Accounts Payable 1099 Activity Report

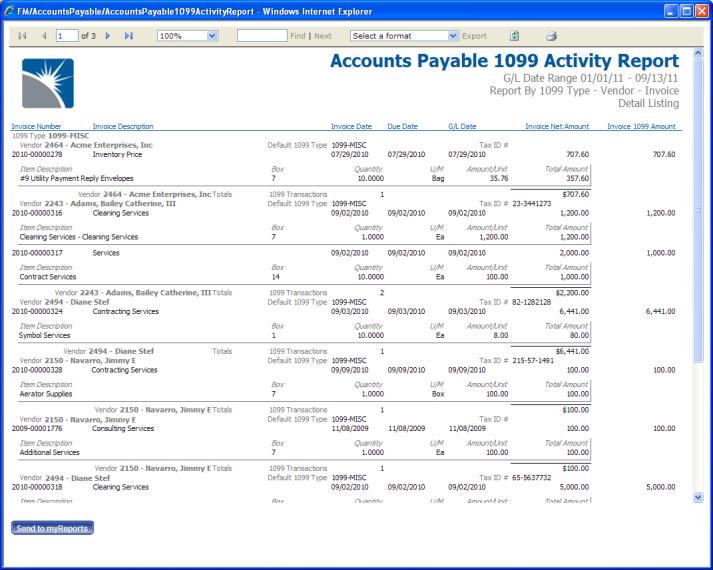

The Accounts Payable 1099 Activity Report is useful for mid-year reporting on 1099’s. This report (like the 1099 Audit Listing) can be run periodically throughout the year to check and verify 1099 information for your vendors. Where the 1099 Audit Report is designed to show only errors that will affect 1099 processing, this report shows all 1099 activity for the date range defined.

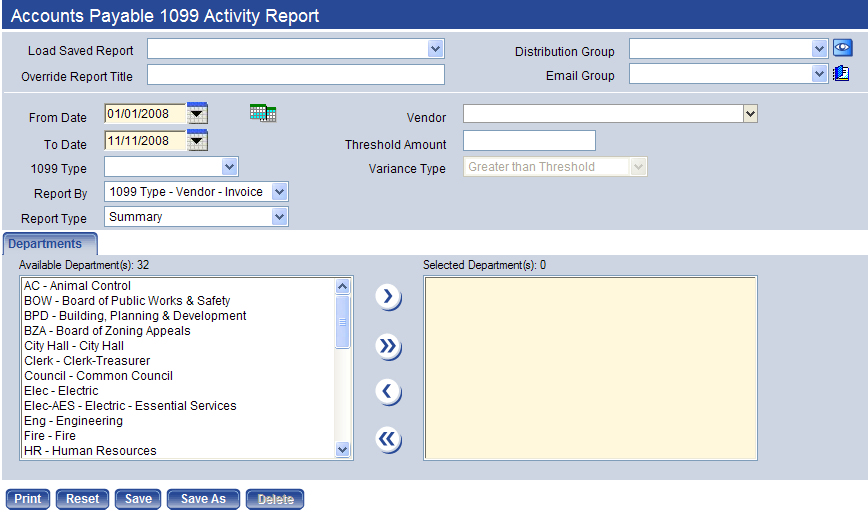

To access the page, go to Financial Management > Reports > Accounts Payable > Accounts Payable 1099 Activity Report.

Follow the steps below to create an Accounts Payable 1099 Activity Report:

- Enter a valid date range in From Date and To Date. The From Date and To Date fields are required. The current tax year is the default range.

- Select the 1099 Type for which you want the report to be run. This field is blank by default. If it is left blank, the report will run for all 1099 types.

- Select a Report By value. This determines the hierarchy for presenting the information in the report output. The default value is Vendor - 1099 Type - Invoice. The other option is 1099 Type - Vendor - Invoice.

- Select the Report Type value. The default value is Summary. Other options are Detail and Detail with G/L Distribution.

- Select a Vendor if you want to run the report for a specific vendor. If you leave this field blank, a list is returned with all vendors that meet the other criteria selected.

- Enter a Threshold Amount, if desired. This field is blank by default. If it is left blank, no threshold is used. Acceptable values range from $0.00 to $999,999,999.99.

- The Variance Typefield is enabled, if aThreshold Amountis entered. The options are Greater than Threshold and Less than Threshold. Greater than Threshold is the default value.

- Select the Departments that should be included on the report. At least one department is required.

- Click Printto submit the report.

See Also