New World ERP Human Resources 2024 Year-End Processing Guide

The Human Resources 2024 Year-End Processing Guide provides users with a workflow-based approach to year-end processing. The steps outlined in this training guide assist with the processing of employee W-2s, 1095-Cs and 1099-Rs in New World ERP.

The 2024 forms and transmittal files have been updated to meet federal and state regulations.

Below is a list of the tasks to be performed in W-2 processing. Following this list helps to ensure a smooth year-end process:

|

W-2 Processing |

|

|

r |

Order W-2 forms. |

|

r |

For customers on the 2024 release, apply the year-end processing patch 2024.1.10. |

|

r |

Select benefits, deductions, hours codes and other taxes that should be included in W-2 processing. See W-2 Setup for more information. |

|

r |

Generate the W-2 work file using Create W-2 Data. |

|

r |

Review the information for W-2 Company. Review W-2 Employee for any employee who may have incorrect W-2 data. |

|

r |

Print and review the W-2 Register. |

|

r |

Compare the W-2 Register to the Quarterly Wage Report and the Earnings Register. |

|

r |

Print W-2 Forms. |

|

r |

Create the transmittal file for submission to the SSA. |

|

r |

Run the transmittal file through AccuWage. |

|

r |

Distribute W-2s to employees. |

|

r |

Submit the W-2 information to the SSA. |

|

Other Payroll Year-End Procedures |

|

|

r |

If accruals are rolled by calendar year, roll accrual hours after posting the last 2024 payroll and before posting the first 2025 payroll. |

|

r |

Set up taxes as needed for the new year. |

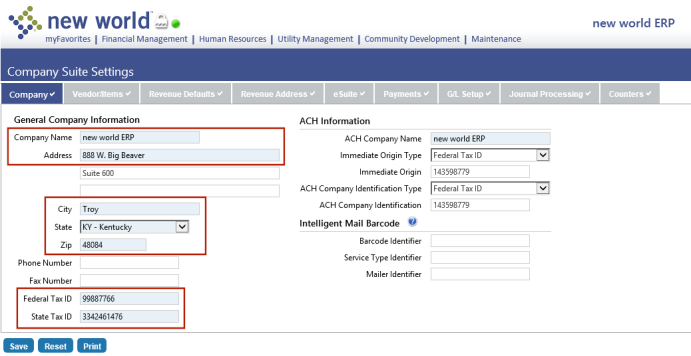

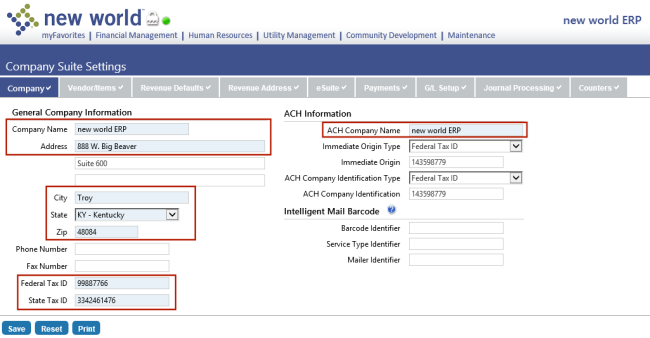

Before beginning W-2 year-end processing, review the company information.

Maintenance > new world ERP Suite > System > Company Suite Settings> Company tab

Verify the following fields on the Company tab are set up correctly:

- Company Name

- Address Line 1

- City

- State

- Zip

- Federal Tax ID

- State Tax ID

When the Create W-2 Data function is run from the W-2 Processing page, this information is pulled into the W-2 Company Information page. Make necessary corrections and save the settings.

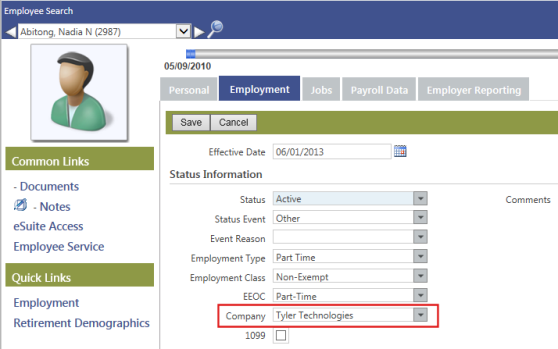

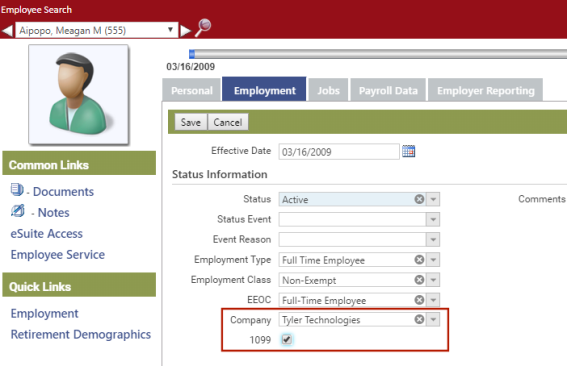

Human Resources > Workforce Administration > Search > Employee > Employment

Unless the user-defined Company field is populated, the employee is considered part of the company specified in Company Suite Settings. To assign the employee to a different company for W-2 purposes, select an override Company and click Save.

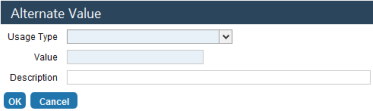

Note: The override Company selections come from validation set 377 (Employment Company) in Maintenance. The validation set Value should be the federal tax ID without the dashes. The Description (appears in the drop-down) may be whatever helps you identify the company (see example below).

Maryland requires the ability to separate other taxes (Local Taxes) by state.

If you have employees who pay state taxes outside the state, set up alternate state tax ID values in Validation Set Maintenance.

Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List

- Select the State row (Validation Set 3) and click the Values button.

- Select the row that designates the state where the employee pays taxes and click the Alternates button.

-

Click the New button to add an alternate value. The Alternate Value pop-up displays:

- In the Usage Type field, select the State Tax ID option.

- In the Value field, type the state tax ID exactly the way the state displays it. Include any dashes or spaces that are used. The ID prints on the form the way it is entered here.

- The Description value is optional.

- Click OK. This value prints in Box 15 for the employer’s state ID number on W-2s for employees who have a state tax deduction for this state. All other employees use the default from Company Suite Settings.

No special setup is required if your organization uses New World standard forms. The year-end update includes all the necessary form information.

No special setup is required for the transmittal file. The year-end update includes all the necessary information.

Human Resources > Year-End Processing > W-2 Processing

W-2 Processing uses a work-flow format to organize the steps and allow users to step through them logically.

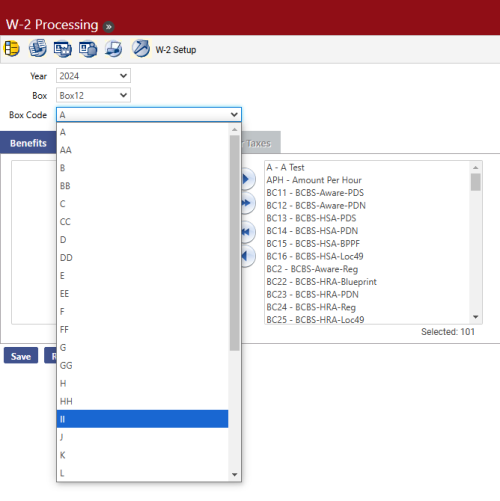

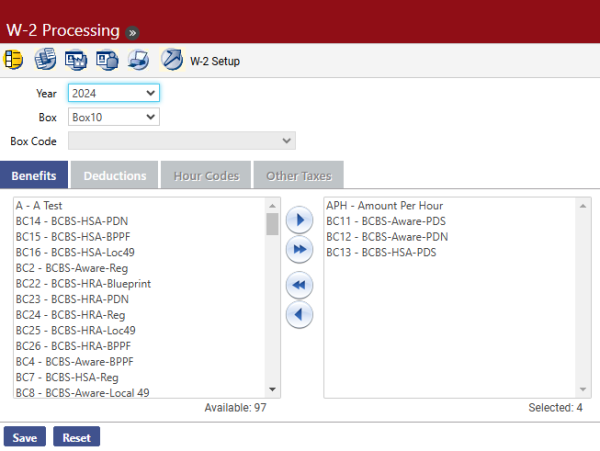

The W-2 Setup page, accessed by clicking the ![]() icon on the W-2 processing page, allows authorized users to select the benefits, deductions, hours codes and other taxes used for Boxes 10, 12 and 14:

icon on the W-2 processing page, allows authorized users to select the benefits, deductions, hours codes and other taxes used for Boxes 10, 12 and 14:

- Select the Year. The current year is the default.

- Select the Box you want to set up. The options are Box 10, Box 12 and Box 14.

-

If Box 12 or Box 14 is selected in the Box field, a Box Code can be specified. The Box Code for Box 12 is hard-coded with the allowable values. The Box Code for Box 14 is a validation set and can be set up to contain values needed by the organization.

The Box 12 code for aggregate health care reporting is DD.

The Box 12 code for Permitted Benefits Under a Qualified Small Employer Health Reimbursement Arrangement is FF. Selecting this code enables the Benefits, Deductions and Hours Codes multi-select list box tabs for selections. The Create W-2 process totals the values from these selections and adds the total to the employee's Box 12 FF. The amount may be edited on the W-2 Employee page.

If you have imputed income set up for an employee, Box 12 populates automatically with the letter C and the imputed income amount.

The codes for Box 14 come from Validation Set 265 (W-2 Box 14 Code) and may be set up by your organization. To add a code to Validation Set 265, hold down the <Ctrl> key, and click in the Box Code field. The Validation Set Values List 265-W2 Box 14 Code pop-up displays, containing a grid of existing Box 14 codes and a New button for adding more.

-

On the Benefits tab, select the benefits to include for the Box selected.

Note: The previous year's W-2 setup is copied automatically to the new year so you may update it as necessary.

- Click the Deductions tab and select the deductions to include for the Box selected.

- If you are setting up Box 12 or Box 14, click the Hours Codes tab and select the hours codes to include for the box selected. This tab is disabled when you are setting up Box 10.

- The Other Taxes tab also is enabled if you are setting up Box 14. You may select other taxes to display in Box 14 instead of displaying with local taxes in Box 19.

- Click Save and repeat for the other boxes.

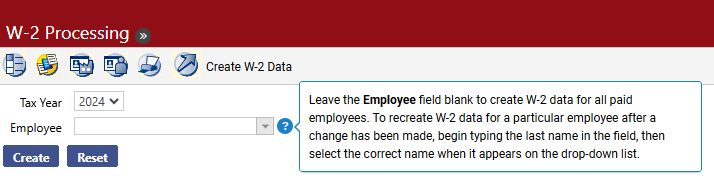

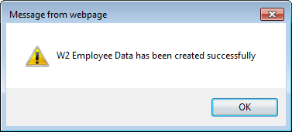

The Create W-2 Data page, accessed by clicking the ![]() icon on the W-2 processing page, allows authorized users to create the data for the employees’ W-2 forms:

icon on the W-2 processing page, allows authorized users to create the data for the employees’ W-2 forms:

- Select the Tax Year. The current year is the default.

- Leave the Employee field blank to create W-2 data for all employees. To create W-2 data for a specific employee, select that Employee.

-

Click Create. You should see a message like the following:

- You can now work with the W-2 data you have created.

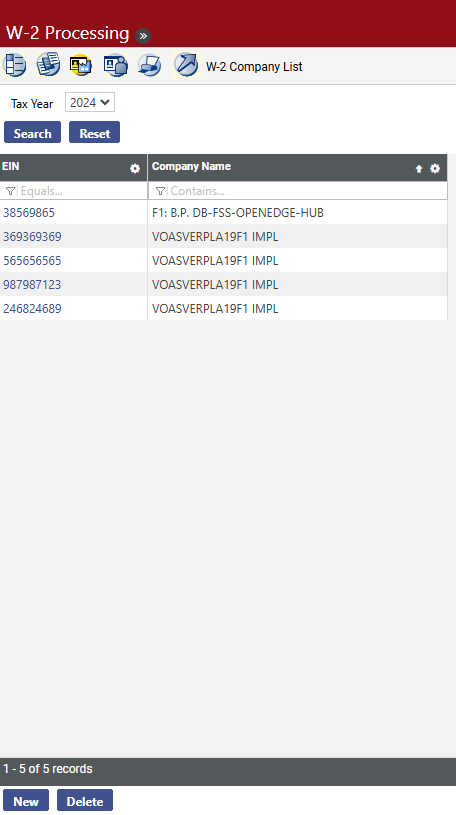

The W-2 Company List page, accessed by clicking the ![]() icon on the W-2 Processing page, allows authorized users to work with companies available for W-2 processing:

icon on the W-2 Processing page, allows authorized users to work with companies available for W-2 processing:

Note: Company information for all companies with W-2 data is created during the Create W-2 Data process. Existing company data is not overwritten.

-

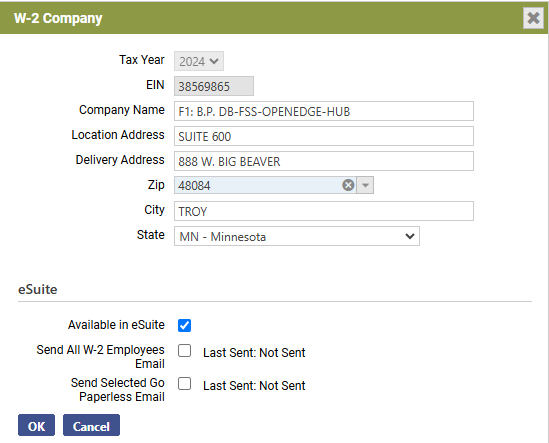

To edit the company information before W-2s are created, click the EIN hyperlink. To add a new company for this tax year, click the New button. The W-2 Company pop-up displays:

- Select the Tax Year. The current year is the default.

- Enter the EIN, or tax ID, for the company. This entry is required. It may contain 9 digits. It may not be edited once the record is saved.

- Enter the Company Name as it should display on W-2s and reports. This emtry is required. It may contain 100 characters.

- If different from the company's Delivery Address, a Location Address may be entered. This field may contain 50 characters.

- Enter the company’s Delivery Address. This entry is required. It may contain 50 characters.

-

Type the beginning of the Zip Code value. The field filters the options based on the values entered so the correct Zip can be selected. Once the Zip is entered, the the City and State fields populate with the corresponding values.

Either a Zip or a Zip+4 value may be entered. If you use the Zip+4 format, the hyphen must be included between the fifth and sixth digits for the value to populate the City and State fields.

-

8. If the City should be different from the one selected, enter its name. The entry may contain 50 characters.

-

If you require a different State, select the correct one.

Note: Steps 10, 11 and 12 below apply only if you are licensed to eSuite.

- Select the Available in eSuite box to make W-2s available for viewing in eEmployee.

- Select the Send All W-2 Employees Email check box to have all employees receive emails informing them of the option in eSuite to have their W-2s delivered electronically.

-

Select Send Selected Go Paperless Email check box to have all employees who choose the electronic delivery of W-2s receive emails informing them of the availability of their W-2s in eSuite.

The email templates for these processes are located on the Email Template Setup page in Maintenance (Maintenance > new world ERP Suite > System > Email Templates).

- Click OK to save the company record.

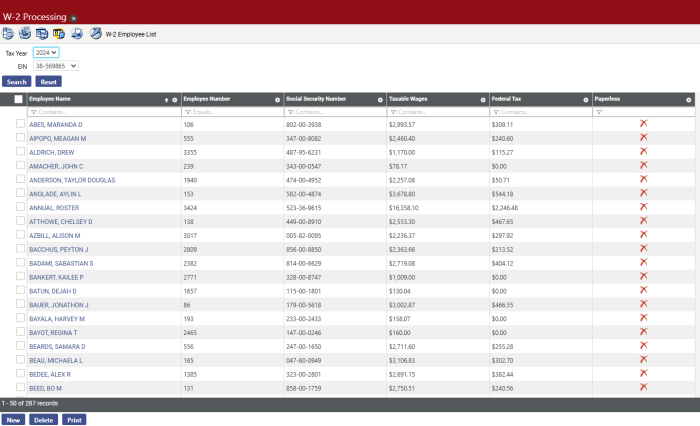

The ![]() W-2 Employee List page, accessed by clicking the

W-2 Employee List page, accessed by clicking the ![]() icon on the W-2 Processing page, allows authorized users to work with employees who should receive W-2s:

icon on the W-2 Processing page, allows authorized users to work with employees who should receive W-2s:

Use the search Tax Year and EIN fields to filter the results that display. To filter the grid by a specific column, type an entry in the cell immediately below the column header.

-

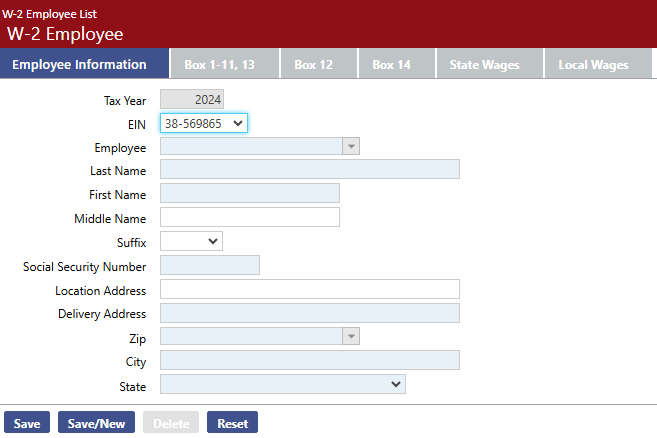

To edit an employee's information, click the Employee Name. To add an employee who is not on the list but who should receive a W-2, click the New button. In either instance, the W-2 Employee page opens with the

Employee Information tab selected as the default:

Employee Information tab selected as the default: Field Descriptions

Field Descriptions

Field Description Tax Year The Tax Year is disabled. It is populated based on the year selected on the W-2 Employee List page EIN Select the EIN, or tax ID, for the company. All EINs set up on the W-2 Company page for the selected tax year are available for selection. Employee If the person to be added is an employee, select him or her from the Employee field or use the  icon to search for the name. The selection populates the fields below with the values from the employee record.

icon to search for the name. The selection populates the fields below with the values from the employee record.Name Employee's name. Suffix Employee's name suffix, if applicable. Social Security Number Required. Location Address If applicable, this entry displays as the second address line on the employee’s W-2. Delivery Address Required. Zip Once the Zip is entered, the system populates the City and State fields with the corresponding values.

A zip or a zip+4 value may be entered. If you use the zip+4 format, include the hyphen between the fifth and sixth digits for the value to populate the City and State fields.

-

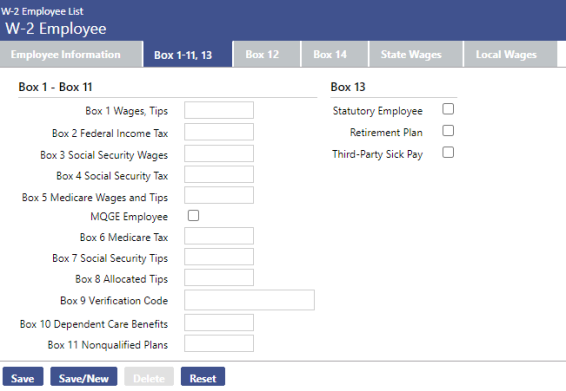

Once the employee information is entered, select the

Box 1-11, 13 tab to enter information that should display on the W-2 form:

Box 1-11, 13 tab to enter information that should display on the W-2 form: Field Descriptions

Field Descriptions

Field Description Box 1 Wages, Tips Federal taxable wage (before payroll deductions) paid to the employee during the year. Box 2 Federal Income Tax Federal income tax withheld from the employee’s wages for the year. Box 3 Social Security Wages Total wages paid (before payroll deductions) subject to employee Social Security tax but not including Social Security tips and allocated tips. The sum of Box 3 Social Security Wages and Box 7 Social Security Tips for 2024 cannot exceed $168,600.00 Box 4 Social Security Tax Employee Social Security tax withheld, including Social Security tax on tips. The employee tax rate for social security is 6.2%. The employer tax rate for social security is 6.2%. Box 5 Medicare Wages and Tips Total of wages and tips subject to Medicare tax. This value must be greater than or equal to the sum of Box 3 Social Security wages and Box 7 Social Security tips. MGQE Employee Signifies whether the employee is exempt from paying Social Security (FICA). The box is checked automatically if the employee has zero Social Security Wages. The system issues a warning if this check box is selected and Box 3 Social Security Wages is greater than zero. Box 6 Medicare Tax Total employee Medicare tax withheld. It includes only tax withheld for wages and tips. Box 7 Social Security Tips Total tips the employee reported. The sum of Box 3 Social Security Wages and Box 7 Social Security Tips for 2024 cannot exceed $168,600.00. Box 8 Allocated Tips Total of tips allocated to the employee for this year. Box 9 Verification Code Verifies the authenticity of the W-2 data taxpayers submit on e-filed returns. This field replaces the Box 9 Advance EIC Payments field. As part of a pilot program implemented to combat tax-related identity theft and refund fraud, the IRS has partnered with certain vendors to include this verification code on many employee W-2 forms; New World ERP, however, is not a selected vendor and does not fill in this field.

The verification code does not display on the W-2 Register, but if the field is filled in, it displays on the W-2 form.

Box 10 Dependent Care Benefits Total dependent care benefits under a dependent care assistance program (section 129) paid to the employee or incurred by the employer for the employee. Box 11 Unqualified Plans Distributions to an employee for a non-qualified plan or a non-governmental section 457 plan. Statutory Employee The Statutory Employee check box signifies whether statutory employees’ earnings are subject to Social Security and Medicare taxes but are not subject to Federal income tax withholding. It is cleared by default Retirement Plan The Retirement Plan check box signifies whether the employee was an active participant in a retirement plan (e.g., pension, profit-sharing, stock-bonus plan, annuity plan, simplified employee pension, trust, etc.). It is cleared by default. Third-Party Sick Pay The Third-Party Sick Pay check box signifies the employer is a third-party sick pay payer filing a Form W-2 for an insured’s employee or is an employer reporting sick payments made by a third party. It is cleared by defaul -

Once the employee information is entered, select the

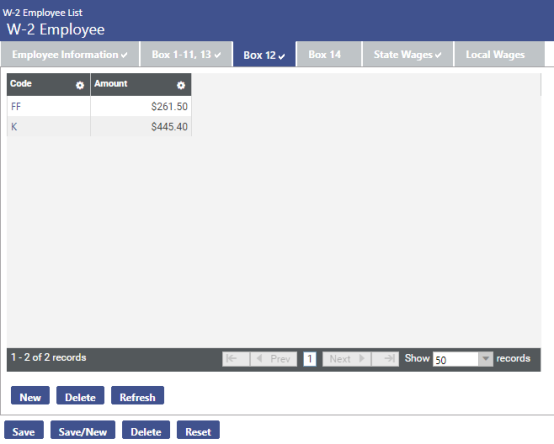

Box 12tab to enter more information that should display on the W-2 form:

Box 12tab to enter more information that should display on the W-2 form: -

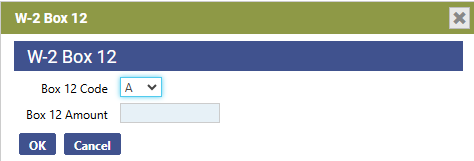

To add Box 12 information, click the New button. The

W-2 Box 12 pop-up displays:

W-2 Box 12 pop-up displays: Field Descriptions

Field Descriptions

Field Description Box 12 Code Select the Box 12 Code for this employee. The options are predefined. Refer to your W-2 instructions or contact your accountant for additional information. Box 12 Amount Enter the Box 12 Amount that applies for this employee. The acceptable range is $0.01 through $999,999,999.99. Zero (0.00) is an invalid entry. - Click OK to save Box 12 entries.

-

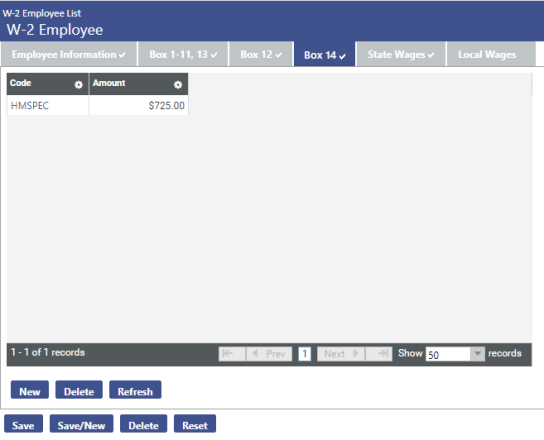

Once the Box 12 information is entered, select the

Box 14 tab to enter more information that should display on the W-2 form:

Box 14 tab to enter more information that should display on the W-2 form: -

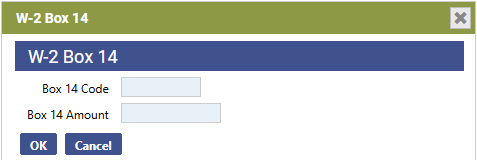

To add Box 14 information, click the New button. The

W-2 Box 14 pop-up displays:

W-2 Box 14 pop-up displays: Field Descriptions

Field Descriptions

Field Description Box 14 Code Enter the Box 14 Code for this employee. The Box Code for Box 14 is a validation set and may be set up to contain the values needed by the organization. Box 14 Amount Enter the Box 14 Amount that applies for this employee. The acceptable range is $0.01 through $999,999,999.99. Zero (0.00) is an invalid entry. - Click OK to save Box 14 entries.

-

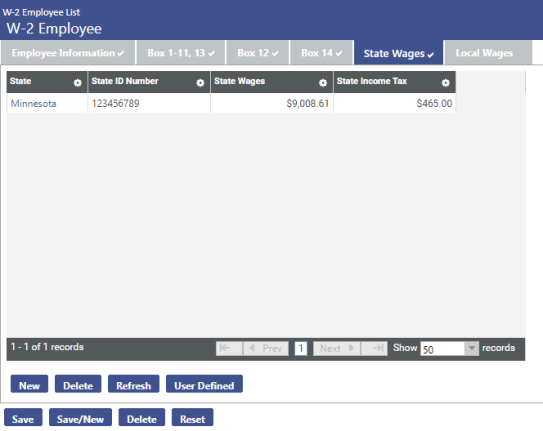

Once the Box 14 information is entered, select the

State Wages tab to enter more information that should display on the W-2 form:

State Wages tab to enter more information that should display on the W-2 form: -

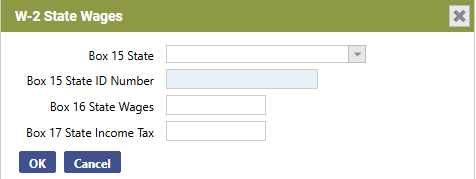

To add State Wages information, click the New button. The

W-2 State Wages pop-up displays:

W-2 State Wages pop-up displays: Field Descriptions

Field Descriptions

Field Description Box 15 State State used for this employee. All states are included in the list. This entry is required. Box 15 State ID Number Required. Box 16 State Wages Total dollar amount of state wages earned by the employee. This entry is required. The acceptable range is $0.01. through $999,999,999.99. Zero (0.00) is not a valid entry. Box 17 State Income Tax Total dollar amount of state income tax paid by the employee. The acceptable range is $0.01. through $999,999,999.99. It may be left blank, which displays as $0.00 on the list page. - Click OK to save state wage entries.

-

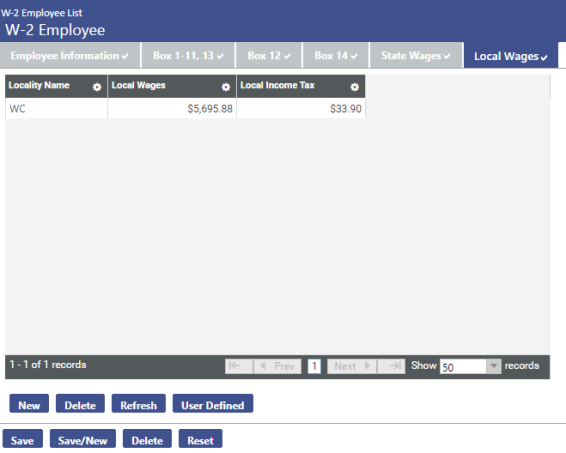

Once the State Wages information is entered, select the

Local Wages tab to enter more information that should display on the W-2 form:

Local Wages tab to enter more information that should display on the W-2 form: -

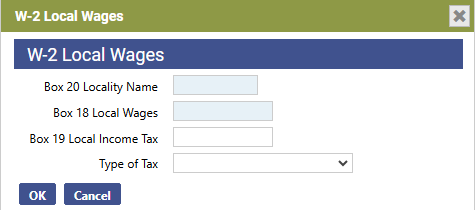

To add Local Wages information, click the New button. The

W-2 Local Wages pop-up displays:

W-2 Local Wages pop-up displays: Field Descriptions

Field Descriptions

Field Description Box 20 Locality Name Name of the locality reporting local income tax information. This entry is required. Customers who have Other taxes should verify the code in the Locality field. Box 18 Local Wages Total dollar amount of local wages earned by the employee. This entry is required. Box 19 Local Income Tax Total dollar amount of local income tax paid by the employee. The acceptable range is $0.01. through $999,999,999.99. It may be left blank, which displays as $0.00 on the list page. Type of Tax Select the Type of Tax: C-City, D-County, E-School District, F-Other Income Tax - Click OK to save local wage entries.

- Click Save to save all changes made to the employee record on these tabs.

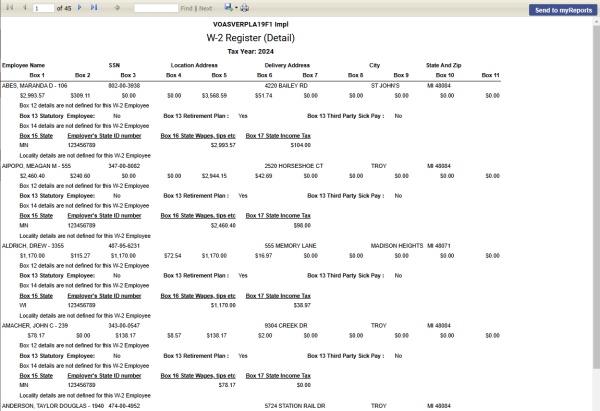

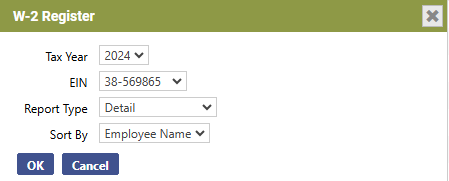

The W-2 Register pop-up, accessed by clicking the Print button on the W-2 Employee List page, allows authorized users to print the W-2 register.

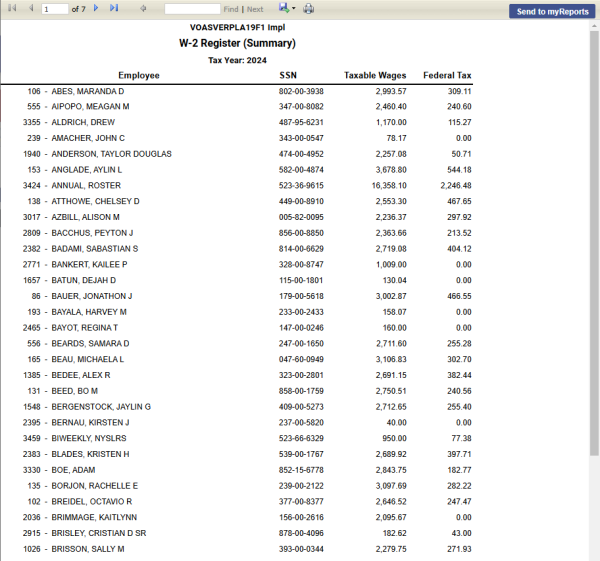

The summary register lists taxable wages and federal taxes for each employee. The detail register lists all W-2 information for each employee. It also includes totals that may be compared to the 941s for the year, verifying the grand total taxes and wages reported on the W-2s match the amounts paid during the year.

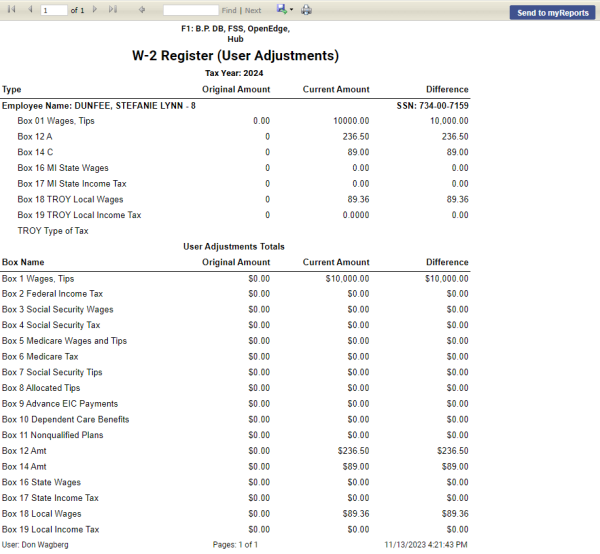

The W-2 Register also may be used in conjunction with the Payroll History Report and the Earnings History Report to reconcile individual employee amounts. The User Adjustments mode is helpful for reviewing any discrepancies between the actual earnings history (including checks, voids and adjustments) and the current W-2 figures. These changes are made from the W-2 Employee List.

The W-2 Register may be sorted by employee name or department.

- Select the Tax Year. The current year is the default.

- Select the EIN for which you want to produce the register. This value defaults from the W-2 Employee List page.

- Select the Report Type to run. The options are Detail, Summary and User Adjustments. Detail is the default.

- Select the Sort By type for the register. The options are Employee Name and Department. Employee Name is the default.

- Click OK to run the register.

Report Type = Detail

The Detail option for this report shows the contents of all the boxes on the W-2.

Report Type = Summary

The Summary option for this report shows Box 1 and Box 2 information for employees receiving a W-2.

Report Type = User Adjustments

The User Adjustments option for this report sjpws adjustments made to an employee’s W-2 file since the W-2 data was created.

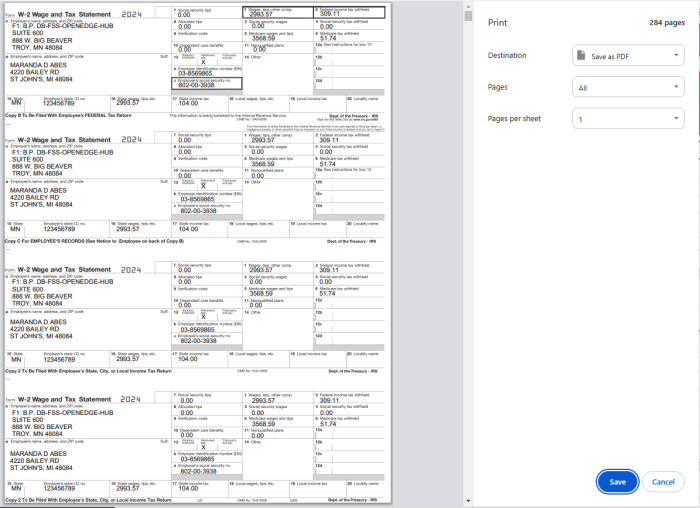

Note: Special instructions for printing the W-2 Z-fold form appear at the end of this section.

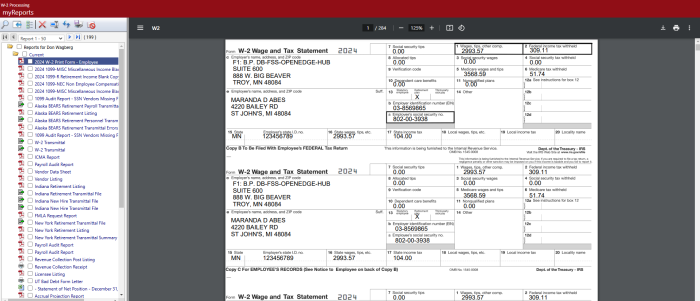

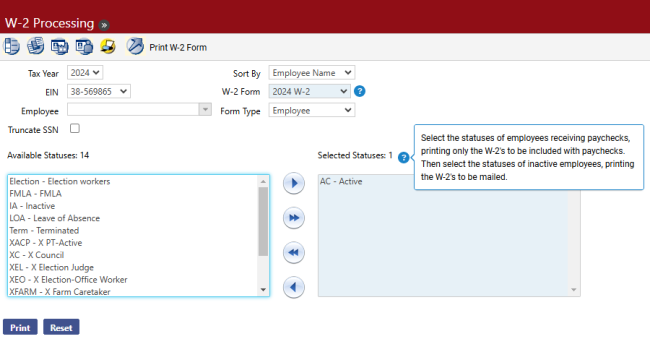

The Print W-2 Form page, accessed by clicking the ![]() icon on the W-2 Processing page, allows authorized users to print official W-2s.

icon on the W-2 Processing page, allows authorized users to print official W-2s.

- Select the Tax Year. The current year is the default.

- Select the EIN. This value defaults from the W-2 Employee List page.

- Leave the Employee field blank to print W-2s for all employees. Select the Employee if W-2s should be printed for one employee only.

- Mark Truncate SSN to mask the social security number on the W-2, showing only the last four digits.

- Select the Sort By. The options are Employee Name and Department.

- Select the W-2 Form you plan to use. This entry is required.

- Select the Form Type. The default is Employee. The options are Employee and Employer.

- Select the Available Statuses for which W-2 forms are created. Forms are created for employees who have the selected status(es) as of the date the print job is submitted.

-

Click Print to send the print file to myReports.

Note: A W-2 does not print for an employee who has elected to go paperless and has a primary email address set up in Workforce Administration; however, if an employee is selected in the Employee prompt (step 3 above), a W-2 prints. The Employer W-2 prints all employees.

-

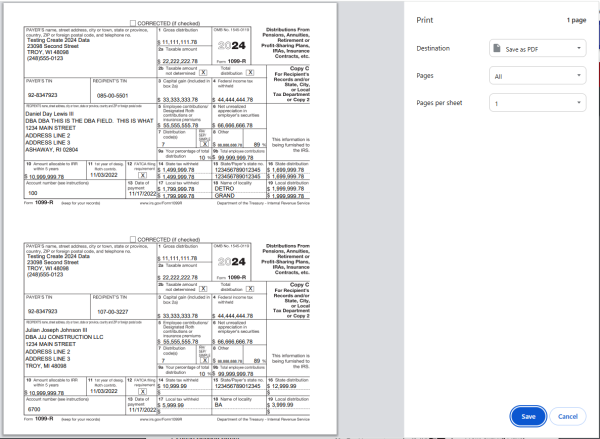

From myReports, click the Print W-2 Form - Employee or Print W-2 Form - Employer link on the left side of the page. The forms display on the right side of the page, allowing the user to view the forms before printing:

-

Click

in the Adobe toolbar of the preview pane:

in the Adobe toolbar of the preview pane: -

Select the appropriate print options.

Note: It is recommended you first print one form to ensure the paper is loaded correctly in your printer before you print all forms.

- Click Print.

Print W-2 Z-Fold Form

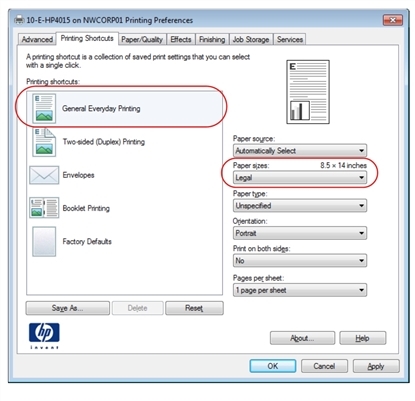

Note: The W-2 Z-fold form must be printed on a network printer, due to additional printer setup that must be performed.

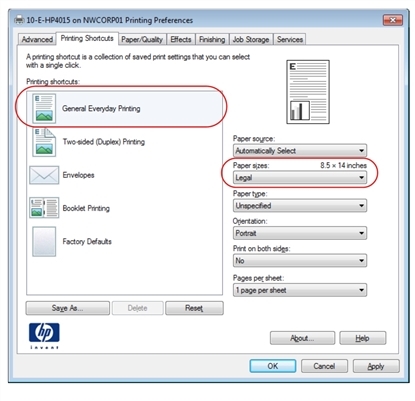

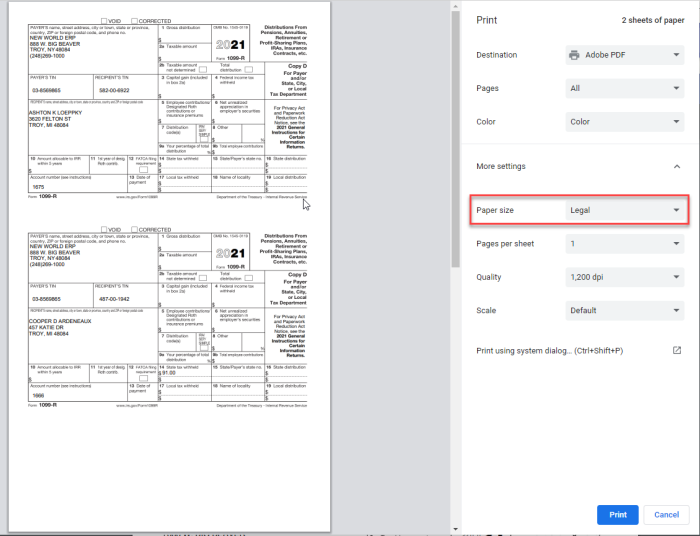

The Z-fold version of the W-2 form prints on legal-size paper. Printing from New World ERP uses the default paper size for the printer you select, so unless it is the default for your printer, follow the steps below to change the network printer’s default paper size to Legal.

-

Connect to the server that houses the application server or the report server (if installed) by going to Start > Run and typing mstsc /console:

- In the Computer field, type the name of your server and click Connect.

- Log into the server using the administrator log in.

- Select Start > Devices and Printers or Start > Printers and Faxes.

- Right click the printer you to print the Z-fold W-2 forms. Remember that it should be a network printer, not a local printer.

-

Select Printing Preferences from the menu. Set the default paper size to Legal. Below is an example for an HP PCL5 printer:

-

Click Apply to make the changes.

Note: The log-on user for the service must have rights to the printer used to print the Z-fold forms. This setup has been performed if the printer is available for selection on the myReports page.

- You may print the W-2 Z-fold forms from the Print W-2 Form page in New World ERP. Remember to select the 2024 W-2 Z-Fold or 2024 W-2 Z-Fold Blank option in the W-2 Form field. When you select the Print button at the bottom of the preview pane in myReports, the printer expects legal-size paper to be used.

- Once the forms are printed, return your network printer to its default settings.

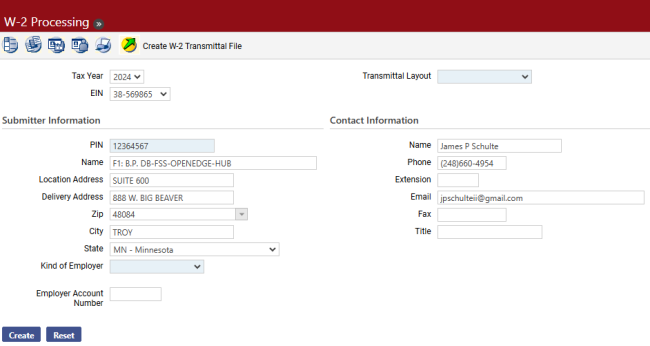

The Create W-2 Transmittal File page, accessed by clicking the ![]() icon on the W-2 Processing page, allows authorized users to create an electronic W-2 file for submission to the federal government.

icon on the W-2 Processing page, allows authorized users to create an electronic W-2 file for submission to the federal government.

- Select the Tax Year. The current year is the default.

- Select the EIN. This value defaults from the W-2 Employee List page.

- Enter the PIN. This number is assigned by the IRS to identify the submitter. This entry is required. It may contain 8 characters.

- Enter the submitter’s Name. This entry is defaulted from the W-2 Company record. It may contain 57 characters.

- Enter the Location Address, if different from the delivery address. This entry may contain 22 characters.

- Enter the Delivery Address. This address is used for all mail and shipments. It is defaulted from the W-2 Company record. It may contain 22 characters.

-

The Zip Code is defaulted from the W-2 Company record. If you need to change it, type the beginning of the new zip. The field filters the options based on the values entered so the correct zip can be selected. Once the zip is entered, the system populates the City and State fields with the corresponding values.

If you use the zip+4 format, the hyphen must be included between the fifth and sixth digits for the entries to populate the City and State fields.

- If the City needed is different from the one matching the Zip Code, enter the city. It may contain 22 characters.

- If you require a different State, select the correct state.

- Select the Kind of Employer. The corresponding letter code from your selection displays in position 174 of the transmittal file

-

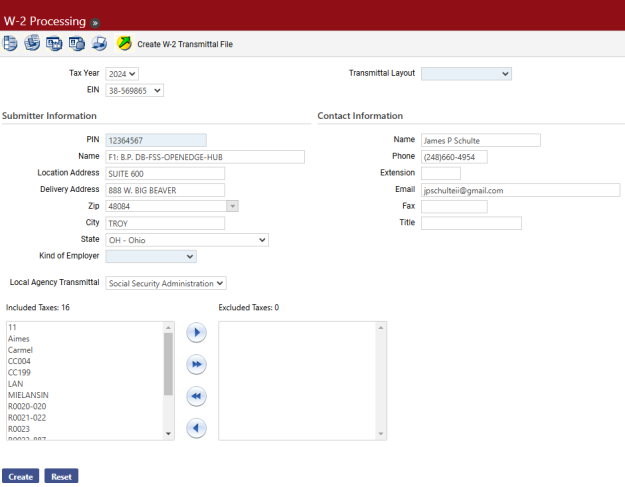

The state of Ohio needs to create a local W-2 transmittal file. Selecting Ohio as the State displays a Local Agency Transmittal drop-down field and multi-select list boxes containing local taxes. Available selections in the drop-down are Social Security Administration, State of Ohio, Regional Income Tax and Central Collection Agency:

-

Use the multi-select list boxes to exclude specific local taxes from the W-2 transmittal file. The available selections in the boxes are the Locality entries from the "Other" tax codes that were set up in Maintenance and were used in the Create W-2 Data step. To exclude a tax, move it from the Included Taxes box on the left to the Excluded Taxes box on the right.

If Michigan is selected as the State and Flint Local as the Local Agency Transmittal, the transmittal file appropriately contains the FL or Flint code, depending on how it is named in the Locality field on the Other Tax page in Maintenance (Maintenance > Human Resources > Deductions and Benefits > Taxes).

If W-2s are processed before the Locality code for Flint has been set up, the code may be added manually through the W-2 Employee Local Wages tab in W-2 Processing (Human Resources > Year-End Processing > W-2 Processing > W-2 Employee List > Employee Name > Local Wages > New).

If Michigan is selected as the State and Lansing or East Lansing as the Local Agency Transmittal, the transmittal file contains the LAN or MIELA code, depending on how it is named in the Locality field on the Other Tax page in Maintenance.

If State of Ohio is selected as the Local Agency Transmittal, only Ohio RS39 records are included in the transmittal file. Any employee who is not associated with an RS39 record is excluded.

To complete an Ohio CCA transmittal file, the State Control Number and Municipality Name must have entries on the Other Tax page in Maintenance > Human Resources > Deductions and Benefits > Taxes > Other Tax Code. State Control Number displays in positions 331-337 of the CCA transmittal file and the Municipality Name in positions 338-412. These entries are required for each municipality. They are not effective-dated so may be changed at any time.

- Select the Transmittal Layout format to use for this file. This entry is required.

-

14. Enter the Name of the person the IRS should contact if there are concerns about the transmittal file. This entry is required; it may contain 27 characters.

-

Enter the Phone number of the person the IRS should use if there are concerns about the transmittal file. Either the phone number or email address is required; it must contain 10 digits.

- Enter the phone Extension, if applicable. This field may contain 5 characters.

- Enter the Email address. The contact’s email address may contain 40 characters. Either the email address or the phone number is required.

- Enter the Fax number. This field must contain 10 digits.

- Enter the Title of the contact person’s role, if desired.

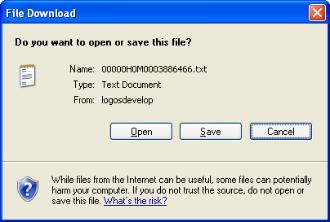

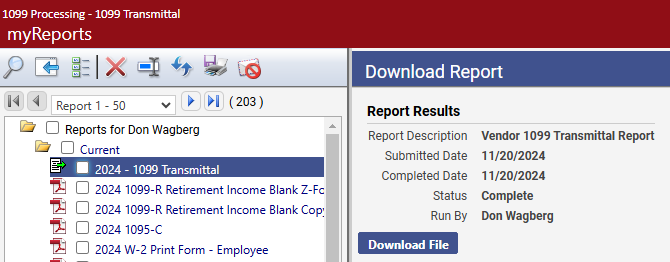

- Click the Create button. The transmittal file is sent to myReports.

-

Go to myReports. Click the 2024 W-2 Transmittal link on the left side of the page. The File Download pop-up displays:

- Click the Save button and save the file to a folder where it can be located to send to the IRS.

Prior to your sending the W-2 transmittal file, it is recommended you run the file through AccuWage.

AccuWage is free software from the Social Security Administration that allows you to check the W-2 transmittal file for correctness.

AccuWage is available at the Social Security Administration website: www.ssa.gov/employer/accuwage

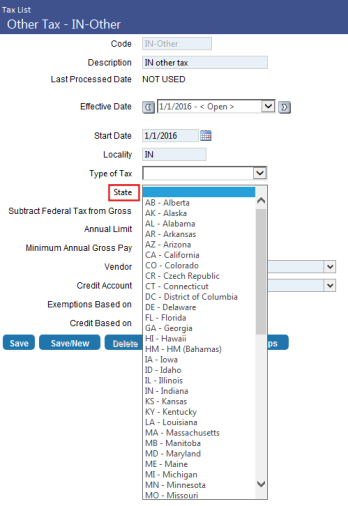

To accommodate situations when employees have local taxes from different states, a State field is available on the Other Tax page in Maintenance:

Select the appropriate state from the drop-down.

When the Locality Code on the Other Tax page matches the Box 20 Locality Name on the W-2 Employee Local Wages tab in W-2 Processing, and the state of the local code and the state gross are Maryland, all local taxes are added to the state tax in the W-2 transmittal file, placing the total amount in RS record position 287-298.

Selecting Ohio as the State on the Create W-2 Transmittal File page (Human Resources > Year-End Processing > Create W-2 Transmittal) displays a Local Agency Transmittal drop-down field and multi-select list boxes containing local taxes.

Available selections in the drop-down are Social Security Administration, State of Ohio, Regional Income Tax and Central Collection Agency.

Use the multi-select list boxes to exclude specific local taxes from the W-2 transmittal file. The available selections in the boxes are the Locality entries from the "Other" tax codes that were set up in Maintenance and were used in the Create W-2 Data step. To exclude a tax, move it from the Included Taxes box on the left to the Excluded Taxes box on the right.

If State of Ohio is selected as the Local Agency Transmittal, only Ohio RS39 records are included in the transmittal file. Any employee who is not associated with an RS39 record is excluded.

To complete an Ohio CCA transmittal file, the State Control Number and Municipality Name must have entries on the Other Tax page in Maintenance > Human Resources > Deductions and Benefits > Taxes > Other Tax Code. State Control Number displays in positions 331-337 of the CCA transmittal file and the Municipality Name in positions 338-412. These entries are required for each municipality. They are not effective-dated so may be changed at any time.

Central Collection Agency Requirements

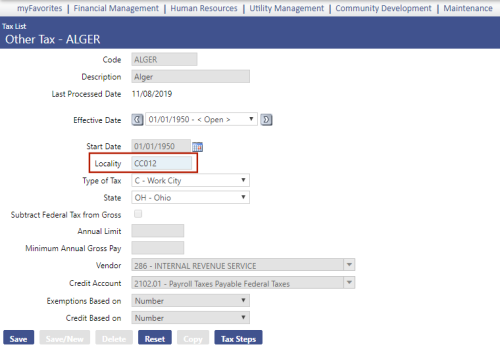

Maintenance > Human Resources > Deductions and Benefits > Taxes > Other Tax Code

Human Resources > Year-End Processing > W-2 Processing > Create W-2 Transmittal

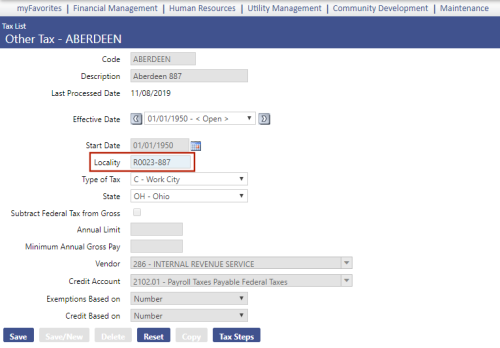

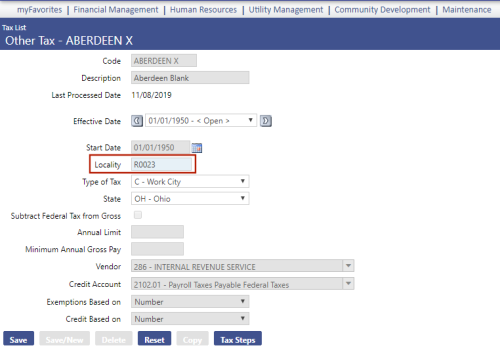

For the Ohio Central Collection Agency (CCA), the Locality code from tax maintenance must be populated on the RS record for all cities, not only CCA members.

When the transmittal file for Ohio CCA is processed, the Locality code from tax maintenance determines the code populated on the transmittal file; for example, a Locality code of CC123 on the tax setup populates a CC in field 5-6 and 123 in field 7-9 on the RS records.

Since CC123 is a member of CCA, the CC characters define the location on the transmittal file; other cities, however, are not members of CCA. They also have locality codes that need to be reported, but because they are not members, they do not need to report a CC in field 5-6; this field must be blank.

In the case of a Locality code of R0345 (Canton OH RITA tax), this non-CCA member tax has been reported in field 3-9 of the transmittal file as 887, where 887 is unknown. The CCA has given Canton OH a city code of 445, meaning the Locality code for Canton tax is set up as R0345 for Rita tax, but now needs to be reported to CCA with a Locality code of 445.

In tax maintenance, a CCA non-member Locality code must be populated for all local taxes that can be used for reporting on the W-2 transmittal.

The Locality code allows 9 characters. To populate correctly, a format of R0123-234 is needed, where R0123 is used for RITA, and 234 is used for the CCA non-member city.

| Rules and Setup | ||

|---|---|---|

| A Rita tax will never be a CCA member, but it can be a Rita and a non-member CCA city. | ||

| Ex. | Locality for Rita | R0123 |

| Ex. | Locality for CCA member | CC123 |

| Example 1 | ||

| ALGER | 004 | Non-Rita, CCA member |

| Locality code | CC012 | No changes (view |

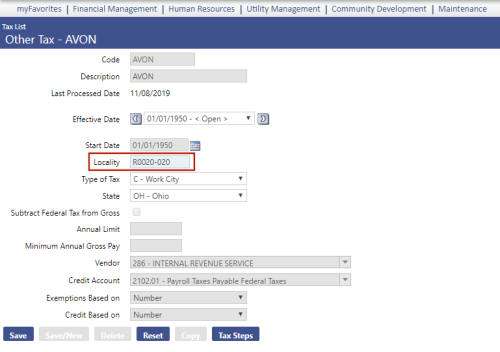

| Example 2 | ||

| AVON | 020 | Rita |

| Avon | 020 | CCA non-member city |

| Locality code | R0020-020 | Where R0020 is used for Rita, and -020 is used for CCA non-member city (view |

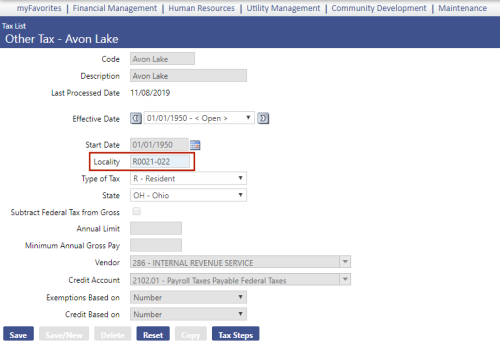

| Example 3 | ||

| AVON LAKE | 021 | Rita |

| Avon Lake | 022 | CCA non-member city |

| Locality code | R0021-022 | Where R0021 is used for Rita, and -022 is used for CCA non-member city (view |

| Example 4.1 and 4.2 | ||

| Aberdeen | 023 | Rita Only, no CCA city code or unknown |

| Aberdeen 887 | R0023-887 | R0023 is used for Rita, and -887 is used for CCA (view |

| Aberdeen X | R0023 | R0023 is used for Rita, and a blank or null value defaults to 887 for CCA (view |

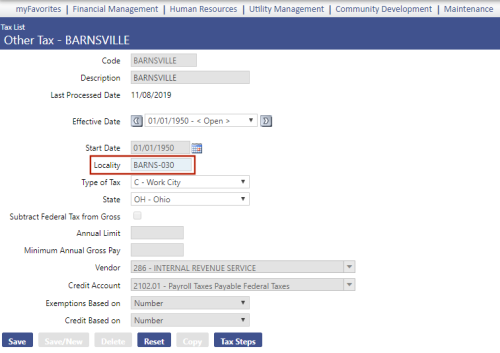

| Example 5 | ||

| BARNESVILLE | 030 | Non Rita, CCA non-member city code |

| Locality code | BARNS-030 or XXXXX-030 | XXXXX is used for Rita (cannot begin with RO or CC), and -030 is used for CCA (view |

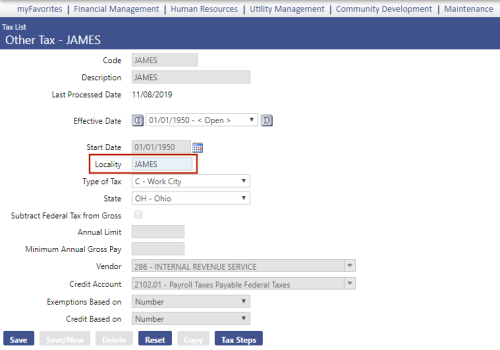

| Example 6 | ||

| JAMES | NA | Non Rita, Non CCA, no codes for either |

| Locality code | JAMES or XXXXX | XXXXX can be anything (as long as it does not begin with RO or CC), Rita is okay, and CCA defaults to 887 (view |

Ohio Local Tax Setup

When a local tax for SSA is set up for a city, the Locality entry should start with a C, followed by four numbers. When it is set up for a school district, the entry should start with an E, followed by four numbers. (Type of Tax is not used.)

When the tax is to go to the Regional Income Tax Agency, the Locality is expected to start with RO, followed by three numbers (RO###). When the tax is to go to the Central Collection Agency, the Locality is expected to start with CC, followed by three numbers (CC###). Both taxes require a Type of Tax selection. The Type of Tax should be R for Residential or C for City.

The employee's state wage needs to be OH.

When the SSA transmittal file is run, the standard Ohio transmittal file runs. All employees are included, but only the selected local tax codes data is supplied.

When the Regional Income Tax Agency or Central Collection Agency is selected, only the employees who have the selected local taxes are included.

Below is a list of the tasks to be performed in 1095-C processing. Following this list helps to ensure a smooth year-end process:

|

1095-C Processing |

|

|

Daily Processing |

|

|

r |

Identify full-time employees through the Initial Measurement Period Report and the Standard Measurement Period Report. |

|

r |

In the Offer and Coverage section on the Employer Reporting tab of Workforce Administration, record information needed for the 1094-C and 1095-C forms. |

|

r |

Using Benefits Administration or the Covered Individual section on the Employer Reporting tab of Workforce Administration, set up covered individuals to be reported on the 1095-C forms. |

|

1095-C Processing |

|

|

r |

Order 1095-C forms. |

|

r |

For customers on the 2024 release, apply the year-end processing patch 2024.1.10. |

|

r |

Verify the correct Plan Start Month is set up. |

|

r |

Generate the 1095-C work file using Create 1095-C Data. |

|

r |

Review and update the information for the Applicable Large Employer Member List. |

|

r |

Review 1095-C Employee for any employee who may have incorrect 1095-C data. |

|

r |

Print and review the 1095-C Register. |

|

r |

Print 1095-C Forms. |

|

r |

Create 1095-C Transmittal for submission to the IRS. |

|

r |

Distribute 1095-Cs to employees. |

|

r |

Submit the 1095-C information to the IRS. |

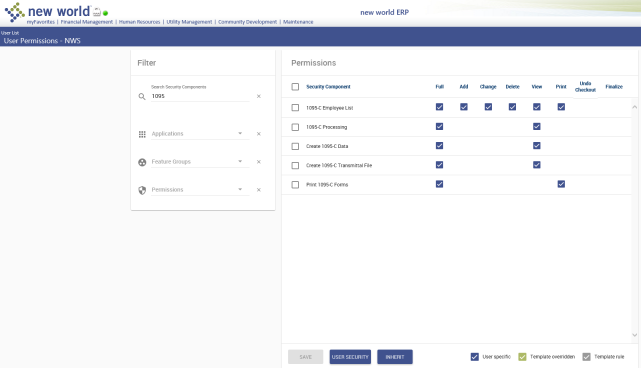

Users need permission to the appropriate 1095-C Processing components in New World ERP Suite Security:

- Navigate to Maintenance > new world ERP Suite > Security > Users.

- Select the user.

- Click Permissions.

- Type 1095 in the Search Security Components filter.

-

Click Search. The components for 1095-C Processing display:

- Select the appropriate permissions.

- Click Save.

- For the permissions to take effect, the user must log off, then log back onto the system.

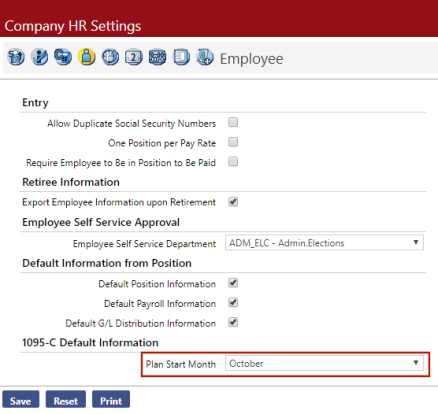

Maintenance > Human Resources > Company HR Settings > Employee

Use the Plan Start Month field to designate a plan start month for 1095-C processing. This entry prints on 1095-C forms and the transmittal to the IRS.

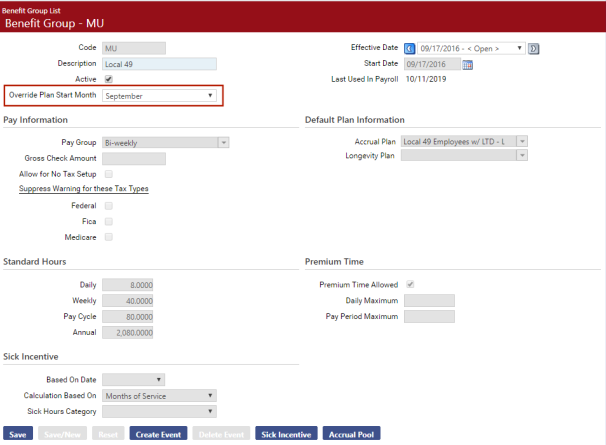

If you want any benefit groups to have a different plan start month from the one selected in Company HR Settings, use the Override Plan Start Month field on the Benefit Group page.

Maintenance > Human Resources > Employee Attributes > Benefit Groups > Code

The 1095-C create process determines all the primary job benefit groups for each employee during the tax year and selects the earliest Override Plan Start Month from these benefit groups. If the Override Plan Start Month is blank in every case, it uses the Plan Start Month from Company HR Settings.

For non-employees, the create process checks the start month on the Non-Employee Benefit Plan Entry page in Maintenance for all the non-employees’ plans where 6055 Reporting is selected. The create process uses the earliest month found.

Human Resources > Year-End Processing > 1095-C Processing

1095-C Processing uses a work-flow format to organize the steps and allow users to logically step through them.

Use the Create 1095-C Data page, accessed by clicking the ![]() icon on the 1095-C Processing page, to aggregate the employee and company data needed to generate and print your 1095-C forms and send the associated transmittal file to the IRS:

icon on the 1095-C Processing page, to aggregate the employee and company data needed to generate and print your 1095-C forms and send the associated transmittal file to the IRS:

- Select the Tax Year being processed. The drop-down contains all available years through the current year. During the months of January through September, the previous year is defaulted. During October through December, the current year is defaulted.

- Select the Employee whose 1095-C data is to be updated for the Tax Year selected. Leave the field blank to update data for all employees. The drop-down contains an alphabetized list of all employees.

- Click the Create button to create the 1095-C file. A message may display, telling you 1095-C data already exists and asking whether you want to overwrite it. Clicking OK clears data for the selected year before generating the new data. Clicking Cancel abandons the process.

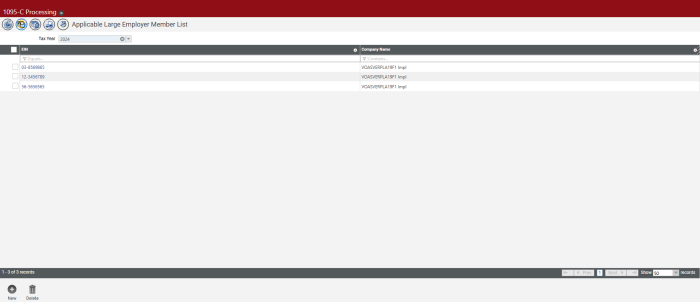

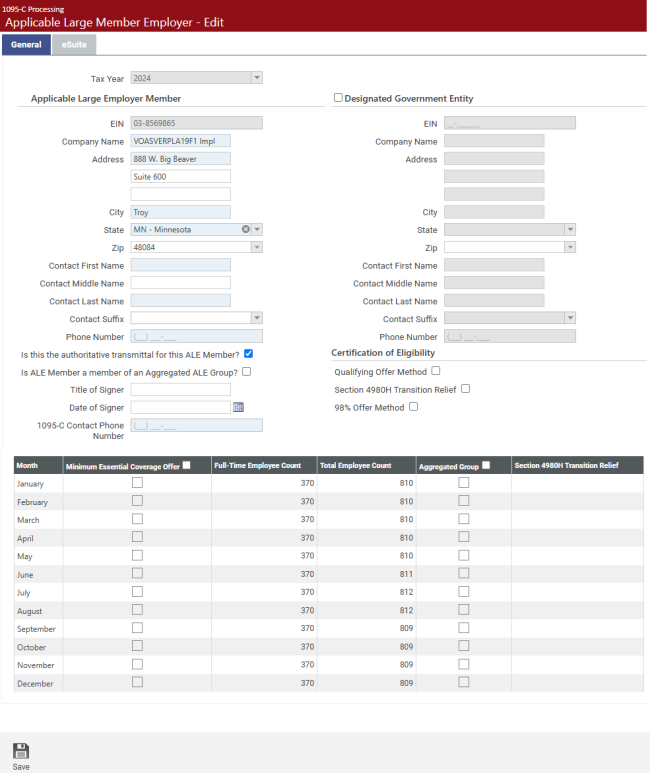

Use the Applicable Large Employer (ALE) Member List page, accessed by clicking the ![]() icon on the 1095-C Processing page, to review and maintain the employer information for your 1095-C forms and transmittal file. This data is sent to the IRS along with the employee 1095-C forms and the employer 1094-C form:

icon on the 1095-C Processing page, to review and maintain the employer information for your 1095-C forms and transmittal file. This data is sent to the IRS along with the employee 1095-C forms and the employer 1094-C form:

Note: Although the system generates some of the employer data, such as name, address, authoritative transmittal and full-time and total employee counts, you must enter the rest of the data, such as the certification of eligibility, MEC offer indicator and section 4980H transition relief indicator.

-

Select the Tax Year. The drop-down contains all available years through the current year. The default selection is the highest year for which data exists. When you select a year, the grid below refrehes with the data for that year.

The grid contains the following data:

EIN: Nine-digit employer identification number assigned by the IRS.

Company Name: Name of the company identified by the EIN.

-

To add an ALE member, click the New button below the grid; to edit an existing ALE member, click the associated EIN link in the grid. In either instance, the Applicable Large Employer Member page displays:

The data on the General tab of this page consists of three parts found on form 1094-C:

- Name and address of the ALE and the Designated Government Entity

- Miscellaneous information about the associated employee forms

- A grid of the monthly information

-

Select the Tax Year being processed. The drop-down contains all available years through the current year. During the months of January through September, the previous year is defaulted. During October through December, the current year is defaulted. If you are editing employer information, this field is disabled.

Applicable Large Employer Member

- Enter the nine-digit, state-assigned employer identification number (EIN). EIN is determined by an entry in the Company field on the Employment tab of Workforce Administration. The Value of the validation set entry contains the EIN. If you are editing employer information, this field is disabled.

- Enter the Company Name.

- Enter the Address, City, State and Zip of the company. The first Address field requires an entry. Use the second and third fields for suite number, apartment number or other parts of the address.

- Enter the name of the contact person for your organization.

- In the Phone Number field, enter the number for the IRS to contact if it has questions.

- If the transmittal file is the authoritative file for the ALE member, mark the Is this the authoritative transmittal for this ALE member? check box.

- If the ALE member is a member of an aggregated ALE group, mark the Is ALE Member a member of an Aggregated ALE Group? check box. This box is enabled only if the check box above it is marked.

- In the Title of Signer field, enter the position title of the person signing the form.

- In the Date of Signer field, select the date the form was signed.

-

In the 1095-C Contact Phone Number field, enter the contact phone number to be printed on the 1095-C forms that are distributed to employees.

Designated Government Entity

- Select the Designated Government Entity check box to enable the fields below it.

- Enter the nine-digit, state-assigned EIN.

- Enter the Company Name.

- Enter the Address, City, State and Zip of the company. The first Address field requires an entry. Use the second and third fields for suite number, apartment number or other parts of the address.

- Enter a Contact Name.

-

Enter the contact person’s Phone Number.

Certification of Eligibility

-

In this section, mark any of the following check boxes that apply. These boxes are enabled only if this transmittal is the authoritative one for this ALE member (Is this the authoritative transmittal for this ALE member? is marked).

- Qualifying Offer Method

- Section 498OH Transition Relief

-

98% Offer Method

Grid

The Month column contains all 12 months.

-

Mark the applicable months for the Minimum Essential Coverage Offer. To mark all entries in the column, markt the check box in the column header.

The Full-Time Employee Count column contains the count of employees with Full-Time Employee marked on the Offer and Coverage Detail section of Workforce Administration effective as of the first day of the corresponding month for the current tax year.

The Total Employee Count column contains the count of employees who qualify to be in a pay batch as of the first day of the corresponding month for the current tax year.

- Mark the applicable months for the Aggregate Group. To mark all entries in the column, mark the check box in the column header.

-

Enter the appropriate value in the Section 4980H Transition Relief cell for each month. If the employer certifies by marking box C on line 22, that it is eligible for Section 4980H Transition Relief and is eligible for the 50 to 99 Relief, enter code A. If the employer certifies by marking box C on line 22, that it is eligible for Section 4980H Transition Relief and is eligible for the 100 or More Relief, enter code B. An employer is not eligible for both types of relief.

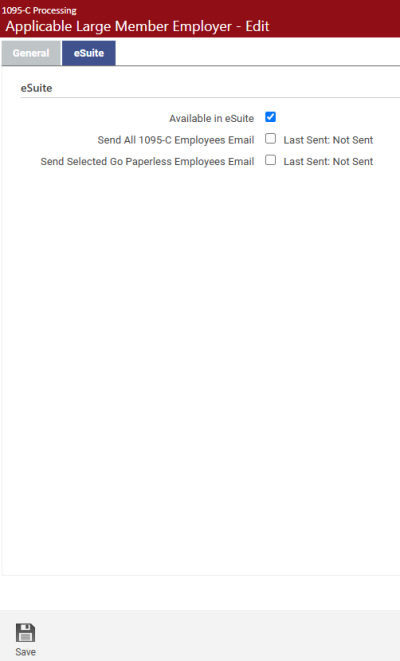

eSuite Tab

- Mark the Available in eSuite check box if you want employees to be able to view and print their 1095-C forms from the eSuite HR Portal. Make sure 1095-Cs are ready to be viewed before marking this box.

- Mark the Send All W-2 Employees Email check box if you want all employees to receive emails informing them of the option in eSuite to have their W-2s delivered electronically.

-

Mark the Send Selected Go Paperless Email check box if you want all employees who choose the electronic delivery of W-2s to receive emails informing them that their W-2s are available in eSuite.

The email templates for these processes are located on the Email Template Setup page in Maintenance (Maintenance > new world ERP Suite > System > Email Templates).

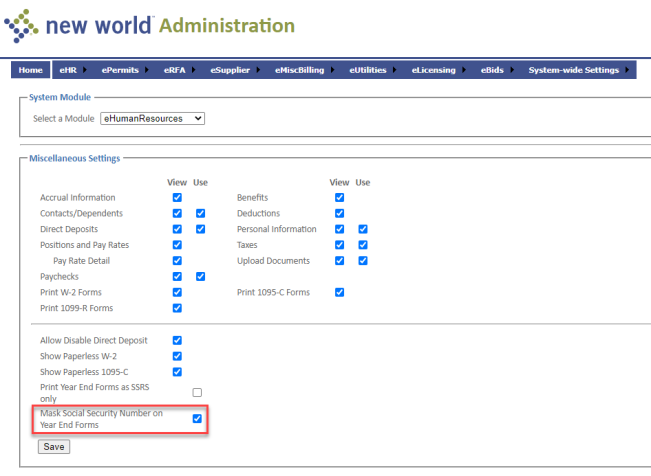

Note: To have social security numbers display only the last four digits on year-end forms and documents downloaded from eSuite, navigate to eHR > eEmployee > Miscellaneous Settings, and mark the ![]() Mask Social Security Number on Year End Forms check box. This feature functions separately from SSN masking in New World ERP.

Mask Social Security Number on Year End Forms check box. This feature functions separately from SSN masking in New World ERP.

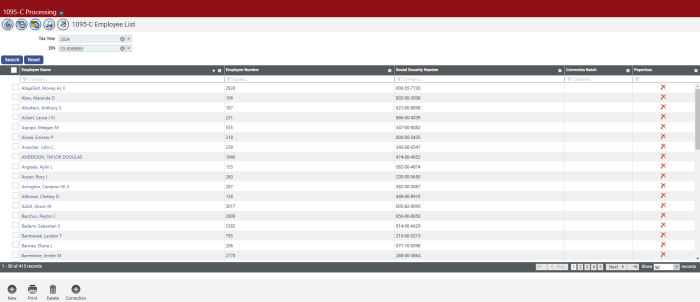

Use the 1095-C Employee List page, accessed by clicking the ![]() icon on the 1095-C Processing page, to review and maintain the employee information for your 1095-C forms and transmittal file:

icon on the 1095-C Processing page, to review and maintain the employee information for your 1095-C forms and transmittal file:

When the page first displays, a search is performed automatically based on the defaulted Tax Year and EIN, loading associated employee names in the grid below.

The far-right column, Paperless, identifies employees who are receiving W-2s electronically and those who are not. The column is populated based on whether employees have the Paperless W-2 check box selected in the Demographics section of the Workforce Administration Personal tab.

Employees who have the check box marked show a green check mark; employees who have it cleared show a red X. By default, the column shows both. To filter the column to show one or the other, click the filter icon at the top of the column and select Yes (green check mark) or No (red X). To show both, select Clear Filter.

- To load the list you want, select the appropriate Tax Year and EIN, and click the Search button.

- Select the Tax Year being processed. The drop-down contains all available years through the current year. The latest year containing data is the default selection. During the months of January through September, the previous year is defaulted. During October through December, the current year is defaulted.

-

Enter the nine-digit, state-assigned employer identification number (EIN). If multiple EINs have been saved, the first one in the list is the default selection. All ALE member EINs that exist for the Tax Year selected display on the drop-down in alphanumeric order.

EIN is determined by an entry in the Company field on the Employment tab of Workforce Administration. The Value of the validation set entry contains the EIN. If a company is not specified as of the last day of the current tax year, the Federal Tax ID from Company Suite Settings is used.

Add or Edit Employee Information

Typically, employee information for 1095-C forms is loaded from Workforce Administration and Non-Employee Service; however, if you have an employee who is not in the system but needs to be reported to the IRS, click the New button below the grid to add the employee's information for your 1095-C forms and transmittal file. To edit an employee's information, click the Employee Name link in the grid. In either instance, the 1095-C Employee page displays.

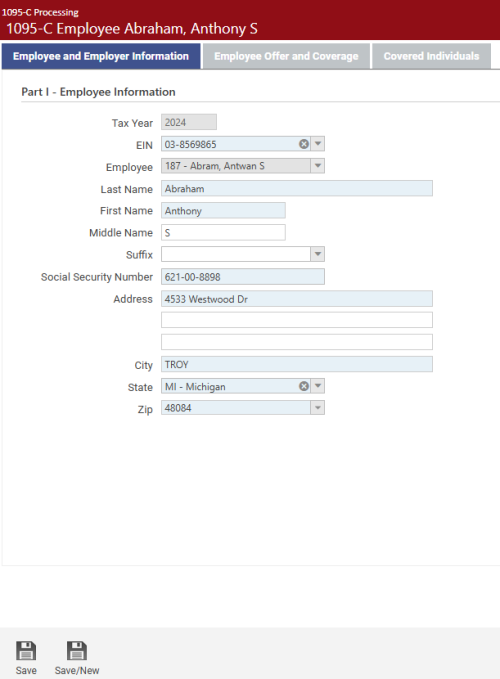

This page contains three tabs: Employee and Employer Information, Employee Offer and Coverage and Covered Individuals.

Employee and Employer Information

Use this tab to add or edit an employee's information for Part I of your 1095-C forms and transmittal file.

- Select the Tax Year. In edit mode, this field is disabled.

- Select the Employee (number and name).

- The employee's last, first, middle name and suffix are defaulted from the Name section of the Workforce Personal tab.

- The employee's nine-digit social security number is defaulted from the Demographics section of the Workforce Personal tab.

- The employee's address is defaulted from the Address section of the Workforce Personal tab.

- To save the information, click the Save button. To save the information and add another employee, click the Save/New button. All except the Tax Year and EIN fields are cleared for entry.

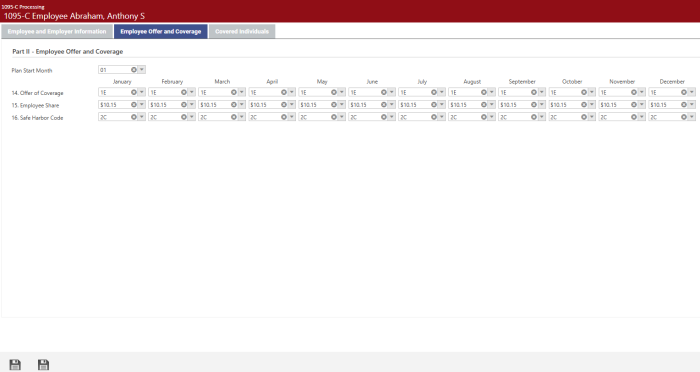

Employee Offer and Coverage

Use the grid on this tab to add or edit the monthly entries for an employee's offer and coverage information for Part II of your 1095-C forms and transmittal file.

- Plan Start Month: Although a plan start month may be selected at the Company HR Settings or Benefit Group level, this field gives you the option to override the plan start month for individual employees. Months correspond with numbers on the drop-down: January = 01, February = 02, March = 03, and so on.

- Offer of Coverage: This entry is defaulted from Workforce based on the one effective on the first day of the month. If you are selecting a code, it should be the one reported each month according to the IRS regulations. The available selections come from validation set 548. The drop-down shows codes and descriptions, although the cells in the grid show only the codes.

- Employee Share: This entry is defaulted from Workforce based on the one effective on the first day of the month. If you are selecting a code, it should be the one reported each month according to the IRS regulations. The available selections come from Maintenance > Human Resources > Affordable Care Act > Lowest Cost Premium. The drop-down shows codes and descriptions; cells in the grid show the associated dollar amounts. Each amount is the one that was effective dated as of the first day of the month being reported.

- Safe Harbor Code: This entry is defaulted from Workforce based on the one effective on the first day of the month. If you are selecting a code, it should be the one reported each month according to the IRS regulations. The available selections come from validation set 549. The drop-down shows codes and descriptions, although the cells in the grid show only the codes.

- To save the information, click the Save button. To save the information and add another employee, click the Save/New button. All fields on this tab and all fields except the Tax Year and EIN fields on the Employee and Employer Information tab are cleared for entry.

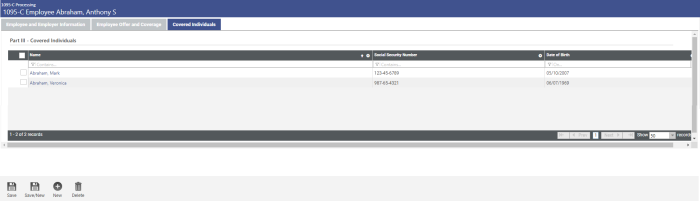

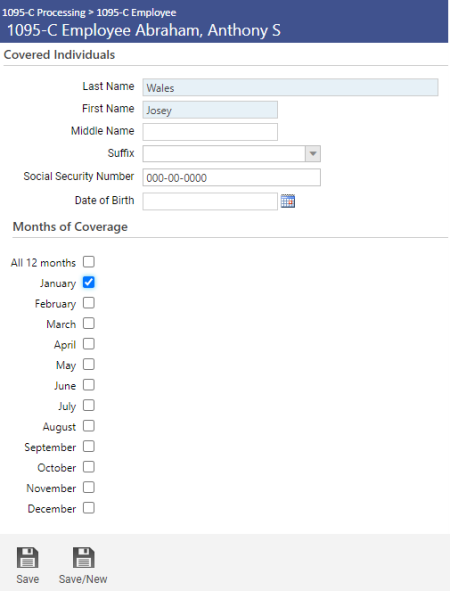

Covered Individuals

Use the grid on this tab to add or edit an employee's covered individuals' information for Part III of your 1095-C forms and transmittal file. The grid contains the names, social security numbers and dates of birth of the covered individuals.

Covered Individuals are flagged in two places in Workforce. Employees and dependents flagged in either location are considered to be covered individuals.

- In the Covered Individuals section of the Employer Reporting tab, included are any entries where the Start Date is less than or equal to the last day of the current tax year and the End Date is greater than or equal to the first day of the current tax year.

- In the Benefit Plans section of the Payroll Data tab, included are entries where the Coverage Start Date is less than or equal to the last day of the current tax year, the Coverage End Date is greater than or equal to the first day of the current tax year, and the 6055 Reporting check box is marked on the associated plan.

Covered Individuals also may be flagged in the Non-Employee module. The Benefit Plans section of Non-Employee Service includes entries where the Coverage Start Date is less than or equal to the last day of the current tax year, the Coverage End Date is greater than or equal to the first day of the current tax year, and the 6055 Reporting check box is marked on the associated plan.

-

To add a covered individual, click the New button below the grid. To edit information for a covered individual, click the corresponding Name in the grid. In either instance, the 1095-C Employee page for the covered individual displays:

- Enter the covered individual's last, first, middle name and suffix.

- Enter the covered individual's nine-digit social security number. If blank, Date of Birth is required.

- Enter the covered individual’s date of birth, but only when the social security number is not known. When the system creates covered individual information, both fields are filled in, but the date of birth only is used on the form and in the transmittal file when the social security number is not found.

-

Mark Months of Coverage for those months in which the individual was covered for at least one day in the month; for example, if an entry on the Covered Individuals section of Workforce has a Start Date of 3/15/14 and an End Date of 7/21/14, the months of coverage for the selected contacts default as March, April, May, June and July.

To mark the check boxes for all months, mark the All 12 Months check box. Clearing the check box for an individual month clears the All 12 Months check box.

- To save the information, click the Save button. To save the information and clear the fields for the addition of another covered individual, click the Save/New button.

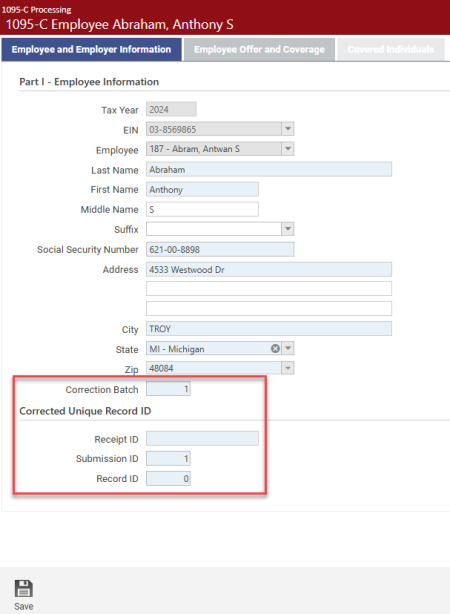

1095-C Correction

Selecting an employee from the 1095-C Employee List page and clicking the Correction button opens the 1095-C Employee page, where the Employee and Employer Information tab provides four additional fields—one for a correction batch number and three that, together, create a unique ID for the corrected record:

Correction Batch defaults the highest existing correction batch number for all employees. (To allow for multiple entries, a sequence number has been added to the 1095-C Employee table to track corrections. The sequence number acts as a "correction batch number" to submit corrections to the IRS. More than one correction may be submitted at once, so the same batch number may be used for several employees.)

If the highest existing correction batch number is 0, the default is 1. Whole numbers up to three digits are permitted. This number may be edited when adding or editing a correction.

Multiple corrections may be made for one employee, as long as the corrections are in different batches.

An employee may not have more than one correction submitted at a time, so the batch number must be unique for the employee/tax year/EIN.

Corrected Unique Record ID fields: When submitting corrections to the IRS, the user must specify the ID of the record being corrected. The IRS identifies this data as the “CorrectUniqueRecordID.” The ID consists of three parts, each separated by a vertical bar (|)--for example, 1095C-17-00001234|12|98.

Receipt ID is issued by the IRS when a transmittal file is sent. Example: 1095C-15-00000953.

Submission ID identifies the company within the transmittal file. The default is 1. Whole numbers up to two digits are permitted.

Record ID identifies the employee within the company. Employees are numbered sequentially, beginning with 1. The default is blank. Whole numbers up to five digits are permitted.

When corrections are saved, the Receipt ID, Submission ID and Record ID are combined with a vertical bar (|) between each and saved as the IRSCorrectedUniqueRecordID (Example: 1095C-17-00001234|1|98), and rows representing the corrected records are inserted below the previous records on the 1095-C Employee List page, with the correction batch number displayed in the Correction Batch column.

1095-C Employee Register

-

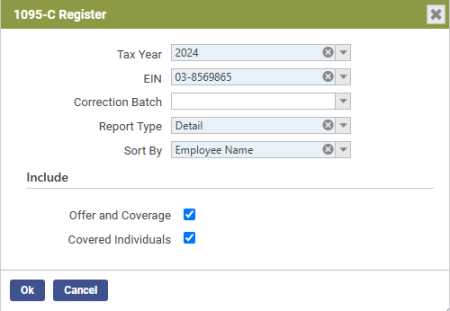

To print the 1095-C Employee Register, a detailed report used to verify the employees’ setup, click the Print button at the bottom of the 1095 Employee List page. The 1095-C Register dialog displays:

- Select the Tax Year for which the register is being generated.

- Select the nine-digit, state-assigned employer identification number (EIN) for which the register is being generated.

- The Correction Batch field is enabled when the Report Type selected is Detail. The register output contains only the employee data that matches the correction batch number selected. The number displays to the right of the EIN. A Corrected Unique Record ID column displays to the right of the employees.

- Select the Report Type to run: Detail generates a list of all 1095-C employee information used to verify the employee’s setup. Audit generates a summary list of employees who meet certain criteria to help identify those who are set up incorrectly. Selecting Audit disables the Offer and Coverage and Covered Individuals check boxes.

- In the Sort by field, select how you want the register sorted: Employee Name sorts the register alphabetically by employee last names. Department sorts the register alphabetically by department names.

- To include offer and coverage information on the register, mark Offer and Coverage. To exclude this information, clear the box.

- To include covered individuals information on the register, mark Covered Individuals. To exclude this information, clear the box.

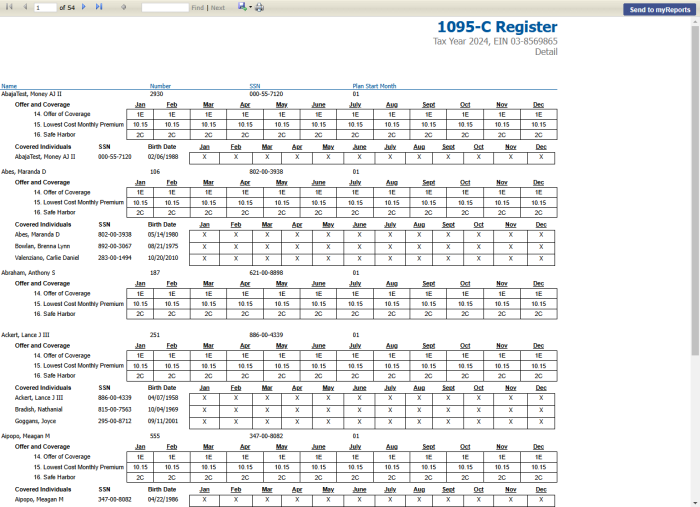

Sample Detail Register by Employee Name

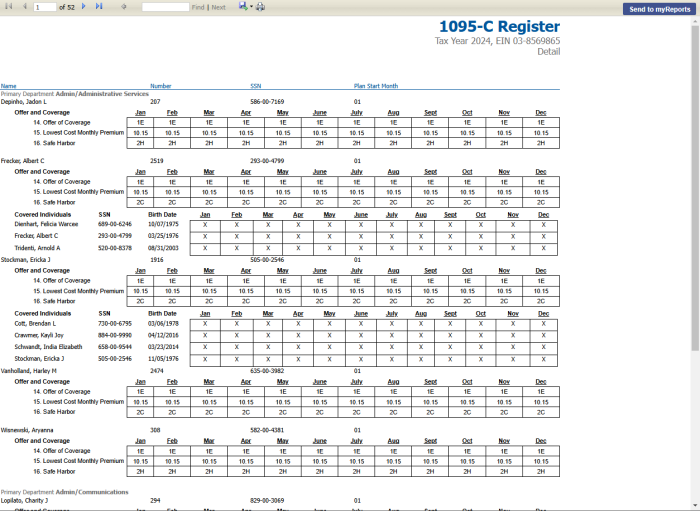

Sample Detail Register by Department

All data comes from the name, employment and primary job records effective as of 12/31 of the tax year.

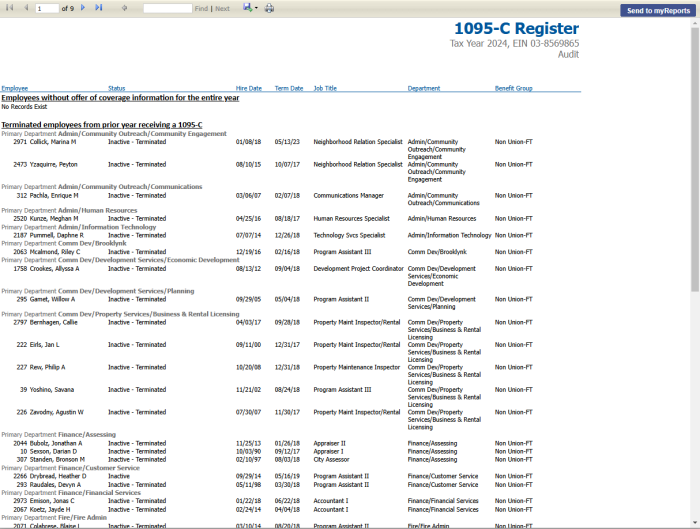

If your Report Type selection is Audit, the following three sections display on the register:

-

Active employees not receiving a 1095-C

This section should contain part-time employees without coverage for the entire year.

-

Terminated employees from prior years receiving a 1095-C

This section contains employees on COBRA and covered retirees.

-

Employees without offer of coverage information for the entire year

This section should be blank; it is not allowed by the IRS.

All three sections show the name and various other information to help identify the employee.

Sample 1095-C Register Audit

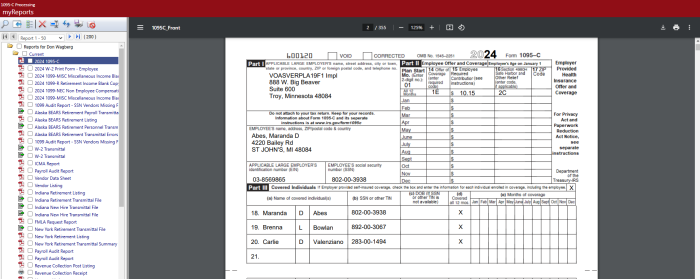

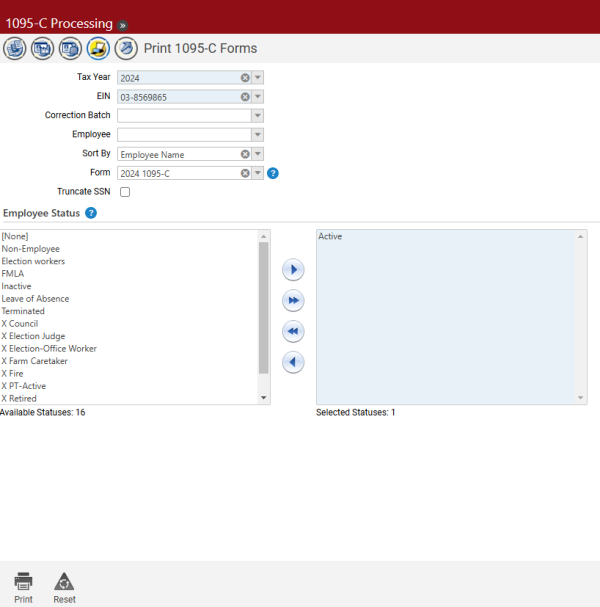

The Print 1095-C Forms page, accessed by clicking the ![]() icon on the 1095-C Processing page, allows authorized users to generate official 1095-C forms.

icon on the 1095-C Processing page, allows authorized users to generate official 1095-C forms.

- Select the Tax Year. The current year is the default.

- Select the EIN. This entry defaults from the 1095-C Employee List page.

- If applicable, select the Correction Batch. The names on the Employee drop-down are filtered according to correction batch number, tax year and EIN. Only the 1095-C forms that match the selected correction batch number are generated. If the correction batch is selected, an X displays in the Corrected box at the top of the 1095-C and 1095-C Z-Fold forms.

-

Leave the Employee field blank to generate 1095-Cs for all employees. Select the Employee if the 1095-C should be generated for one employee only.

Note: A 1095-C does not print for any employee who has elected to go paperless and has a primary email address set up in Workforce Administration; however, if an employee is selected in the Employee prompt, a 1095-C prints.

- In the Sort By field, select whether to generate 1095-C forms by Employee Name or Primary Department.

- Select the 1095-C Form you want to use. This entry is required.

- In the Employee Status multi-select list boxes, select the status(es) for which 1095-Cs will generate. You may use the list boxes to generate 1095-Cs for current employees to be distributed with paychecks separate from the 1095-Cs that need to be mailed to former employees.

-

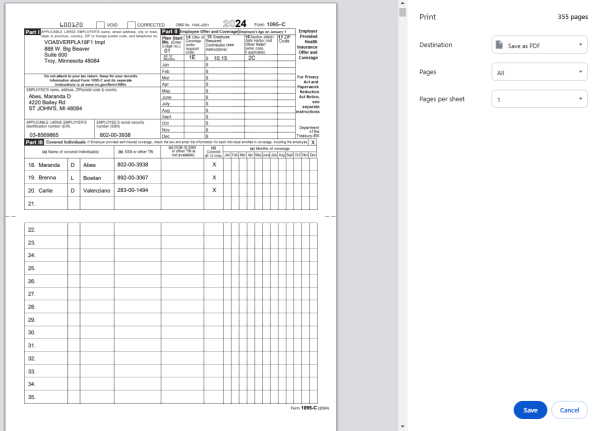

Click Print to send the print file as a PDF to myReports.

The standard form prints on 8 ½” x 11” paper with no perforations.

The form prints “portrait” instead of “landscape” so it fits into a window envelope.

A Z-Fold form also is available.

-

From myReports, click the 2024 1095-C link on the left side of the page. The forms display on the right side of the page, allowing you to view them before printing:

-

Click

in the top border of the preview pane:

in the top border of the preview pane: -

Select the appropriate print options.

Note: It is recommended you first print one form to ensure the paper is loaded correctly in your printer before you print all forms.

- Click Print.

Print 1095-C Z-Fold Form

Note: The 1095-C Z-fold form must be printed on a network printer, due to additional printer setup that needs to be performed.

The Z-fold version of the 1095-C form prints on legal-size paper. Printing from New World ERP uses the default paper size for the printer you select, so unless it is the default for your printer, follow the steps below to change the network printer’s default paper size to Legal.

-

Connect to the server that houses the application server or the report server (if installed) by going to Start > Run and typing mstsc /console:

- In the Computer field, type the name of your server and click Connect.

- Log into the server using the administrator log in.

- Select Start > Devices and Printers or Start > Printers and Faxes.

- Right click the printer you will use to print the Z-fold 1095-C forms. Remember that it must be a network printer, not a local printer.

-

Select Printing Preferences from the menu. Set the default paper size to Legal. Below is an example for an HP PCL5 printer:

-

Click Apply to make the changes.

Note: The log-on user for the service must have rights to the printer you use to print the Z-fold forms. This setup has been performed if the printer is available for selection on the myReports page.

- You may print the 1095-C Z-fold forms from the Print 1095-C Forms page in New World ERP. Remember to select the 2024 1095-C Z-Fold option in the Form field. When you click the Print button at the bottom of the preview pane in myReports, the printer expects legal-size paper to be used.

- Once the forms are printed, return your network printer to its default settings.

Note: Certain information required for the 1095-C transmittal file must be entered on your employer record prior to creating the transmittal file. If you have not set up these required fields on the Applicable Large Employer (ALE) Member List, you will receive an error when uploading your transmittal file to the IRS. Please review the sections on the Applicable Large Employer Member List and the 1095-C Employee List.

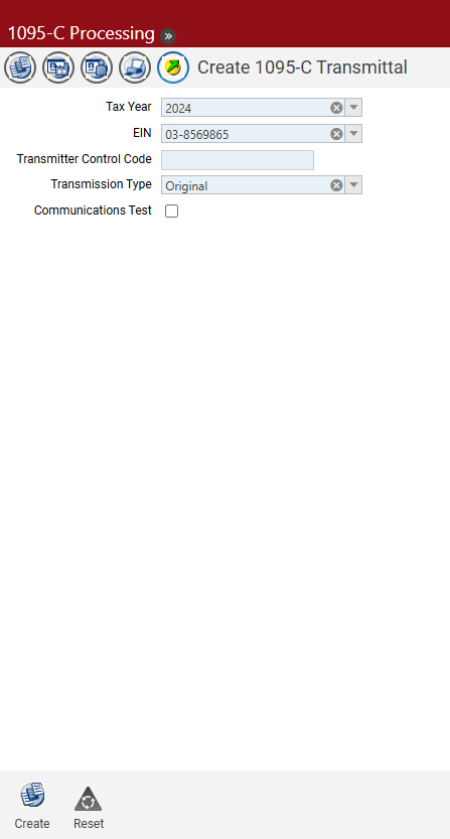

The Create 1095-C Transmittal page, accessed by clicking the ![]() icon on the 1095-C Processing page, allows authorized users to create electronic 1095-C XML files for submission to the federal government:

icon on the 1095-C Processing page, allows authorized users to create electronic 1095-C XML files for submission to the federal government:

- Select the Tax Year. The current year is the default.

- Select the EIN. This entry defaults from the 1095-C Employee List page.

- Enter the Transmitter Control Code. This number is assigned by the IRS to identify the transmitter. This entry is required.

-

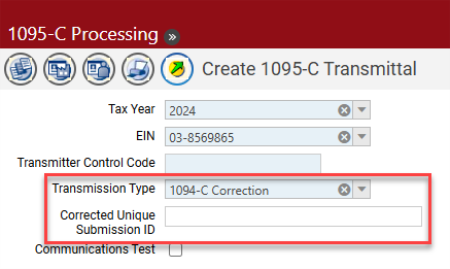

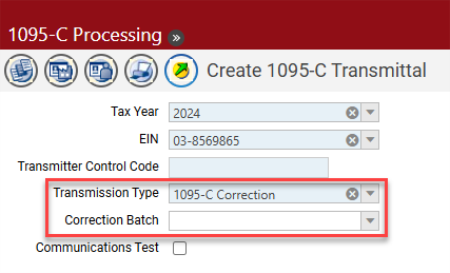

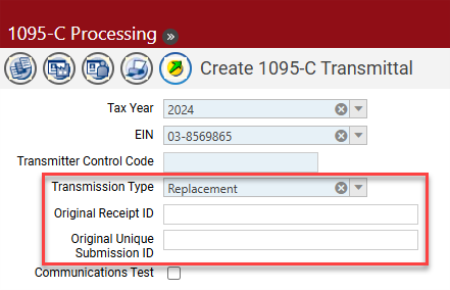

Select Original, Replacement, 1094-C Correction or 1095-C Correction for the Transmission Type. A replacement transmission should only be used when requested by the IRS.

Selecting 1094-C Correction adds a Corrected Unique Submission ID field to the page. Selecting 1095-C Correction adds the Correction Batch drop-down, which requires a selection. For the 1095-C correction, only the employees linked to the selected correction batch number are included in the transmittal file.

Note: The Corrected Unique Submission ID is a combination of the Receipt ID and Submission ID, using the pipe symbol (|) as a separator: ReceiptID|SubmissionID.

The following step (5) is not required for customers who have completed this step successfully in a prior year; it is required only for customers who are uploading 1095-Cs to the IRS for the first time:

-

To create a file you are required to send to the IRS as a communications test prior to sending your actual 1095-C electronic file, mark the Communications Test check box. The files created for the communications test do not contain your actual data; they contain test data required by the IRS. After you have sent those files to the IRS and passed the communications test, clear this check box to create files containing your actual data.

Step summary for customers uploading 1095-Cs to the IRS for the first time:

- Create a transmittal file with the Communications Test check box marked.

- Upload the file to the IRS.

- Once the file is accepted, contact the IRS to have your account moved from test to production before creating data with the Communications Test check box cleared.

-

If the IRS requires a replacement file, an Original Receipt ID or Original Unique Submission ID must be entered:

-

Click the Create button. The following files are sent to myReports:

- Validation Results for Manifest 1094-C Request

- Validation Results for 1094-C Request

- Manifest 1094-C Request

- 1094-C Request

-

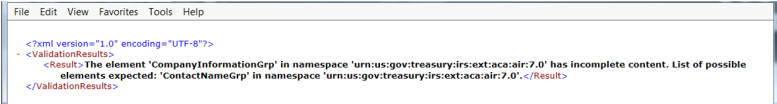

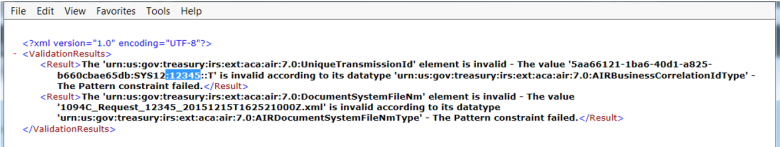

For each validation report, click Open to check for errors. If either report contains errors, make corrections and recreate the transmittal files. Below are examples of common validation errors and what they mean:

This error indicates the Applicable Large Employer (ALE) was not updated. Contact information must be entered, along with any other information the IRS requires for the 1094-C. Please see the IRS instructions for additional details.

This error indicates an invalid Transmitter Control Code was entered when the transmittal file was created. Recreate the transmittal file, verifying the Transmitter Control Code is entered correctly.

Once both validation reports indicate "No errors found," the Transmission Data File 1094-C Request and the 1094-C Request are formatted correctly and may be sent to the IRS.

- Go to myReports. Click the 1094-C Request link on the left side of the page. You are asked whether you want to open or save the file.

- Click the Save button to save the file to a folder where it may be located to upload to the IRS. Follow the same process for the Transmission Data File 1094-C Request file.

- Upload these files to the IRS.

- 1094-C/1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

- IRS ACA Home page: https://www.irs.gov/affordable-care-act

- ACA Administration and End User Guide (online help)

Below is a list of the tasks to be performed in 1099-R processing. Following this list helps to ensure a smooth year-end process:

|

Daily Processing |

|

|

r |

Set up 1099 information on employee records. |

|

1099-R Processing |

|

|

r |

Order 1099-R forms. |

|

r |

For customers on the 2024 release, apply the year-end processing patch 2024.1.10. |

|

r |

Set up Box 7 codes. |

|

r |

Review the information on the1099 CompanyList. Review the 1099 List for any employee who may have incorrect 1099 data. |

|

r |

Generate the 1099-R work file using Create 1099 Data. |

|

r |

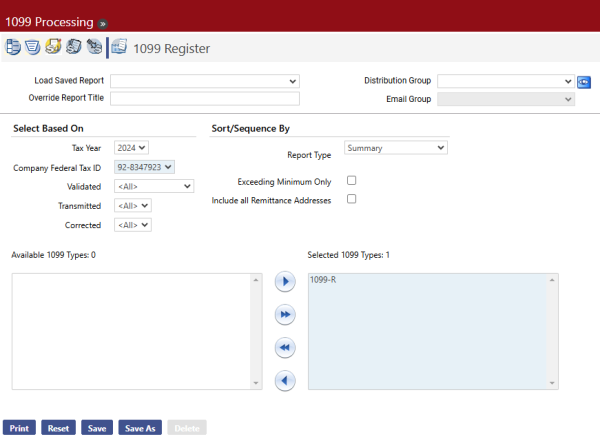

Print and review the 1099 Register. |

|

r |

Compare the 1099 Register to the Quarterly Wage Report and the Earnings Register. |

|

r |

Print 1099 Forms. |

|

r |

Create the transmittal file for submission to the IRS. |

|

r |

Distribute 1099-R forms to employees. |

|

r |

Submit the 1099-R information to the IRS. |

|

Other Payroll Year-End Procedures |

|

|

r |

Set up taxes as needed for the new year. |

Before beginning 1099 year-end processing, review the Company Information.

Maintenance > new world ERP Suite > System > Company Suite Settings > Company tab

Verify the following fields on the Company tab are set up correctly:

- Company Name

- Address Line 1

- City

- State

- Zip

- Federal Tax ID

- State Tax ID

- ACH Company Name

When the Create 1099 Data function is run from the 1099 Processing page, it pulls this information into the 1099 Company Information page. Make corrections and save the settings.

Human Resources > Workforce Administration > Search > Employee > Employment

To set up an employee who has a 1099-R instead of a W-2, check the 1099 box on the Employment tab.

An employee who was paid should show up under the Federal Tax ID specified in New World ERP Company Suite Settings. If you select a Company on the Employment tab, the employee should show up under the tax ID associated with the company.

The information on the minimum dollar amount that is required to create a 1099 may be found in the company record in Year-End Processing.

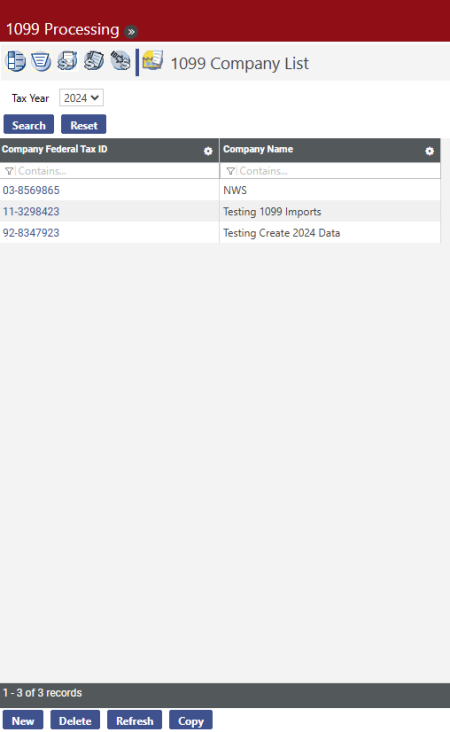

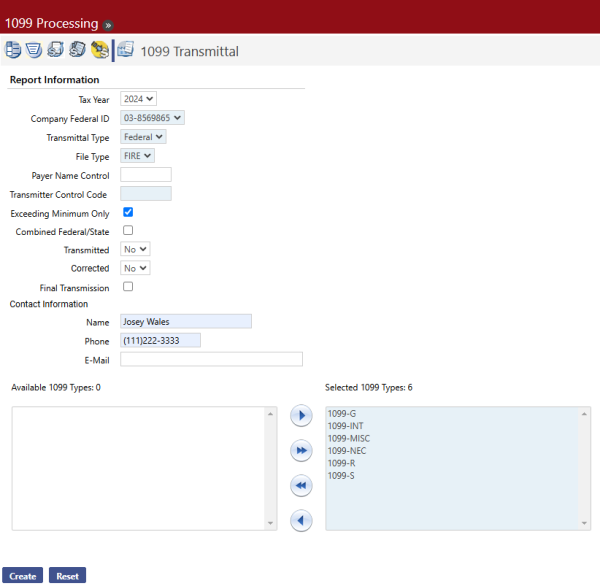

Human Resources > Year-End Processing > 1099 Processing

-

Select the

icon to display the 1099 Company List:

icon to display the 1099 Company List:

- Click the Company Federal Tax ID hyperlink to open the record:

-

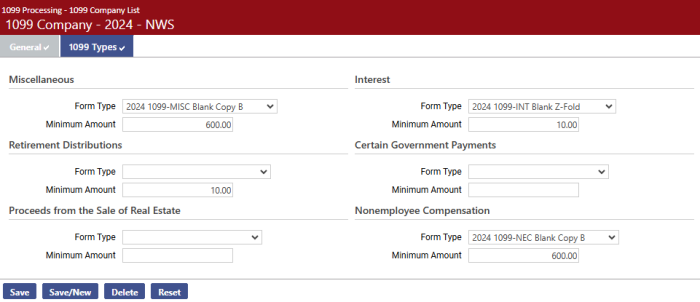

Click the 1099 Types tab:

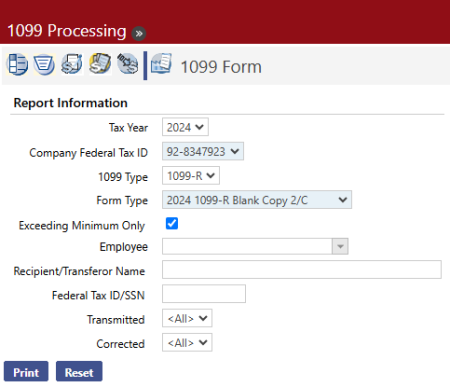

- For Retirement Distributions (1099-R), select the Form Type you plan to use.

- In the Minimum Amount field, enter the minimum dollar value for which a 1099 should be created. The minimum dollar value is evaluated against all amount fields on the 1099-R. If this field is left blank, a 1099 generates for any amount paid to a 1099 employee.

- Click Save to retain the values.

No special setup is required if your organization uses New World standard forms. The year-end update includes all the necessary form information.

No special setup is required for the transmittal file. The year-end update ioncludes all the necessary information.

Human Resources > Year-End Processing > 1099 Processing

Once the proper records have been set up and the year’s daily processing is complete, users can begin the task of processing 1099s.

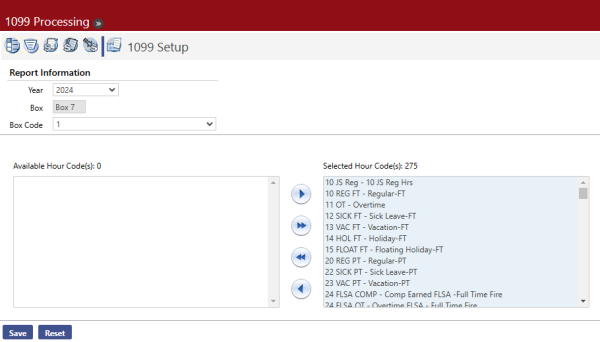

The 1099 Setup page allows authorized users to associate hours codes with each distribution type.

-

Select the

icon to display the 1099 Setup page. (This page is the default when opened from the Human Resources main menu.)

icon to display the 1099 Setup page. (This page is the default when opened from the Human Resources main menu.)

- Select the tax Year. The current year is the default.

- Click in the Box Code field to select from a list of available distribution codes for Box 7.

- For each Box Code, select the associated hours code(s) from the Available Hour Code(s) multi-select list box and move to the Selected Hour Code(s) list box.

The Create 1099 Data process creates data based on the Box 7 code associated with the hours codes paid to an employee. If an employee has wages for hours codes with two different Box 7 codes, two different 1099 records are created.

The 1099 Register breaks down the totals based on the code entered in Box 7.

Human Resources > Year-End Processing > 1099 Processing

-

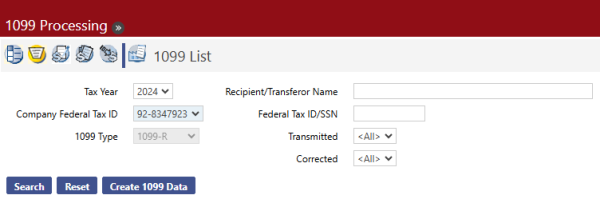

Select the

icon to display the 1099 List page. The current year defaults in the Tax Year field. Once the user selects a Company Federal ID, 1099 data can be created.

icon to display the 1099 List page. The current year defaults in the Tax Year field. Once the user selects a Company Federal ID, 1099 data can be created.

- Select the Tax Year. The current year is the default. 1099 data can be created for previous tax years.

- Select the Company Federal Tax ID. This entry is required. The company’s tax ID(s) populate the drop-down field.

- Select the 1099 Type. This field populates with 1099-R and disabled.

- The Recipient/Transferor Name field lets you search for a 1099 for a recipient who is not a retiree. The entry may contain up to 192 characters.

- The Federal Tax ID/SSN field is another option that lets you search for a 1099 for a recipient who is not a retiree. It may be used with the Recipient/Transferor Name field or by itself.

-

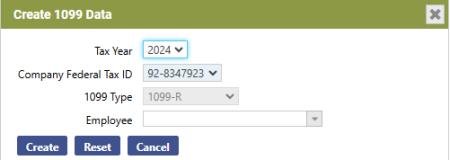

Click Create 1099 Data. The Create 1099 pop-up appears:

- The Tax Year and 1099 Type selected on the previous page display as defaults on this page. Leave the Employee field blank to create 1099s for all employees.

- Click Create.

- If 1099 data already exists for the employees, the following message displays: “1099 Data exists for selected employee(s). Overwrite this data?”

-

11. Once the data is created, click Cancel to close the pop-up and return to the 1099 List page.

Searching for 1099 Data

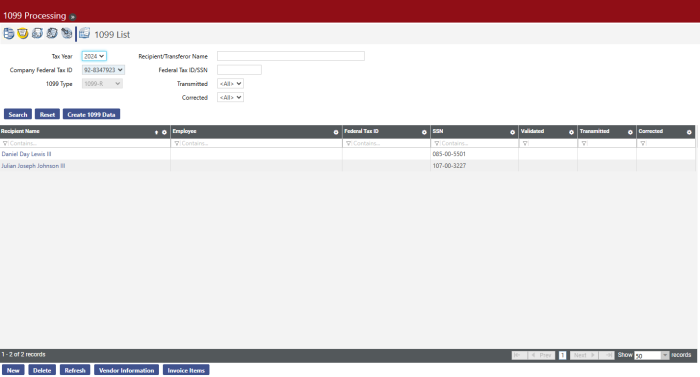

Once created, the 1099 may be viewed on the 1099 List page.

- Make sure the Tax Year, Company Federal ID and 1099 Type fields contain the entries they contained when 1099 data was created.

-

Click Search. The list of 1099 employees displays on the page:

-

3. Employee information may be maintained as needed from this list.

Using the 1099 List

The 1099 List (shown above) displays the following employee information:

- Recipient Name

- Employee

- Federal Tax ID

- SSN

- Validation Status

Each page of this list may contain 50 employees. Users can scroll through the current page and use the  ,

,  , or

, or  options at the bottom of the list to navigate among the pages. The segment of the list being displayed and the total number of employees returned by the search displays in the bottom left of the page:

options at the bottom of the list to navigate among the pages. The segment of the list being displayed and the total number of employees returned by the search displays in the bottom left of the page:  .

.

Sorting the 1099 List

The 1099 List by default sorts by Primary Contact in ascending alphabetical order. Sort the list by any other column by clicking on the column header of the column you want to use as the new primary sort. To re-sort the list in descending order, re-click the same column heading.

Modifications to the sort order are retained only for the current page session. If you close the session or navigate to another page using one of the buttons at the bottom of the page, the page returns to the default sort order.

Modifying 1099 Form Information

Once 1099 Data is created, you may view the data created for a particular employee and edit it as needed.

-

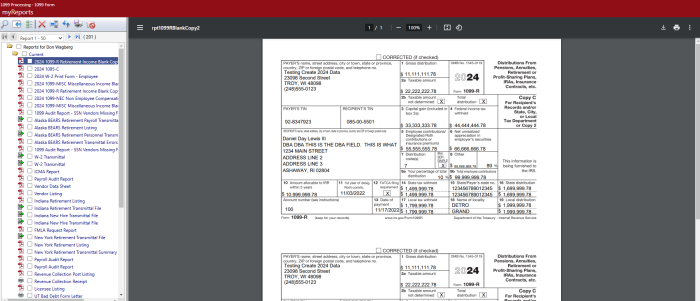

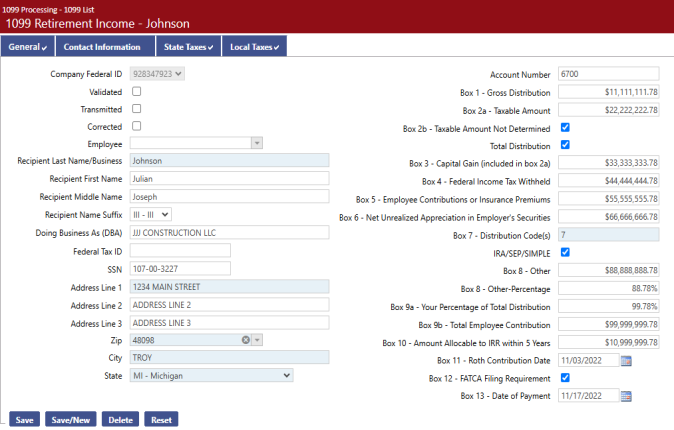

On the 1099 List page, click the Recipient Name hyperlink for the employee record you want to view. The 1099 Retirement Income page displays, defaulted to the General tab:

- All the information except the tax ID may be edited as needed. Click Save when all changes are complete. The updates are saved to the 1099 file.

Adding an Employee to the List

If other employees need to receive a 1099, you may add them to the 1099 list.

-

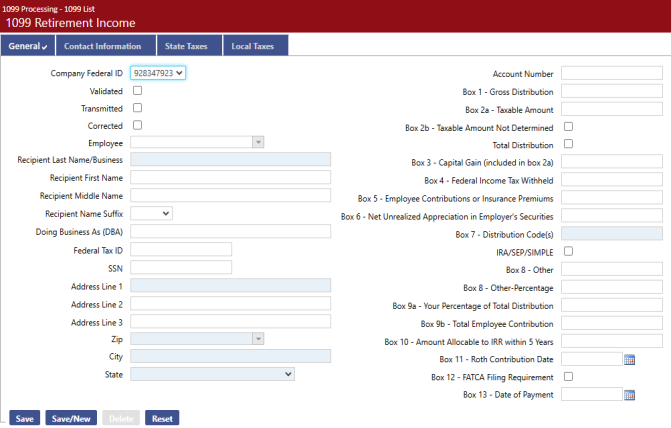

From the 1099 List page, click the New button. The 1099 Retirement Income page opens, defaulted to the General tab:

- If the Validated check box is marked, it confirms that this should be a 1099-R rather than a W-2. The check box is informational only.

- If you are adding an employee, select the name from the Employee field. You may type part of the name in this field to filter the available entries. Once you select the employee, the name and address information from the employee record populate the fields on this page.

- If you are adding a non-employee to the list, use the Recipient Name field.

- If applicable, the Doing Business As (DBA) field contains the name under which the company conducts business.

- A Federal Tax ID or an SSN must be provided before the record can be saved.

- Fill in the Address Line 1, the Federal Tax ID or the SSN, and Zip Code fields. The Zip Code entry populates the City and State fields.

- Fill in the appropriate 1099 boxes with the amounts that should appear on the 1099.

- When you click Save, the employee is added to the 1099 List. A 1099 generates for the amounts you specified, but this person is not flagged as a 1099 employee.

Deleting an Employee from the List