Each year, when the new federal tax tables are released by the IRS, you need to update your system so that taxes calculate correctly on employee paychecks. Prior to 2020, there were always two tables, one for single and one for married. In 2020, that number increases to six different tax tables: single, married, head of household, single with 2 jobs, married with 2 jobs and head of household with 2 jobs.

The steps below guide you through updating the existing tax tables and adding the new ones:

-

Add New Withholding Statuses for Step 1 (c) and Step 2 Check Box of W-4 Form.

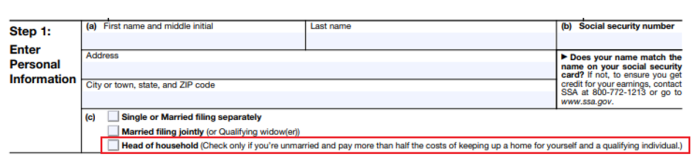

Validation Set 11 – Withholding Status contains the values that are used to designate the employee’s filing status in the Tax section of their Workforce Payroll Data tab. It is common to have statuses for Single and Married. Step 1 from the W-4 also contains a status for Head of Household, which must be added to the validation set:

In addition, Step 2 from the W-4 contains a check box that the employee may select if they “(1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works” and there are only two jobs total. To distinguish between employees who have checked the Step 2 check box, you need to add withholding status validation set entries for Single 2 Jobs, Married 2 Jobs, and Head of Household 2 Jobs. There is no specific naming convention that needs to be used when adding these Validation Set Values; you may use whatever is most appropriate for your organization to distinguish between the various withholding statuses:

Follow these steps to add the new statuses.

- Go to Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List.

- Select the row for validation set 11 - Withholding Status and click Values at the bottom of the screen. (Do not click the hyperlink on the set name, which is used only to edit the name.)

- Click New to add a new status.

- Fill in the new value and description. Click Save/New to add another, or click Save to add the final entry.

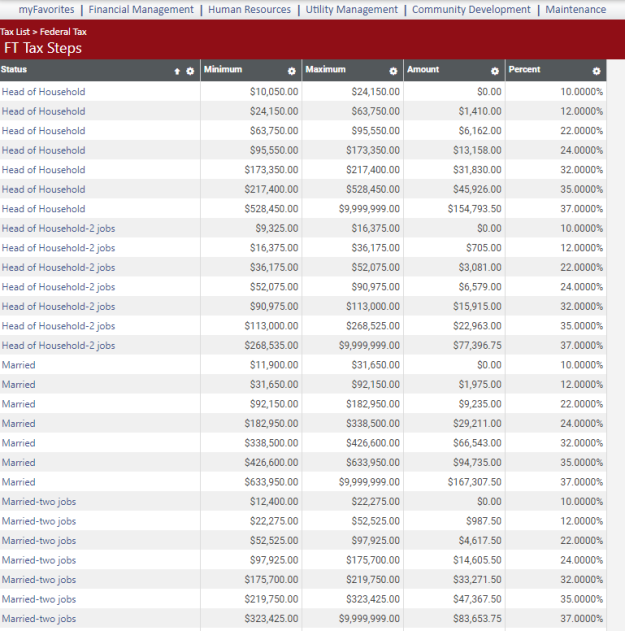

- Update the tax tables from the old amounts to the new amounts.

- Go to Maintenance > Human Resources > Deductions and Benefits > Taxes.

- Click the Code for your federal tax to edit it.

- Click Copy.

- Enter the effective date for the new tax tables and click OK. That date must be greater than the Last Processed Date on this tax code.

- Update the Allowance/Exemption amount and click Save.

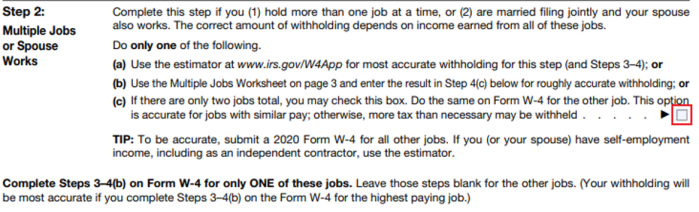

- Click Tax Steps.

- Click a Status to edit the values, enter the new values and click OK. Repeat this until all steps have been updated. You can click on the Status column header to sort the existing entries by status. Begin with the highest step and work your way down so that the new minimum and maximum amounts do not overlap. Here is the link to the IRS Withholding Rate Schedule.

- Add the new tax tables that correspond to the new withholding statuses.

- Click New to add a federal tax step.

- Select a new status from step 1 above.

- Enter the new values for that step and click OK.

-

Repeat a. through c. until all steps for each of the new statuses have been added.

Below is an example of the tax table setup:

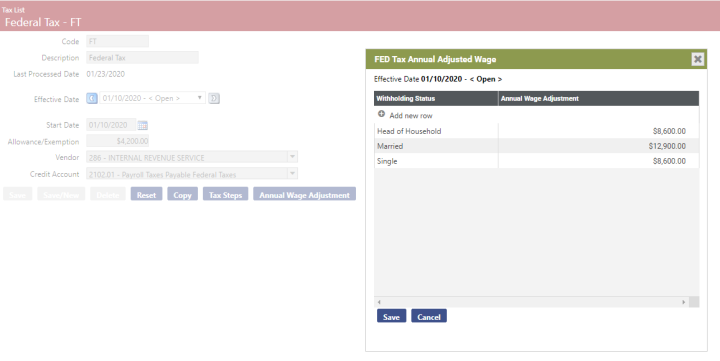

- Enter the Annual Wage Adjustment amounts.

- Click the breadcrumb to take you back to your federal tax code.

- Click the Annual Wage Adjustment button.

- Double click Add new row.

- Select a withholding status from the drop-down.

- Enter the appropriate Annual Wage Adjustment amount for that status.

- Click Update.

- Repeat steps c through f until each status has been added.

-

Click Save.

Below is an example of adjustments: