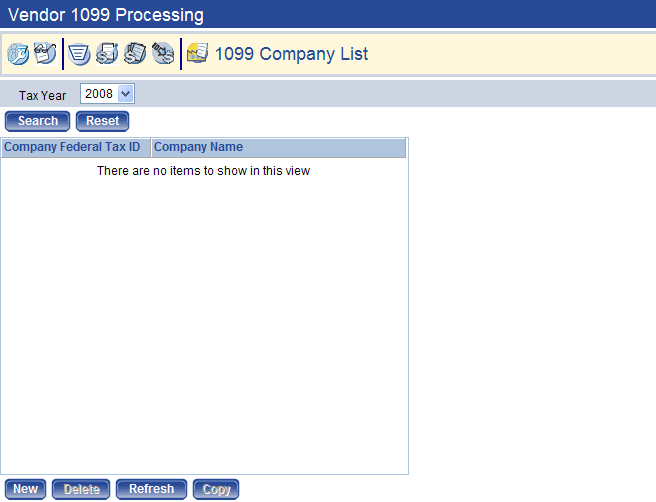

1099 Company List

Prior to beginning your 1099 Processing, your organization must first set up the payer Company Information for the applicable tax year. What you need to do varies based on whether this is your first year processing 1099’s in New World ERP.

To access the page, go to Financial Management > Year-End Processing > Vendor 1099 Processing and click the 1099 Company List  icon.

icon.

First Year Setup

If this is the first year you are processing Form 1099's on the New World ERP system, you need to define your Payer Company Information for each organization processing 1099's. To set up your company's information, follow the steps below:

- In the Tax Year drop-down list, select the tax year for which you would like to process 1099's.

- Click Search. Verify that the 1099 Company List for the year selected is blank.

- Click New and the 1099 Company screen refreshes with a General tab and a 1099 Types tab on the page.

- On the General tab, in the Company Federal ID field, type your organization's Federal Tax ID which prints in the Payer's federal identification number field on the 1099 forms.

- In Company Name, Secondary Name, Address, Zip, City, State, and Phone, type the appropriate information. This information prints as the Payer's name and address information located in the upper left corner of the 1099 form. The Secondary Name is optional; all other information is required.

- Click Save.

- Select the 1099 Type tab, select the Form Type you plan to use for printing each 1099 form supported (MISC, INT, R, S, and G) . This form type defaults when selecting the corresponding 1099 form type to print.

- In Minimum Amount, you can also enter the minimum dollar value for which a 1099 should be created. The acceptable range of values is $0.01 through $999,999,999.99. If this field is left blank, a 1099 is generated for any amount paid to a 1099 vendor.

- Click Save to retain the values.

Subsequent Year Setup

If you have used Vendor 1099 Processing in previous years, the first step is to copy the Company Information from a previous year into the current year.

- Navigate to Financial Management > Year-End Processing > Vendor 1099 Processing.

- Click the last tab for 1099 Company List.

- Select the tax year in the Tax Year drop-down list for the most recent tax year when you processed 1099's on the system (e.g., 2007).

- Click Search.

- If more than one company is returned, highlight the applicable company. Click Copy.

- Select the tax year for which you would like to process 1099's (e.g., 2008).

- Click OK. You return to the 1099 Company List page for the tax year selected.

Modify Company Information

After copying Company Information from the previous year, you may modify the information for the current year.

- Navigate to Maintenance > new world ERP > System > Company Suite Settings.

- Click the Vendor/Item tab.

- On the 1099 Company List page, click the Company Federal Tax ID hyperlink for the company you need to modify.

- On the General tab, review the company information and verify that all name, address, and phone information is still pertinent. Modify, if needed.

- On the 1099 Types tab, modify the Form Type and the Minimum Amount, if necessary.

- Click Save.

See Also