New York Quarterly Tax and Wage Report Update

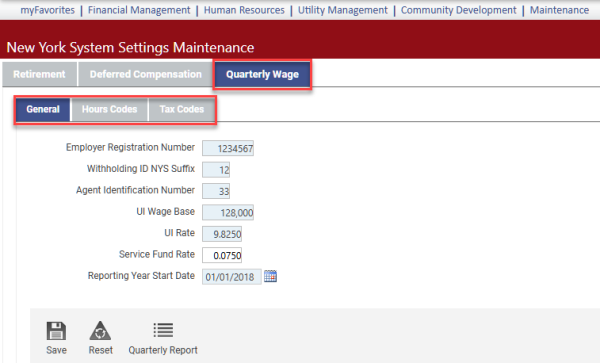

Human Resources > State Requirements > NY > System Settings Maintenance

Human Resources > State Requirements > NY > Quarterly Wage Report

New York quarterly tax and wage reporting requirements have been updated so that withholding tax information is combined with unemployment insurance information.

To accommodate the new requirements, the New York System Settings Maintenance and New York Quarterly Tax and Wage Report pages have been updated.

New York System Settings Maintenance

A Quarterly Wage tab for setting up the New York Quarterly Tax and Wage Report has been added to the New York System Settings Maintenance page:

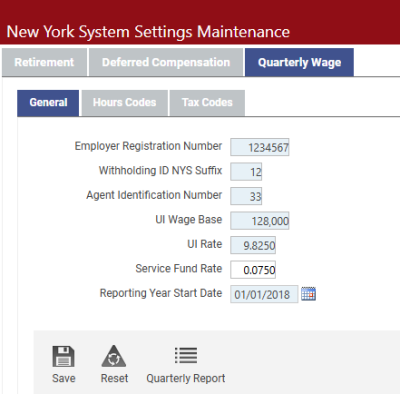

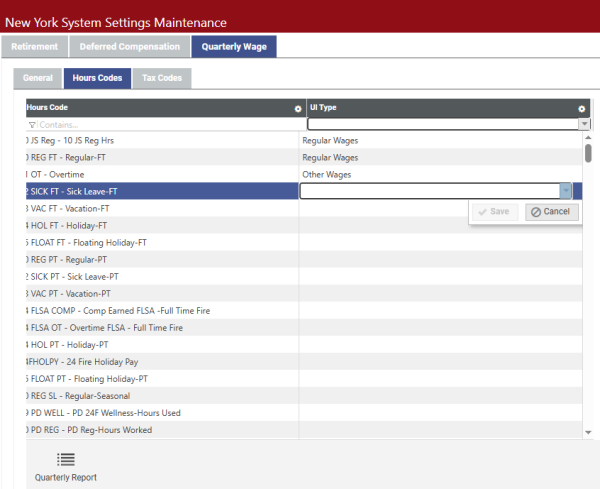

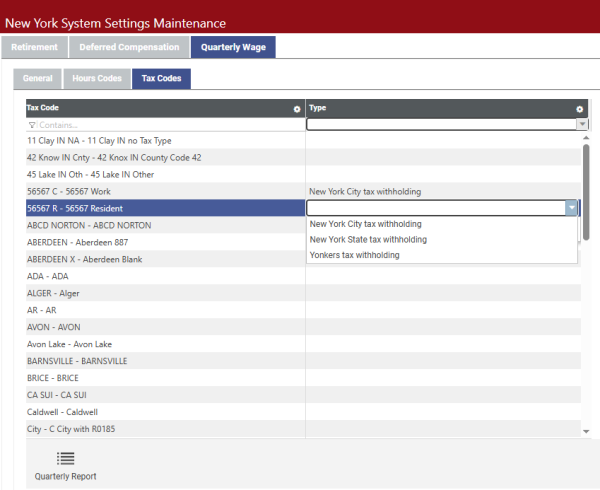

This tab contains three sub-tabs: General, Hours Codes and Tax Codes.

This tab contains general fields. The first three, Employer Registration Number, Withholding ID NYS Suffix and Agent Identification Number, only need to be entered once.

The UI Wage Base, UI Rate, Service Fund Rate and Reporting Year Start Date need to be updated once per year, usually in January, when the state increases rates.

The Hours Codes tab is for the unemployment insurance (UI) information part of the report. Map the relevant hours codes in the left column to the appropriate UI types in the right column. Double-click a cell in the right column to select the UI type, Regular Wages or Other Wages, from the dropdown, clicking Save after each selection.

On the Tax Codes tab, map the relevant tax codes in the left column to the appropriate tax types in the right column. The state of New York requires each tax code to be designated as one of three types: New York City tax withholding, New York State tax withholding or Yonkers tax withholding. Double-click a cell in the right column to select the tax type from the dropdown, clicking Save after each selection.

Note: To navigate quickly from New York System Settings Maintenance to the New York Quarterly Tax and Wage Report page, click the Quarterly Report button below any grid.

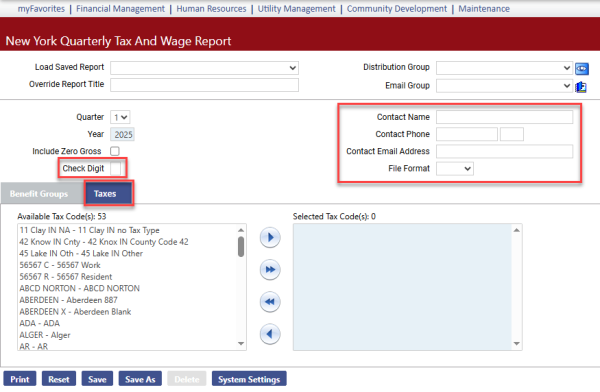

New York Quarterly Tax and Wage Report

Updates to the New York Quarterly Tax and Wage Report page include a Check Digit field, Contact fields, a File Format field and a Taxes multi-select list box:

Check Digit is a calculated number. The state has a formula that uses the first seven digits of the unique bar code of each report to arrive at this number.

Contact Name, Contact Phone and Contract Email Address are required on the transmittal file.

From the File Format dropdown, select Text or CSV. The Text layout is the entire transmittal file, while the CSV is the web upload format containing the employee detail section only; it does not include totals, employer information or other information. Select one or the other format, or leave the field blank to create both formats.

Use the Taxes list boxes to run the report for selected tax codes instead of all codes mapped in New York System Settings Maintenance.

Note: To navigate quickly from the New York Quarterly Tax and Wage Report to New York System Settings Maintenance, click the System Settings button.

When all entries and selections are complete, click Print. The report and transmittal file(s) are sent to myReports.