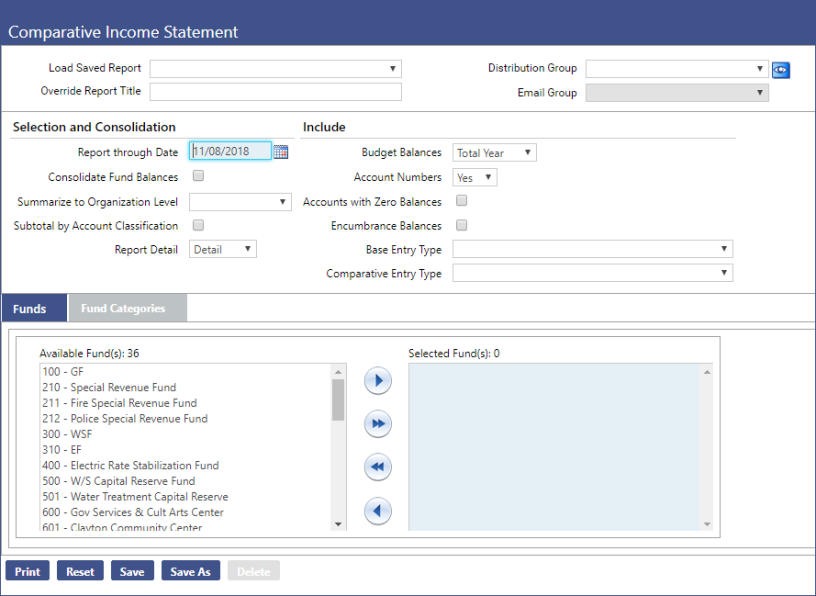

Comparative Income Statement

Financial Management > Reports > General Ledger > Comparative Management Reports > Comparative Income Statement

The Comparative Income Statement page allows users to print a report that contains information on your organization’s revenue and expense accounts. The difference between the Organization element revenue and expense balances represents the net change (positive or negative) to the organization’s equity accounts.

Income Statements can be run in multiple formats:

- Consolidated Income Statements displays the combination of multiple “like” funds.

- Summary Income Statements display balances by classification within organizations.

- Detail Income Statements display balances by account with organizations.

Regardless of the format, the type of information on the listing includes the current period revenues and expenditures, fiscal year-to-date revenues and expenditures, budgeted revenues and expenditures, fiscal year-to-date encumbrances (expense accounts only), year-to-date remaining budgeted funds, percentage of budget used and comparison information to the prior fiscal year. Fund totals compare all revenue and expenditure balances.

| Name | Description |

|---|---|

| Report through Date | This control is required. It contains the ending date of the report. The default is the current system date. |

| Consolidate Fund Balances | This control signifies whether all selected funds will be reported separately or whether the balances will be consolidated into a single listing. The default is deselected. |

| Summarize to Organizational Level | This control contains the organization level for which to provide subtotals. The default is blank. Accept the default to include subtotals for every organization level. |

| Subtotal by Account Classification | Enabled if the Report Detail control is Detail, this control signifies whether to print subtotals for each account classification. The default is deselected. If deselected, the listing will provide subtotals at the primary classification level only. If selected, the listing will include totals for all levels of sub-classification. |

| Report Detail | This control determines whether the listing will only contain the subtotals at the account classification level (Summary) or whether the listing will contain totals for each transaction as well as the subtotals for each account classification (Detail). The default selection is Detail. |

| Budget Balances | This control determines whether to include budget balances by the year-to-date budget balance or total year budget balance. The default selection is Total Year. |

| Account Numbers | Enabled if the Report Detail control is Detail, this control determines whether to include the account number with the account descriptions on the detail version of the listing. The available options are Yes, No, and Only. The default selection is Yes. |

| Accounts with Zero Balances | Enabled if the Report Detail control is Detail, this control signifies whether to include accounts with zero balances on the listing. The default is deselected. |

| Encumbrance Balances | This control signifies whether to include encumbrance balances on the listing. The default is deselected. |

| Base Entry Type | This control contains the type of entries to include on the listing as the base amounts. The available options are <blank> and all reclassification journal type entries defined for the Reclassification Journal Type validation set. The default is blank. |

| Comparative Entry Type | This control contains the type of entries to include on the listing for comparative purposes. The available options are <blank> and all reclassification journal entries defined for the Reclassification Journal Type validation set. The default is blank. |

| Fund and Fund Category jump boxes | These controls allow users to subset their report output with desired values. |