Create W-2 Transmittal File

Use this page to create an electronic W-2 file for submission to the federal government.

| Field | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax Year | Tax year being reported. The current tax year is the default selection. | ||||||||||||

| EIN | Employer Identification Number. This entry defaults from the W-2 Employee List page. | ||||||||||||

| Transmittal Layout | Required. Transmittal format to be used for the W-2 file. | ||||||||||||

| Submitter Information | |||||||||||||

| PIN | Required. IRS-assigned number uniquely identifying the submitter. It may contain 8 characters. | ||||||||||||

| Name | Submitter's name. Defaulted from the W-2 Company record, this entry may contain 57 characters. | ||||||||||||

| Location Address | If different from the Delivery Address. This entry may contain 22 characters. | ||||||||||||

| Delivery Address | Address used for all mail and shipments. Defaulted from the W-2 Company record, this entry may contain 22 characters. | ||||||||||||

| Zip |

Defaulted from the W-2 Company record. If you need to change the zip, type the beginning of the new zip. The field filters the options based on the numbers entered, so that you may select the correct zip without typing the entire code. If you use the zip+4 format, include the hyphen between the fifth and sixth digits. Once you select the Zip, the City and State fields are populated automatically with the correct entries. |

||||||||||||

| City, State | Automatically populated according to Zip selection. You may edit either entry, if necessary. | ||||||||||||

| Kind of Employer |

Required. In the transmittal file, identifies the type of employer. The available selections for are shown in the table below. The corresponding letter code shown in the right column displays in position 174 of the transmittal file:

|

||||||||||||

| Local Agency Transmittal |

Available options depend on the State selected; for example, if Michigan is selected, the available options are Social Security Administration, Flint Local, Lansing and East Lansing. If Flint Local is selected, the transmittal file appropriately contains the FL or Flint code, depending on how it is named in the Locality field on the Other Tax page in Maintenance (Maintenance > Human Resources > Deductions and Benefits > Taxes). If W-2s are processed before the Locality code for Flint has been set up, the code may be added manually through the W-2 Employee Local Wages tab in W-2 Processing (Human Resources > Year-End Processing > W-2 Processing > W-2 Employee List > Employee Name > Local Wages > New). For more information, see the HR Year-End Guide. |

||||||||||||

| Included/Excluded Taxes List Boxes | Displayed when the State selected is Indiana, Michigan or Ohio. The available selections in the boxes are the Locality entries from the "Other" tax codes that were set up in Maintenance and were used in the Create W-2 Data step. To exclude a tax, move it from the Included Taxes box on the left to the Excluded Taxes box on the right. | ||||||||||||

| Contact Information | |||||||||||||

| Name | Required. Name of person for IRS to contact regarding issues with the transmittal file. The entry may contain 27 characters. | ||||||||||||

| Phone | Phone number of person for IRS to contact regarding issues with the transmittal file. It must contain 10 digits. This field or the Email field requires an entry. | ||||||||||||

| Extension | Phone extension, if applicable. It may contain 5 characters. | ||||||||||||

| Contact person's email address. This field or the Phone field requires an entry. | |||||||||||||

| Fax | Contact person's fax number. If used, it must contain 10 digits. | ||||||||||||

After making your entries, click the Create button. The transmittal file is generated and sent to myReports.

Navigate to myReports, and click the W-2 Transmittal link located on the left side of the page. A File Download pop-up opens.

Click the Save button, and save the file to a folder on your computer. When you are ready to send the file to the IRS, select it from this location.

Prior to your sending the W-2 transmittal file, you may want to run the file through AccuWage.

AccuWage is free software from the Social Security Administration that lets you check the W-2 transmittal file for correctness.

AccuWage is available at the Social Security Administration website: www.ssa.gov/employer/accuwage.

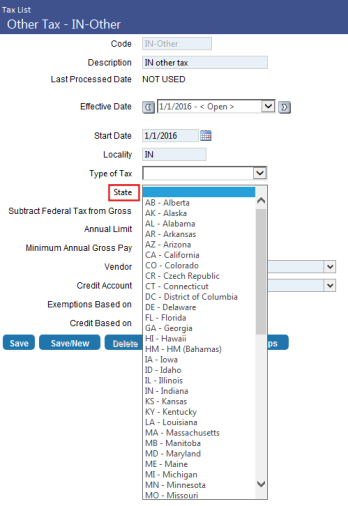

To accommodate situations when employees have local taxes from different states, a State field is available on the Other Tax page in Maintenance:

Select the appropriate state from the drop-down.

When the Locality Code on the Other Tax page matches the Box 20 Locality Name on the W-2 Employee Local Wages tab in W-2 Processing, and the state of the local code and the state gross are Maryland, all local taxes are added to the state tax in the W-2 transmittal file, placing the total amount in RS record position 287-298.

Selecting Ohio as the State on the Create W-2 Transmittal File page (Human Resources > Year-End Processing > Create W-2 Transmittal) displays a Local Agency Transmittal drop-down field and multi-select list boxes containing local taxes.

Available selections in the drop-down are Social Security Administration, State of Ohio, Regional Income Tax and Central Collection Agency.

Use the multi-select list boxes to exclude specific local taxes from the W-2 transmittal file. The available selections in the boxes are the Locality entries from the "Other" tax codes that were set up in Maintenance and were used in the Create W-2 Data step. To exclude a tax, move it from the Included Taxes box on the left to the Excluded Taxes box on the right.

When State of Ohio is selected, only Ohio RS39 records are included in the transmittal file. Any employee who is not associated with an RS39 record is excluded.

Central Collection Agency Requirements

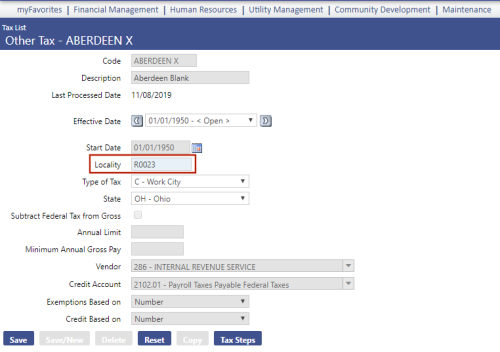

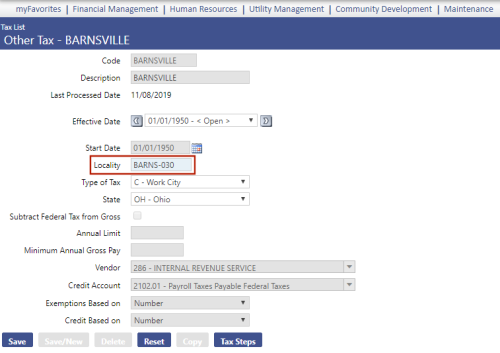

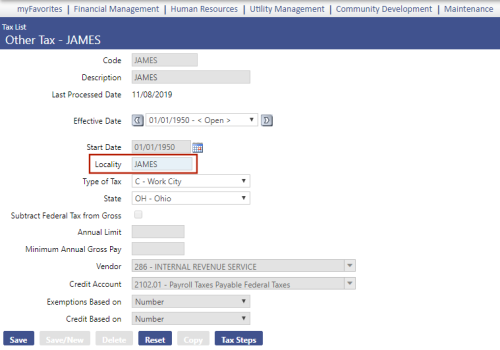

Maintenance > Human Resources > Deductions and Benefits > Taxes > Other Tax Code

Human Resources > Year-End Processing > W-2 Processing > Create W-2 Transmittal

For the Ohio Central Collection Agency (CCA), the Locality code from tax maintenance needs to be populated on the RS record for all cities, not only CCA members.

When the transmittal file for Ohio CCA is processed, the Locality code from tax maintenance determines the code populated on the transmittal file; for example, a Locality code of CC123 on the tax setup populates a CC in field 5-6 and 123 in field 7-9 on the RS records.

Since CC123 is a member of CCA, the CC characters define the location on the transmittal file; other cities, however, are not members of CCA. They also have locality codes that need to be reported, but because they are not members, they do not need to report a CC in field 5-6; this field must be blank.

In the case of a Locality code of R0345 (Canton OH RITA tax), this non-CCA member tax has been reported in field 3-9 of the transmittal file as 887, where 887 is unknown. The CCA has given Canton OH a city code of 445, meaning the Locality code for Canton tax is set up as R0345 for Rita tax, but now needs to be reported to CCA with a Locality code of 445.

In tax maintenance, a CCA non-member Locality code needs to be populated for all local taxes that can be used for reporting on the W-2 transmittal.

The Locality code allows 9 characters. To populate correctly, a format of R0123-234 is needed, where R0123 is used for RITA, and 234 is used for the CCA non-member city.

| Rules and Setup | ||

|---|---|---|

| A Rita tax is never a CCA member, but it can be a Rita and a non-member CCA city. | ||

| Ex. | Locality for Rita | R0123 |

| Ex. | Locality for CCA member | CC123 |

| Example 1 | ||

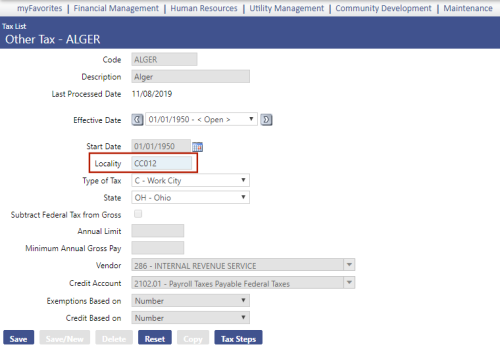

| ALGER | 004 | Non-Rita, CCA member |

| Locality code | CC012 | No changes (view |

| Example 2 | ||

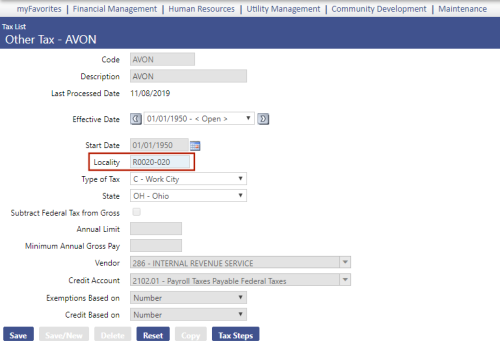

| AVON | 020 | Rita |

| Avon | 020 | CCA non-member city |

| Locality code | R0020-020 | Where R0020 is used for Rita, and -020 is used for CCA non-member city (view |

| Example 3 | ||

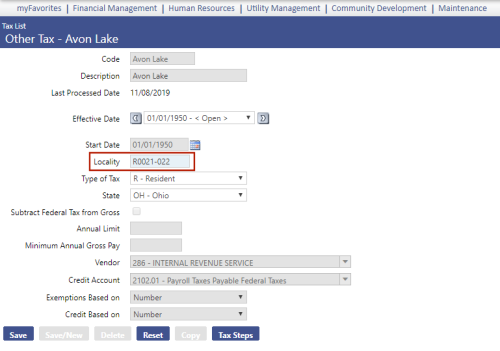

| AVON LAKE | 021 | Rita |

| Avon Lake | 022 | CCA non-member city |

| Locality code | R0021-022 | Where R0021 is used for Rita, and -022 is used for CCA non-member city (view |

| Example 4.1 and 4.2 | ||

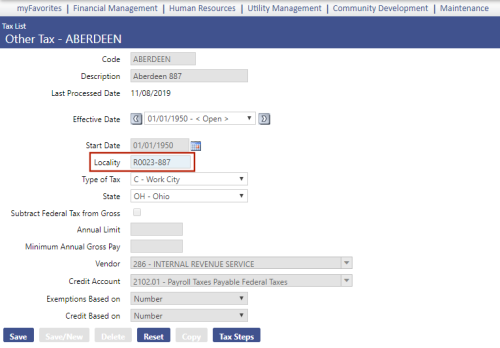

| Aberdeen | 023 | Rita Only, no CCA city code or unknown |

| Aberdeen 887 | R0023-887 | R0023 is used for Rita, and -887 is used for CCA (view |

| Aberdeen X | R0023 | R0023 is used for Rita, and a blank or null value defaults to 887 for CCA (view |

| Example 5 | ||

| BARNESVILLE | 030 | Non Rita, CCA non-member city code |

| Locality code | BARNS-030 or XXXXX-030 | XXXXX is used for Rita (cannot begin with RO or CC), and -030 is used for CCA (view |

| Example 6 | ||

| JAMES | NA | Non Rita, Non CCA, no codes for either |

| Locality code | JAMES or XXXXX | XXXXX can be anything (as long as it does not begin with RO or CC), Rita is okay, and CCA defaults to 887 (view |

Ohio Local Tax Setup

When a local tax for SSA is set up for a city, the Locality entry should start with a C, followed by four numbers. When it is set up for a school district, the entry should start with an E, followed by four numbers. (Type of Tax is not used.)

When the tax is to go to the Regional Income Tax Agency, the Locality is expected to start with RO, followed by three numbers (RO###). When the tax is to go to the Central Collection Agency, the Locality is expected to start with CC, followed by three numbers (CC###). Both taxes require a Type of Tax selection. The Type of Tax should be R for Residential or C for City.

The employee's state wage needs to be OH.

When the SSA transmittal file is run, the standard Ohio transmittal file runs. All employees are included, but only the selected local tax codes data is supplied.

When the Regional Income Tax Agency or Central Collection Agency is selected, only the employees who have the selected local taxes are included.

To see help for another page in the W-2 Processing workflow, click the appropriate link provided below: